Can you spot a scam artist?

Transcript for the video "Can you spot a scam artist?" (PDF 83.93KB)

Scam artists – often referred to as scammers or fraudsters – are using increasingly sophisticated methods to try to gain access to your money and personal data.

These methods include bogus websites, social media adverts, texts, calls and emails. The scammers may offer financial products such as:

- Investments promising high returns

- Pensions and savings products with eye-catching benefits

- Mortgages and loans

- Cheap insurance policies

Complete Our Survey

Help inform our ongoing work to build greater awareness and understanding of scams by completing our short, anonymous survey to share your thoughts.

What are the most common types of scams?

What are investment scams?

Investment scams arise when you are offered an exciting “investment opportunity” promising a high-interest return on your money for very little risk. The investment could be in anything from shares or bonds to crypto. In reality, there is no investment opportunity and the scam artist simply wants you to transfer your savings to them.

How do investment scams work?

You are contacted by a “firm” offering you an investment opportunity to make an unusually high return on your savings. Or you may be researching investment opportunities online and stumble across the scam artist’s website. The scammer may pose as a legitimate firm and their website may be virtually indistinguishable from a genuine firm’s website – this is what’s called a “cloned” firm/website. The scammer might say that the opportunity is only available for a limited time and that you need to invest quickly in order to take advantage of it. The scam works by getting you to transfer your money directly to the scam artist.

How can you protect yourself from investment scams?

- Always get independent financial advice before investing your money.

- Don’t pursue unexpected offers related to investment opportunities.

- Be suspicious of any investment promising guaranteed returns or large profits.

- Make enquiries about the firm that is engaging with you.

- Do not provide personal information about yourself or agree to send money until you are absolutely sure the firm is genuine.

- Check the firm’s regulatory status using Central Bank of Ireland’s register of authorised firms. But remember, scam artists often impersonate legitimate firms so, if you find the firm listed on the register, you should still do additional checks.

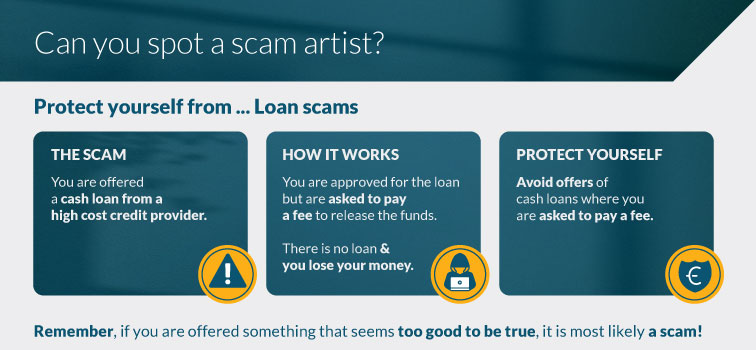

What are loan scams?

Loan scams target people looking for cash loans from high cost credit providers. This type of scam is a form of “advance fee fraud” where you are offered a cash loan but only after you pay an upfront fee or administration charge.

How do loan scams work?

You apply for, or are offered, a cash loan through a website with the promise it will be processed quickly. The website may state that you don’t need to have a good credit rating, or to provide much documentation apart from basic personal details, in order to be approved. The firm may claim to be regulated by Central Bank of Ireland. After you submit your application, you receive a call, text or email telling you that your loan application has been approved, with details of the amount of the loan and the monthly repayment. However, before the money can be issued, you will be asked to pay a fee upfront. The scammer may say the fee is an administration charge or some other type of fee that is necessary to “release” the money. In reality, the loan doesn’t exist and you end up scammed out of the fee.

How can you protect yourself from loan scams?

Beware of cash loan offers from firms that:

- Try to push you into making a quick decision

- Say there will be no credit checks

- Promise to give you a loan even if you have bad credit

- Ask for a fee upfront to release the loan funds.

High cost credit providers regulated by the Central Bank are not allowed to charge any administration fees to apply for a loan. If you are asked to pay a fee, do not use that provider as it is likely to be a scam.

What are phishing scams?

“Phishing” scams are amongst the most common scams out there. Phishing is where scam artists use text messages, emails or phone calls to trick you into giving them valuable personal information such as your online banking passwords, credit card details or PPS number.

How do phishing scams work?

You receive a message that looks like it is from a reputable organisation such as your bank, an online shop, An Post or Revenue.

Phishing attempts can be difficult to spot and may even appear within a genuine “thread” of text messages you may have received from a legitimate organisation. The message may say your account has been compromised and you need to reset your password. Or it may say you need to pay a customs charge for an item you’ve ordered online to be delivered. The aim of the scam is to get you to go to a fake website and input your online banking details, credit card information or other personal financial information. The scammer then uses this information to access your account and steal your money.

How can you protect yourself from phishing scams?

- Be suspicious of text messages received out of the blue that claim to come from a reputable organisation, such as your bank or credit/debit card issuer.

- Do not respond to texts, emails or phone calls requesting personal information such as your bank account details or other passwords.

- Do not call any phone number or click on any link embedded within a text message.

- Be cautious of messages that prompt you to visit a website to resolve an issue or verify your details urgently.

- Only reset your online passwords if you initiated the reset.

How do you protect yourself from scams?

We asked members of the public about the steps they take to protect themselves from financial fraud/scams. Their responses highlight the prevalence and variety of scams being used to target individuals, and what people are doing to stay one step ahead of the scam artists.

Read the transcript of the video "How do you protect yourself from financial fraud"? (PDF 153.56KB) (PDF 73.13KB)

Take the “SAFE” test

If you are considering buying that product or dealing with that firm, through a website or social media, or if you receive an unsolicited phone call, email, text message or pop-up box out of the blue, take the SAFE test first.

What is this firm offering? Who is contacting me? Where did they get my contact details? Who are they? Do I feel rushed to provide personal or financial information? Remember, there is no short-term advantage to making quick decisions on your longer-term financial wellbeing.

Check Central Bank of Ireland’s registers to see if the firm is authorised. Even if the firm appears to be authorised, you should still make sure it is genuine. It’s common for scammers to pretend to be genuine by “cloning” the appearance of an authorised firm and copying some or all information related to that firm. Check for any irregularities such as misspellings and grammatical errors in the firm’s website, emails or paperwork. Call the firm using its publicly advertised phone number.

Seek advice to ensure the service or product is genuine. Never provide your personal information or agree to send money unless you are satisfied that the firm is authorised and genuine. Ask yourself:

- Is the financial service or product I am being offered from trusted sources?

- Is this a genuine financial product?

- Do I need this product?

- Are the returns high? Does firm say it will cover all of my capital investment so I don’t lose anything?

- Does it seem too good to be true? If yes, then its most likely a Scam.

If you are looking for a loan and you are asked for an upfront fee, you should immediately stop engaging with the firm as it’s a scam.

If you have any concerns that a firm is not genuine or is not authorised to sell financial products, we want to hear from you. We have powers to investigate and take action against these fraudsters. We are here to support and protect you and we work closely with the Gardaí to stop and prevent financial criminals from taking advantage of our loved ones and us. You can make your report to us directly on our website or by phoning us on Lo-call 0818 681 681 or Landline 01 224 5800.

Remember, if you engage with an unauthorised firm, you lose important protections designed to look after you if things go wrong. For example, you are not able to make a claim under the Investor Compensation Scheme, and the Financial Services and Pensions Ombudsman will not be able to help you with your complaint. This means you are unlikely to get your money back if things go wrong.

Please also remember that the Central Bank will never contact you asking for money or your PPS number.

See also:

Complete our survey

Has the content on this web page been useful? Please consider completing our short, anonymous survey to share your thoughts. Your views will help inform our ongoing work to build greater awareness and understanding of scams.