Explainer - What information do I need to provide when buying insurance?

The requirements for buying insurance differ depending on what type of insurance you need. For example, the questions you are asked and the documents you need to provide to your insurer are different for motor insurance than for home insurance.

Questions your insurance provider will ask you

When you buy or renew an insurance policy, your insurance provider will ask for certain information. It is important you provide all of this information. Failure to provide some or all of this information could mean you do not have insurance cover.

The two most common types of insurance that people buy are motor and home insurance.

Motor insurance

When applying for motor insurance, you will need to provide certain information. Examples include:

- The registration number and estimated value of the vehicle you want to insure

- Details of driving experience, including the type of driving licence you hold and for how long, evidence of no claim discounts and details of any previous claims

- Whether or not you have accrued any penalty points

- The make, model, engine size and age of your vehicle along with the primary purpose of driving and estimated usage

- Relevant personal details, including your address, age and previous insurance details.

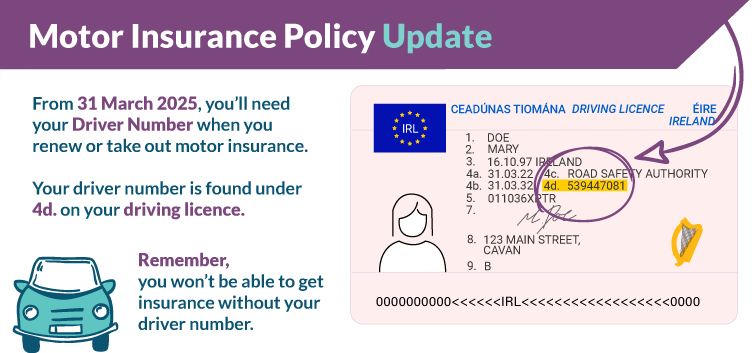

If you are taking out a new motor insurance policy, or renewing an existing one, from 31 March 2025, you are legally required to provide your driver number and the driver number of anyone named on your policy. The driver number can be found in Section 4 (d) of an Irish Driver’s licence or learner permit. Without your driver number, you will not be able to get insured.

Home insurance

When applying for home insurance, you will need to provide certain information. Examples include:

- The Eircode of the home you want to insure and details about the occupancy of the property

- Details of the level of rebuild costs and contents cover that must be provided To avoid being underinsured on your home insurance, take a look at our explainer on home underinsurance.

- Home insurance history, including any related claims.

- Information such as the age and type of property, number of bedrooms, type of heating, construction and roof type and whether the property has a burglar alarm

- Relevant personal details, including your address, age and previous insurance details.

Make sure to compare providers to ensure you’re getting the best deal

You can make savings on insurance costs by shopping around for the best deal. However, it is important to look at what the policy covers as well as the cost, so make sure you compare the level of cover provided when reviewing quotes from different insurers. The Competition and Consumer Protection Commission (CCPC) has a useful checklist to help you compare policies.

What are insurance providers required to do?

The Consumer Protection Code sets out requirements for insurance providers on the information they must provide to you. Along with general requirements for all firms, there are specific rules for insurance providers:

- Renewal notifications must be sent to customers at least 20 working days ahead of the policy end date.

- You must receive a quotation for all policy options available e.g. comprehensive, third party, building only or building and contents.

- For motor insurance renewals, you must be provided with details of the premium paid in previous years.

- Where an insurer refuses to quote for a home or motor policy, they must give you the reasons why and notify you of your rights to refer the matter to a Declined Cases Committee.

- Your insurer must provide you with all policy documents within 5 days of providing cover.

See also: