Understanding finance

04 November 2020

Blog

I’ve spoken before about the importance of a well-functioning financial system for prosperity and economic growth. The ‘financial system’ is at the heart of every modern economy. It has many ‘actors’, including financial service providers like banks, credit unions, insurance companies, funds, and asset managers among others. Consumers of financial services include individuals, households, businesses and governments, while central banks and regulators are crucial parts of the architecture of the financial system. The system enables the transmission of resources through an economy, providing liquidity for and intermediating between individuals, households and firms who represent an economy's borrowers and savers. Funds are allocated for investment, for people purchasing a property or starting a business for example. Risks can be shared through insurance, which can be obtained for protection against the uncontrollable events which may affect us. And, of course, payments can be made for goods and services in a safe and efficient manner. When the system works well, resources are allocated efficiently and satisfy the needs of the community that, at the end of the day, represents ‘the economy’.

In this post, I want to delve into a bit more detail on the consumers of financial services, particularly individuals and households, and how important understanding finance is for them.

What is ‘financial literacy’ and why does it matter?

Financial literacy can be described as “peoples’ ability to process economic information and make informed decisions about financial planning, wealth accumulation, pensions, and debt.” (PDF 331.52KB) Many people make decisions about their finances but they don’t always feel comfortable doing so, nor knowledgeable enough to understand the wide variety of financial products available to them. This isn’t just in Ireland: low levels of financial literacy or understanding are evident around the world. (PDF 331.52KB)

Financial literacy impacts on financial wellbeing (the ability of individuals and households to finance their current and future needs and their resilience to shocks). A 2018 survey from the Competition and Consumer Protection Commission (CCPC) (PDF 372.34KB) found that 25% of respondents described themselves as financially secure while 52% of respondents reported a positive level of financial comfort but had less put aside for their future financial needs (such as retirement). These results suggest that, on average, consumers in Ireland have some level of financial comfort but there are also significant numbers who describe themselves as “just about coping” (16%) and “struggling” (7%). The report highlighted the importance of financial education for these results: 60% of respondents in the ‘financially secure’ category received some form of financial education at school, while for those ‘financially struggling’, the comparable figure was just 10%.

Financial literacy and education are highly relevant for the Central Bank of Ireland’s consumer protection role. I’ve previously outlined how protecting consumers is at the heart of everything we do at the Central Bank, whether that be through our work on price stability, financial stability, conduct of business rules, or working to ensure financial institutions are resilient. One, more specific, example of how we aim to deliver on this is to ensure that regulated firms treat their customers in a fair and transparent way. Transparency is fundamental to enable consumers to make informed decisions in their best interest. And financial literacy is a key tool in this decision-making process.

I agree with the Organisation for Economic Cooperation and Development (OECD) that the education system has a critical role to play here. It recommends that financial education starts as early as possible and is taught in schools. In my view, building financial education into the school curriculum allows children to acquire valuable knowledge and skills that will help them throughout their lives (particularly important as parents may not be well-equipped to pass on these skills). Early financial education also helps build financial resilience by enabling people to devise short and long-term strategies to cope with financial shocks (as the OECD also highlights) alongside the public policy actions to lessen the effects of the shock on households and firms.

Some recent evidence from the Irish mortgage market

A recent example of how we work to ensure consumers’ best interests are protected can be seen in our efforts to make mortgage switching easier. In 2018, we introduced measures that mean lenders must provide clear information, such as telling borrowers about cheaper mortgage options 60 days before you come out of a fixed rate mortgage or informing borrowers whether they can switch to a cheaper mortgage based on how much equity is in your home. And last week, we published some research on how much mortgage switching is taking place in the Irish mortgage market.

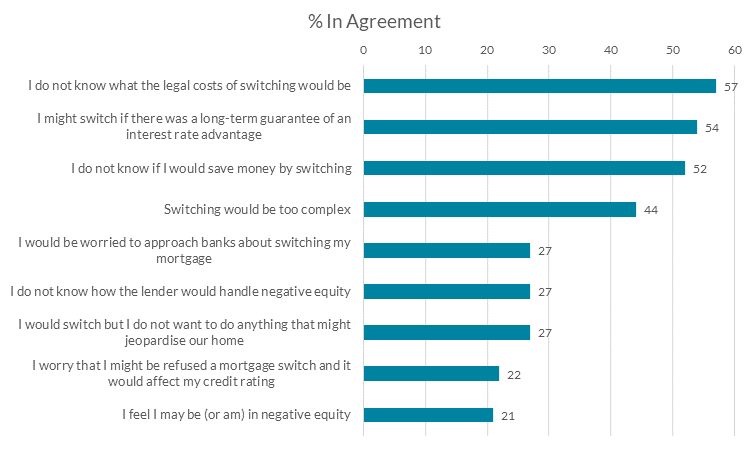

It shows that there is room to improve. Although there has been some increase in switching activity in recent years, it remains low relative to the outstanding pool of borrowers who could benefit. The benefits of switching may not be high enough in some cases to offset costs such as legal fees but three in every five eligible mortgages stand to save over €1,000 within the first year if they switch mortgage provider, and more than €10,000 over the remaining term. There are a diverse range of potential obstacles to switching including psychological factors, lack of knowledge of the costs and benefits, and the perceived complexity of the process. The main self-reported reasons consumers don’t switch include that they don’t realise how much money they could save, they find it difficult to compare mortgages and that they believe the process is too long and complicated. Our measures to make switching easier should help with some of these concerns and we will continue to ensure that lenders make the switching process as straightforward as possible.

(It’s worth mentioning here that interest rates on new mortgages in Ireland are higher than in most other EU countries, although recent trends show that rates have been falling month-on-month. The reasons for higher interest rates deserve a blog post of their own, and I will discuss these in greater detail in the coming weeks, but, in brief, it’s a mix of the legacy of the 2008 financial crisis [which means banks in Ireland are required to hold higher capital and have higher non-performing and restructured loans than most other European peers which result in higher costs that are passed on to consumers] and the lower levels of competition in the mortgage market here in Ireland relative to other jurisdictions. Interest rate setting is ultimately a matter for commercial lenders. However, the steps we’ve taken to encourage mortgage switching are designed to ensure consumers receive the best rate possible and higher switching levels would lower the average rate facing consumers.)

Figure 1: Attitudes to mortgage switching

Source: Room to improve: A review of switching activity in the Irish mortgage market, Byrne, S., Devine, K., and Y. McCarthy (2020).

Conclusion

Financial literacy matters to all of us. It improves our financial wellbeing, providing us with knowledge that also builds resilience to cope with financial shocks. It should be a core part of our children’s education.

But, while improving financial literacy can help all of us make better decisions, it isn’t a silver bullet when thinking about consumer protection. As my colleague Derville Rowland said recently, “while financial education is vitally important, for most consumers it will never ensure parity of experience or knowledge with [financial] professionals ... there is a duty of care on financial services firms to design and provide suitable products and, where advice is sought, to recommend the most suitable from their range.” Consumer protection begins with financial service providers themselves.

Gabriel Makhlouf

Read More