Good morning everyone. Thank you to the BPFI for organising this year’s National Payments Conference and for inviting me to take part. I’m delighted to be joining you again this year.1

When we met this time last year, my main message was that many of the benefits of innovation in payments remained untapped from the perspective of the domestic economy.2 Put differently, Ireland has been lagging behind some of our peers in terms of the payments offerings available to domestic households and businesses. The Government’s National Payments Strategy (NPS), published last October, has set the foundations to address that.3 And our collective near-term focus now needs to be on delivery, to realise the intended outcomes outlined in the NPS.

In my remarks today, though, I would also like to look further ahead. To consider not just how we catch up with the frontier of innovation of payments, but how we keep up over time. Because that frontier continues to shift rapidly, driven by technological and business model innovation.

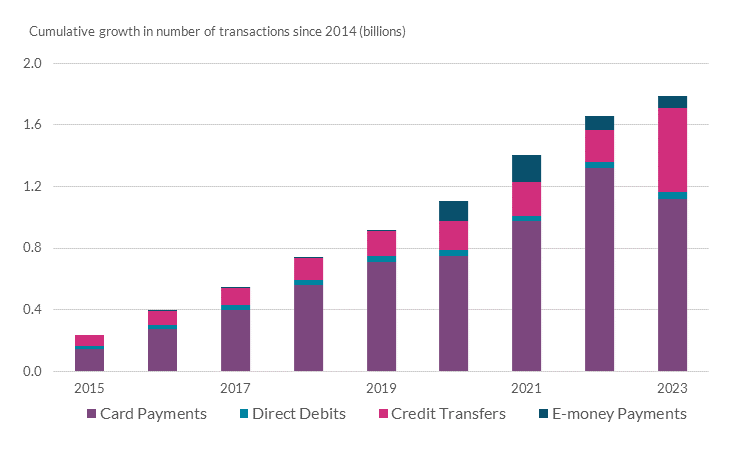

Chart 2: The growth in domestic electronic payments has been driven by cards

Internationally, paying by account has evolved into an increasingly effective payment method, enabled by greater use of application programming interfaces, ‘open banking’ and upgrades to the underlying infrastructure to support instant payments. Paying by account offers a convenient alternative to cards, strengthening competition, lowering costs for merchants and consumers and improving system-wide resilience. However, Ireland continues to lag behind other jurisdictions in the availability of pay-by-account offerings. Rightly, therefore, the NPS has prioritised the development of pay-by-account solutions as an additional payment method in Ireland.

In that context, it has been positive to see the progress made over the past year, whether in terms of the constructive engagement of the sector with the account-to-account workshops organised by the Central Bank or the implementation of the “receiving” leg of instant payments. Indeed, progress on the latter means that we’ve seen a significant increase in reachability of Irish bank accounts with instant payments (Chart 3). But it is also clear that there is substantial further work ahead of us to make pay-by-account solutions broadly available in Ireland. This includes progress with the implementation of the “sending” leg of instant payments as well as accompanying enablers, such as APIs and verification of payees. Ultimately, delivering a convenient and trusted pay-by-account solution for consumers and businesses in Ireland remains an important near-term priority.

Chart 3: Reachability with instant payments has risen, amid progress with implementing the “receiving” leg of instant payments

A further wave of transformation in payments (and finance)

So this is where we are now. But the transformative potential of technology in the world of payments – and finance more broadly – remain as strong as ever. In that context, progressing near-term priorities also needs to be accompanied with actively preparing for the future.

And a likely spark for further innovation is based on the potential of distributed ledger technology (DLT). DLT allows for the creation of common shared ledgers, which can be updated simultaneously across all parties to a financial transaction. The technology has the potential to reduce frictions and inefficiencies, by removing the need for parties to a transaction to individually update and reconcile their own ledgers. DLT also allows for certain functions to be built into financial contracts, such as making conditional payments. And the possible use cases of DLT extend well beyond payments, introducing the potential for a diversity of digital assets to co-exist on shared ledgers.

The use of DLT is increasingly being explored for its potential to introduce greater efficiency and effectiveness in payments processes. For example, tokenised deposits are being investigated by banks across the world.4 Put simply, these refer to the potential for using DLT technology to represent a standard deposit balance on a shared ledger. The majority of exploratory efforts at the moment have centred on the use of tokenised deposits for wholesale financial transactions, but attention is also being given to the tokenisation of retail deposits.5

And, of course, DLT is also already in use by various so-called stablecoins.6 These broadly comprise digital assets that aim, by one means or another, to maintain a stable value relative to some reference asset(s). At present, these tokens are mainly issued by non-bank entities, so they have been spurred not just by technological innovation, but also business model innovation. To date, their use has been largely confined to facilitating transactions within the crypto ecosystem, but there are certainly stated ambitions that they could be used for broader payment purposes across the economy, including for cross-border payments.

So where does this all leave us? It is clear that the journey of transformation in payments is ongoing. Indeed, we could be at the cusp of another wave of innovation disrupting the landscape.7 While it is hard to predict the future, it certainly seems plausible that we will see increasing integration of DLT into financial services, including payments. Which then begs the question: how do we best respond to, and prepare for, the ongoing transformation in the payments landscape to achieve optimal public policy outcomes?

Why central banks and regulators are responding

What is very clear – in this context – is that central banks and regulators cannot afford to stand still.

Why? Well, as you know, the modern monetary system is based on a public and a private tier: public money – liabilities of the central bank; and private money – deposits of credit institutions. And payments systems – through which these different forms of money flow – rely on an inextricable partnership between the public and private sectors.

In that partnership, the role of central banks and regulators is to ensure trust. We do this in different ways: by issuing the safest and most liquid asset in the economy – public, or central bank, money; by operating core payments infrastructures; by regulating and supervising financial institutions; and by overseeing privately-operated payments systems. These foundations then enable the private sector to do what it does best: interface with customers, innovate, compete to win business and, ultimately, meet the evolving financial needs of households and business.

Given this inextricable partnership between the public and private sectors, to achieve optimal outcomes for households and businesses, central banks and regulators need to anticipate, and respond to, innovation. And, to illustrate why this is essential, it’s useful to consider the counterfactual: what might be the costs of standing still, in light of the innovation that we’re seeing in the private sector?

At the very least, there would be a risk that the full benefits of innovation in payments are not maximised from the perspective of the broader economy. Fragmentation harms efficiency in payments, resulting in higher costs for businesses and households. The core payments infrastructures operated by central banks guard against fragmentation, by offering a common platform and unified standards, upon which the private sector can build to provide services to businesses and households. If those infrastructures and standards did not keep up to speed with technological developments, we would risk a more fragmented payments ecosystem.

Similarly, if regulators were to stand still, the emergence of novel risks amid an evolving landscape could undermine confidence and integrity in payments. For example, it is not just payments providers that have innovated. Unfortunately, so have fraudsters.8 Which means that our collective approach to preventing fraud needs to constantly evolve to protect consumers. And the increasing participation of new, innovative entities in the payments ecosystem requires that our regulatory and supervisory approach adapts, to remain fit for purpose and maintain confidence.

There are also more severe scenarios, from the perspective of the system as a whole, if central banks were to stand still amid broader innovation. Imagine, for example, a scenario where DLT becomes embedded across the financial system, but public money does not keep pace. If that were to happen, private money could replace central bank reserves as the key settlement asset for wholesale financial transactions. Such an outcome would be systemically risky. Central bank reserves are the ultimate risk-free and most liquid asset in the financial system. Their use as a settlement asset for large and time-critical wholesale transactions anchors confidence across the entire payments system, ultimately supporting all payments in the economy.

These scenarios illustrate the main point: for the benefits of the next wave of innovation to be harnessed, central banks and regulators need to keep up pace with developments.

The Central Bank’s response to innovation in payments

So let me now turn to how the Central Bank – as part the Eurosystem and the European System of Financial Supervision – is responding to the innovation we are seeing in payments. Ultimately, we ourselves are on a journey, as we are deepening our understanding of the opportunities and risks of different technologies and innovations.

Our ultimate aim is to ensure that the benefits of innovation for consumers of financial services are realised and the risks are managed effectively, thereby maintaining confidence in money and payments throughout this ongoing transition. This is a strategic priority for us, and the approach we are taking is multi-faceted, reflecting the range of activities we undertake to deliver trust in money and payments.

New technologies for settlement in central bank money

One key initiative is the exploration of new technologies for settlement in central bank money.

Last year, the Eurosystem concluded a successful series of tests employing DLT for settlement in central bank money.9 This work generated widespread interest amongst market participants, across multiple European jurisdictions. This pointed to the market’s desire for the Eurosystem to play an active role in the ongoing digital transformation of the settlement landscape.

Last month, the Governing Council of the ECB decided to step up the Eurosystem’s efforts in this area, following a two-track approach.10 First, in order to meet market demand, as soon as feasible, the Eurosystem will develop and implement a safe and efficient platform for settlements of transactions recorded on DLT in central bank money, through an interoperability link with TARGET Services. Second, the Eurosystem will look into a more integrated, long-term solution for settling DLT-based transactions in central bank money.

Digital Euro

Another way in which the Eurosystem is responding to the innovation in payments is through the preparation for a Digital Euro.

The development of a retail central bank digital currency is especially relevant in the euro area, given the persistent fragmentation of the retail payments landscape in Europe. Despite multiple efforts, more than 30 years since the inception of the Single Market, 25 years since the launch of the single currency, and 10 years since the publication of the Single Euro Payments Area Regulation, most European retail payment solutions remain national in scope. This is preventing us from reaping the full benefits of the Single Market.

The public infrastructure that needs to be built to facilitate a Digital Euro would – amongst others – fill the gaps in our current fragmented retail payments landscape in Europe. More broadly, as a complement to cash, the Digital Euro could be used for all digital payments throughout the euro area, be free for basic use, be available both online and offline, and offer the highest level of privacy. No existing digital payment instrument offers all these features in the Euro Area.

A Digital Euro would offer an open platform for innovation, based upon which private payments providers could build value-added services and achieve pan-European reach, strengthening competition and competitiveness. It is yet another example of a public-private partnership.

A responsive approach to regulation and supervision

Our approach to regulation and supervision has also responded, in different ways, as the payments ecosystem has continued to evolve.

One dimension of that has been the increased supervisory attention on the payments and e-money institutions (PIEMI) sector. In recent years, we’ve seen significant growth in the number and activity levels of PIEMI firms authorised in Ireland, providing services across Europe. Our supervisory efforts have sought to strengthen the regulatory maturity, governance and risk management capabilities of the sector, to better match those growing activity levels.11

Another dimension has been our increased focus on operational resilience. This is critical in the context of growing digitalisation of financial services, including payments, set against ageing legacy IT platforms in some firms. Enhancing operational resilience, including cyber-related resilience, across the financial sector remains a priority for the Central Bank.12 In 2025, a key element of that will be the effective implementation of DORA obligations by regulated firms.

And the regulatory framework has also responded to the growth of digital assets, through the introduction of MiCAR. The Central Bank is the National Competent Authority for the authorisation and supervision of entities in Ireland subject to MiCAR. We have put in place a well-resourced and expert team to deal with the authorisation process in a responsive and timely way.

Strengthened engagement with the domestic sector

Catalysing better public policy outcomes in payments requires effective engagement amongst participants of the payments ecosystem. The Central Bank actively supports that outcome, acting as a ‘convening’ force. We can bring together innovators and incumbents, payment service providers and payment service users, private market participants and public authorities.

An example of that has been the ongoing work through the Irish Retail Payments Forum on identifying and removing barriers to the development of account-to-account payment solutions in Ireland. Later this year, we also plan to engage with the sector on developments in, and implications of, new technologies in payments, including DLT.

From a regulatory perspective, our new Innovation Sandbox helps us deepen our understanding of the opportunities and risks associated with cutting edge innovations, while sharing our expectations for innovators seeking to enter the regulatory remit.13

Our first iteration of the Innovation Sandbox has focused on combatting financial crime and fraud, which are particularly relevant to the payments trends we see. Future iterations of the sandbox could potentially explore DLT and its applications across the financial system, though of course that would require that there is sufficient engagement with the technology from the financial sector.

Our commitment to cash

Finally, let me also cover cash. Because part of the preparation for the future is ensuring that digital developments in payments do not outpace society’s needs and preferences.

Cash is – and will remain – a core element of the payments ecosystem – in Ireland and internationally. Indeed, the Eurosystem’s cash strategy aims to ensure that cash remains widely available and accepted. While the use of cash in Ireland has been declining, it is very clear that there is a continued societal and economic demand by households and businesses to be able to use cash as a means of payment.

In that context, the Central Bank has been preparing for the delivery of our responsibilities under the legislative framework currently going through the Oireachtas on Access to Cash. This is an important public policy intervention, providing a mechanism for ensuring that future developments in the cash infrastructure provided by the private sector reflect society’s needs. And, as a further signal of our commitment to cash, we have embarked on a project to build a new Cash Centre. We see this as a critical piece of national infrastructure, serving society for decades to come.14

Taking a strategic lens on payments innovation

So let me now turn to how we see the financial sector preparing for the potential transformation that lies ahead.

Overall, my observation is that the extent to which payments are seen as a strategic priority across the Irish financial system is uneven, and parts of the sector providing services to domestic households and businesses need to take a more forward-looking approach than we have seen to date. I recognise, of course, that the landscape is shifting constantly and rapidly. And that there are many competing priorities. But it is precisely because of this context, that a strategic lens is important.

Let me give you some practical examples of what I mean.

A strategic lens would recognise that expanding the breadth of data that accompanies a payment transaction is a necessary foundation for the future of payments. We are in the midst of an ongoing enhancement of the infrastructures underlying payment transactions, including by making increasing use of enriched messaging formats – such as ISO20022. Yet, we continue to see provisional, stop-gap measures, rather than long-term solutions. The use of intermediary ISO20022 converters is an example here, which needs to be phased out of the market.

A strategic lens would also seek to maximise the synergies between different tracks of the evolution of payments. For example, in the context of the Digital Euro, the Eurosystem wants to maximize the re-use of standards, payment instruments and infrastructures, allowing payment service providers to build on existing investments, including the ones made for instant payments. So, a strategic approach would seek to go beyond delivering the minimum requirements to meet the Instant Payments Regulation, and see the development of an effective pay-by-account functionality as a building block for scaling up capabilities and reaping the benefits of synergies in the future.

Active exploration of new technologies and innovations is also an important enabler for incumbent financial institutions to better understand their benefits and risks, consider the implications for their business models, and prepare for the future. While Irish financial institutions did not participate in the Eurosystem’s exploratory work on new technologies for wholesale settlement last year, the Central Bank stands ready to support anyone who wishes to engage with the next steps of this work. Similarly, in terms of the Digital Euro, active engagement – with us, with the broader Eurosystem, and within industry fora – is key to building understanding and enhancing preparedness.

So I think a step change is needed in terms of taking a strategic lens to the future of payments, and grasping the opportunities available. Because failure to keep pace is a real risk, both from the perspective of central banks and regulators as well as the financial system itself.

Conclusion

Let me conclude by taking a step back and considering the importance of innovation in payments from a broader lens.

Digitalisation is one of the most powerful ‘mega-trends’ shaping our society and economy. And payments are the lifeblood of the economy. So innovation in payments – done well and safely – can unlock broader economic benefits. It can improve efficiency, enhance competition, and reduce costs for businesses and households. And, at a European level, it can reduce fragmentation, helping to maximise the benefits of the Single Market for all Europeans. For those benefits to be realised, the Irish payments landscape needs to catch up with the frontier of innovation, and also keep up over time. That requires taking a strategic lens on the evolution of payments. And it also relies on an effective partnership between the public and private sectors. I look forward to continued engagement with many of you here today to realise those opportunities in the years ahead. Thank you for your attention this morning – and I hope you enjoy the rest of the conference.

[1] I am very grateful to Austin Carberry, Robert Davies, John Geelon, Patrick Haran, Anne Marie McKiernan, Karen O’Leary, Gillian Phelan, Heloise Rosset, Jason Roche and Mikela Trigilio for their advice and help with preparing these remarks.

[2] Madouros (2024) ‘The evolving payments landscape in Ireland’, available here.

[3] Department of Finance (2024) ‘National Payments Strategy’, available

here.

[4] See, for example, European Banking Authority (2024) ‘Report on Tokenised Deposits’, available here (PDF 869.85KB).

[5] See, for example, UK Finance (2024) ‘UK RLN Experimentation Phase: Summary Report’, available here.

[6] In practice, of course, there have been various incidents of deviations from the peg. See, for example, Kosse et al (2023) ‘Will the real stablecoin please stand up?’, available here (PDF 606.96KB).

[7] See, for example, Carstens and Nilekani (2024) ‘Finternet: the financial system of the future’, available here (PDF 846.75KB).

[8] For an analysis of payments fraud trends in Ireland, see Varadarajan (2025) ‘Behind the Data – Insights from Irish Payment Fraud Statistics’, available here.

[9] See https://www.ecb.europa.eu/press/intro/news/html/ecb.mipnews241204.en.html.

[10] See https://www.ecb.europa.eu/press/pr/date/2025/html/ecb.pr250220_1~ce3286f97b.en.html.

[11] See McMunn (2024) ‘Perspectives and priorities - payments and e-money’, available here.

[12] See Central Bank of Ireland (2025) ‘Regulatory and Supervisory Outlook, available here (PDF 2.15MB).

[13] See Donnery (2024) ‘Innovation and Trust- Regulating in the interests of us all’, available

[14] See https://www.centralbank.ie/news/article/statement-cash-centre-7-december-2022.