Explainer - How has the Central Bank made mortgage switching easier?

-buying-a-house-756x350.jpg?sfvrsn=c0c1b21d_6)

Taking out a mortgage is a big financial commitment and you should try to get the best deal that you can on the loan. However, the best deal when you take out your mortgage, may not be the best deal forever. Over time, cheaper deals can become available and you could end up paying more for your mortgage than you need to.

Switch and save

An easy way to cut your monthly mortgage bill and save money is to switch to a cheaper one. A cheaper mortgage could be available from your existing lender or offered by a completely different lender which you could switch to.

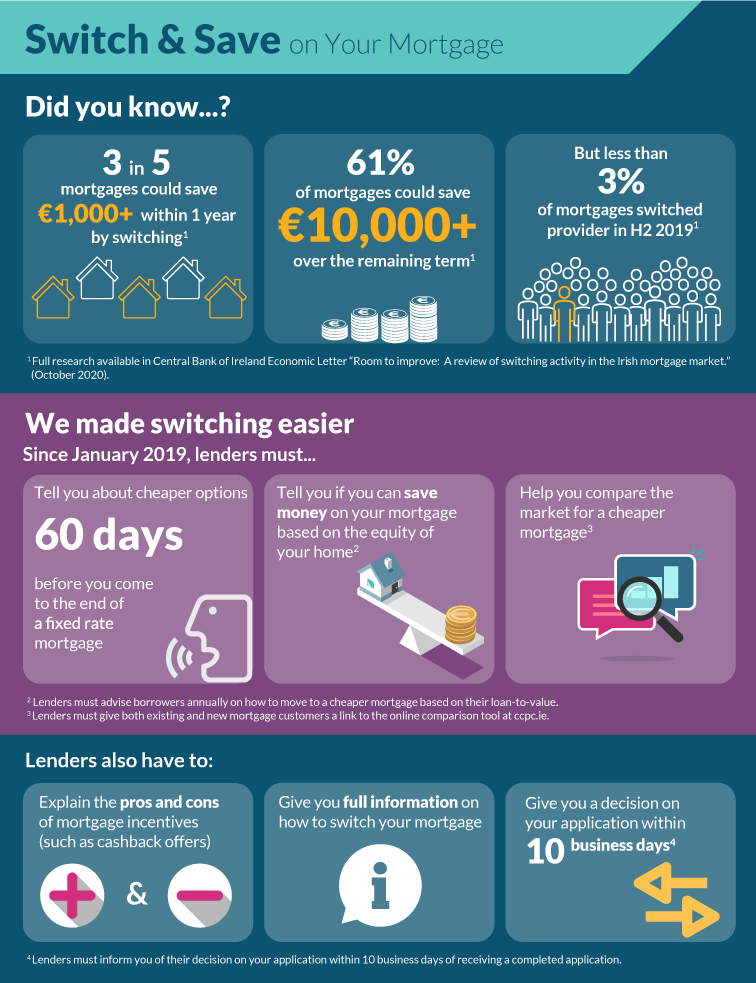

Exactly how much money you could save depends on lots of factors. However our research shows that three in five people in Ireland could save €1,000 or more within a year of switching. And over 60% of switched mortgages are €10,000+ cheaper over the remaining term of the loan.

Do many people switch in Ireland?

No - not at all. Despite the potential savings, most people in Ireland never switch their mortgage. In fact less than 3% of mortgages were switched in the first six months of 2019.

Our research shows that among the reasons people don’t switch is because:

- They don’t realise how much money they could save

- They find it difficult to compare mortgages

- They believe the process is too long and complicated

Making switching easier

To make mortgage switching easier, last year we introduced new measures that lenders will have to follow.

In summary, the measures mean lenders must:

- Tell you about cheaper mortgage options 60 days before you come out of a fixed rate mortgage

- Tell you if you can switch to a cheaper mortgage based on how much equity is in your home

- Clearly explain the pros and cons of any mortgage incentives such as cashback offers

- Give you a comparison of how much your mortgage costs versus other options offered by your lender if you ask for one

- Give you all the information you need to switch, including telling you how long it will take

- Give you a decision within ten business days of receiving a completed mortgage application

For help comparing mortgage providers and to find out exactly how much money you could save by switching see the Competition and Consumer Protection Commission’s mortgage switching calculator.

See also: