COVID-19 and developments in credit

13 May 2020

Blog

In the last few weeks I have written about how we and the financial system more broadly have sought to support households and businesses through the crisis and to be well positioned for the recovery when it comes. In this post, I want to go into some more detail on the provision of credit to the economy, a key function of the financial system.

The importance of credit may be obvious but it is worth stating: it enables investment and consumption that otherwise could not take place. Credit helps individuals start a business or purchase a home and it helps firms increase their productive capacity and employ more workers. It is particularly important when businesses or households are liquidity-constrained, which is very relevant today.

The interaction between the supply and demand for credit in a crisis is not necessarily simple or straightforward. In times of adverse shocks, the financial system may draw back on how much credit it is providing to the real economy. An excessive credit contraction can be damaging. It can amplify existing shocks and further reduce economic activity which, in turn, adds to downward pressures on incomes and employment making existing debt burdens harder to manage. These dynamics can result in damaging and potentially long-running debt spirals. Former Federal Reserve Chairman, Ben Bernanke, labelled this propagation from credit conditions to the business cycle as a "financial accelerator".1

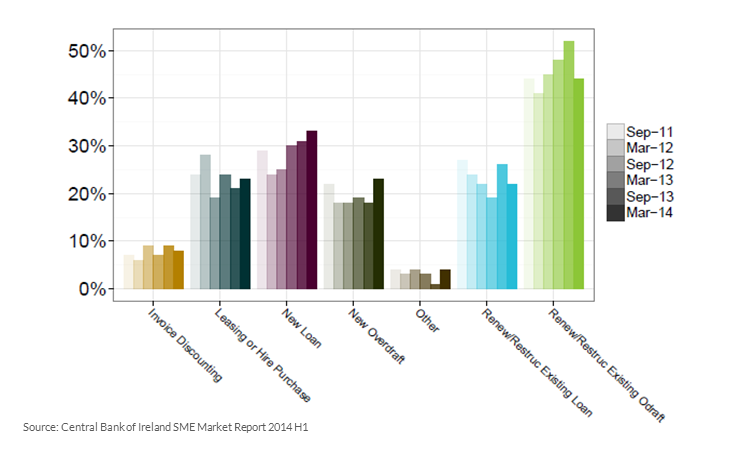

A stable supply of credit is essential to ensure the liquidity demands of viable firms are met. For example, the renewal or restructuring of existing overdrafts was the most common bank lending product requested following the last crisis in Ireland (figure 1); 44 per cent of all SMEs seeking credit in the period October 2013 to March 2014 requested this type of product.2 Supporting viable businesses through difficult economic times can avoid unnecessary bankruptcies and is a critical function of the banking system.

Figure 1: Bank finance products requested, 2011 to 2014

Credit also plays an important role in supporting households and businesses to invest and consume when recovering from an economic slump. The financial system needs to remain resilient through crises so it can support the recovery. Credit increases that support sustainable growth and investment, and are based on prudent lending practices, are a source of long term prosperity.

Of course, one can also have too much of a good thing. Excessive credit growth can be extremely damaging, as Ireland knows too well. If credit growth is in excess of economic fundamentals and does not enhance the productive capacity of the country, then individuals, households and businesses may have trouble paying back what they borrow and can become over indebted. This leads to financial fragility and ultimately financial instability. An adverse shock – such as the COVID-19 crisis – could lead to people losing their jobs and having trouble repaying their debts, which impacts on both their lenders as well as the economy as a whole.

Understanding what we call the 'credit cycle' underpins our macroprudential policies (such as the Counter Cyclical Capital Buffer (CCyB) and the mortgage measures). It is also why we pay so much attention to credit developments, and why we require banks to have sufficient buffers to deal with adverse shocks and not create vulnerabilities through imprudent lending.

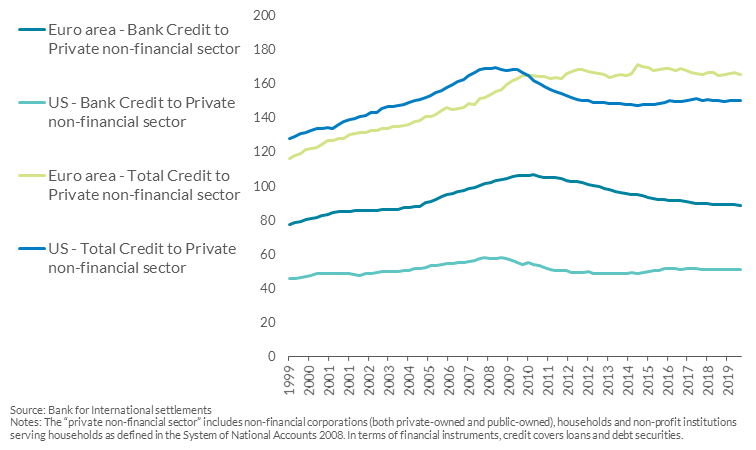

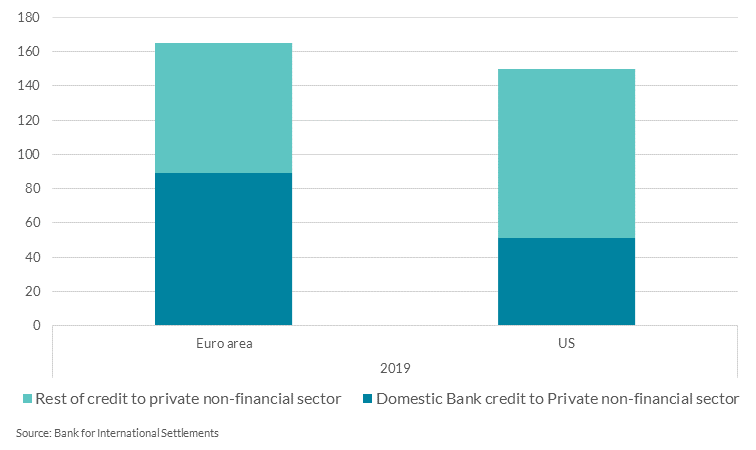

The structure of the financial system is also important when it comes to analysing credit and business cycle fluctuations, as different markets differ considerably in their effects.3 Figures 2a and 2b shows that – when looking at all types of credit and over time – the euro area provides considerably more credit to non-financial corporates than in the US. The bank-based structure in the euro area underscores the importance of analysing these bank credit conditions. Non-bank financial intermediation has also grown rapidly in recent years, doubling in value in Ireland.4

Figure 2a: Bank and total credit to the private non-financial sector as share of GDP (percentage) - 1999 to 20195

Figure 2b: Credit to the private non-financial sector as share of GDP (percentage) - 20196

Overall, credit developments are driven by a combination of supply and demand factors. At its simplest, credit supply is the ability and willingness of financial institutions to lend, and credit demand is the ability and willingness of households and firms to borrow. Uncertainty about the future affects both the supply side (as banks' risk appetites may reduce, resulting in less lending) and the demand side (as households and firms may be unwilling to take on additional debt). And of course the cost of credit matters. (Interest rates for non-financial corporate loans in Ireland have remained high in recent years – in comparison to elsewhere in the Eurozone – for a number of reasons including the country's relative macroeconomic volatility, its crisis experience, and higher credit risk.7 But even in the euro area market structures are different and we need to be careful about simple comparisons.)

Credit Developments in Light of COVID-19

So what is happening in Ireland with regard to credit? As you might expect, COVID-19 is having an impact.

Pre-existing credit lines are an important source of liquidity for corporates and SMEs and material from a macroeconomic perspective. In June 2019, Irish resident SMEs had €2.7bn in undrawn credit available from Irish retail banks.8

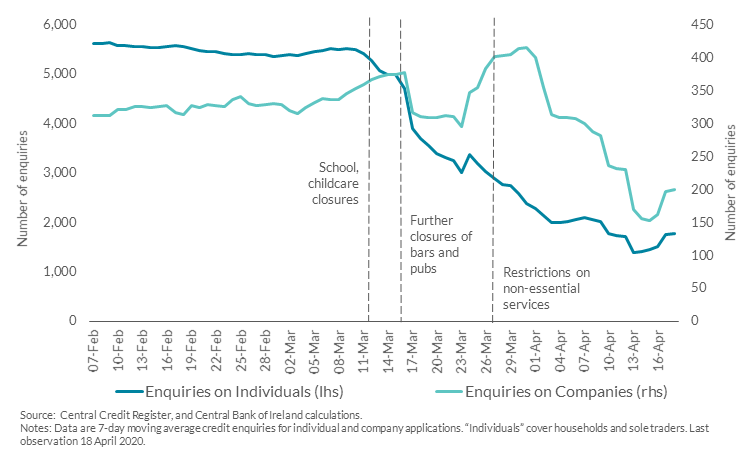

Last week, colleagues at the Central Bank released some interesting and timely research based on Central Credit Register data, which sheds further light on credit developments in Ireland. Figure 3 shows that credit enquiries for new loans decreased significantly with the onset of COVID-19, although enquiries for businesses briefly picked-up in around the quarter-end, before decreasing at the beginning of April.

Figure 3: Decline in Credit Enquiries for New Loan Application's

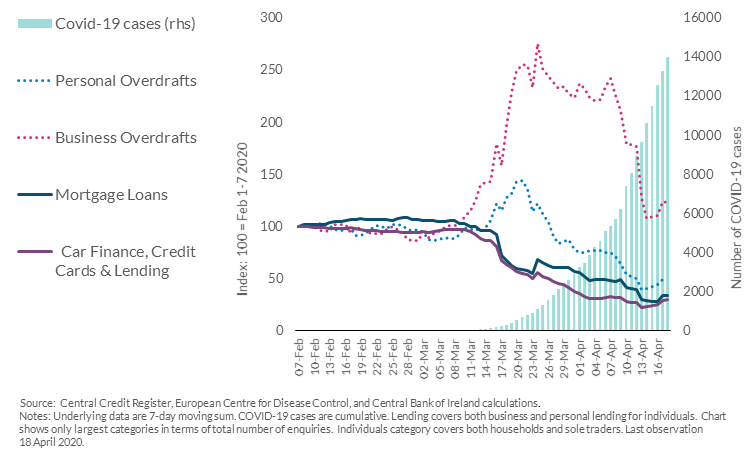

Aside from overall credit demand, the composition of demand can change from application's for mortgages and term loans, to overdrafts or working capital loans. Figure 4 shows new loan demand appearing to decline for mortgages and other forms of personal lending (including credit cards and car finance). However, lender enquiries on new overdraft application's (from both individuals and companies mainly for business purposes) increased during March before falling back in early April. Precautionary motives or cash-flow concerns may explain these developments.

Figure 4: Less demand for mortgages and other types of personal debt but some increases in overdraft application's since February 2020

Evidence from the Bank Lending Survey – which we carry out quarterly – confirms the patterns in the application's data.9 A further piece of research (to be published tomorrow) shows that banks expect firms' demand for short-term loans to increase and demand for longer-term loans to decrease. On the household side, demand is expected to contract sharply, both for mortgage lending and for consumer credit. Banks reported a very marginal tightening in credit standards on loans to firms in the first quarter of the year, owing to changes in the economic outlook and borrower creditworthiness. And, so far, banks do not report any changes in credit supply coming from changes in their own cost of funds or balance sheet conditions although they expect to tighten their credit standards in the second quarter of the year.

Finally, credit unions also play an important role in the provision of credit to Irish households and businesses. If we consider lending to households and non-financial corporations from banks and credit unions, credit unions account for about 4 per cent of this. Credit unions also represent approximately one third of the consumer credit market and are well positioned to provide access to credit to support the recovery.10

Conclusion

We know that credit supply contracts during a crisis and banks' risk appetite is pro-cyclical. As I wrote last week, we've looked to ensure credit supply is not excessively constrained, with measures designed to safeguard liquidity conditions and protect the flow of credit to the real economy. It is in the interest of the whole banking system to maintain the supply while ensuring prudent lending. The Government's recent announcements on guarantee scheme loans and SBCI on-lending programmes are also an important contribution against a tightening in credit supply to SME customers.

Over the coming months we will continue to look closely at credit conditions in the economy, including how Irish institutions are using the new facilities provided by the ECB. The recovery will need an effective supply of credit and a resilient financial system to provide it.

Gabriel Makhlouf

1 Mr. Ben S Bernanke (15 June 2007). The Credit Channel of Monetary Policy in the Twenty-first Century (PDF 54.09KB). Federal Reserve Bank of Atlanta, Atlanta, USA.

2 Central Bank of Ireland (2014) (PDF 3.35MB).

3 See for example BIS Quarterly Review, March 2014, Financial Structure and Growth (PDF 270.51KB).

4 See Central Bank of Ireland research Mapping Market-Based Finance in Ireland (PDF 1.23MB). Also see remarks from my ECB colleague, Vice-President Luis de Guindos.

5 Source, Bank for International Settlements.

6 Ibid.

7 See 'Influences on Standard Variable Mortgage Pricing in Ireland', Central Bank of Ireland, May 2015, here for a useful overview of some of these factors. Also, see ECB Monetary and Financial Statistics.

8 McGeever, McQuinn, Myers (2020). SME liquidity needs during the COVID-19 shock (PDF 486.78KB). Financial Stability Note No.2.

9 See ECB Bank Lending Survey.

10 See Financial Conditions of Credit Unions 2014-2019 (PDF 1.03MB).

Read more