Behind the Data

Has demand for new loans changed during the COVID-19 crisis?

Rory McElligott, Martina Sherman and Maria Woods*

May 2020

New daily data suggest the demand for loans fell during March 2020 and the first half of April although overdraft applications, mainly for business purposes increased.

The demand for loans is important for understanding current and future economic developments, including demand for property and company investments. However, demand for certain types of loans, such as overdrafts, may indicate cash-flow pressures.

Households and firms continue to adjust to the rapidly evolving COVID-19 environment. Containment measures have changed the global economic environment (e.g., the IMF’s April 2020 World Economic Outlook projects 3 per cent contraction in 2020). Domestically, the economic outlook also remains uncertain (see the Central Bank’s Quarterly Bulletin, April 2020). In response, policy makers have moved to reduce the economic impact of the pandemic (see Governor Makhlouf’s Blog).

In this environment, real-time data provide useful insights for policy and risk analysis. In this “Behind the Data” (BTD) we introduce a new daily dataset based on lender enquiries on the Central Credit Register following new loan applications. We examine how this proxy for credit demand has changed since the onset of the global COVID-19 pandemic in Ireland.

The Data

These daily data are based on lender enquiries on the Central Credit Register. As part of post-banking crisis reforms, the Central Credit Register was established and is managed by the Central Bank of Ireland. Since 2017, its coverage has expanded in terms of both lender and loan categories. This mandatory national database supports credit decisions within the economy and also contributes to the Central Bank’s strategic functions of financial stability, regulatory oversight and consumer protection.

In this BTD we focus on a subset of the Central Credit Register database. Specifically, daily data on the number of lender enquiries related to new credit applications for both individuals and companies across a range of loan categories are used. Dating from 1 February 2020, these daily reports were created to assess the economic impact of the outbreak of the COVID-19 virus in Ireland. Movements in these data provide early insights into the profile of new loan demand as the economic climate evolves.

There are some limitations to the enquiry data as a complete measure of overall credit demand in Ireland. First, discouraged borrowers or immediate application rejection by lenders will not be captured. Therefore, it is useful to also review sectoral surveys on access to finance and Bank Lending Surveys when assessing demand and supply credit conditions. Second, borrowers may apply to many lenders, creating multiple credit enquiries, which could lead to an overestimation of demand. Finally, lenders must enquire on the Central Credit Register if the loan application is above €2,000 which may omit smaller credit applications if the lender does not opt to enquire.

General Decline in Total Credit Enquiries Since early-March 2020

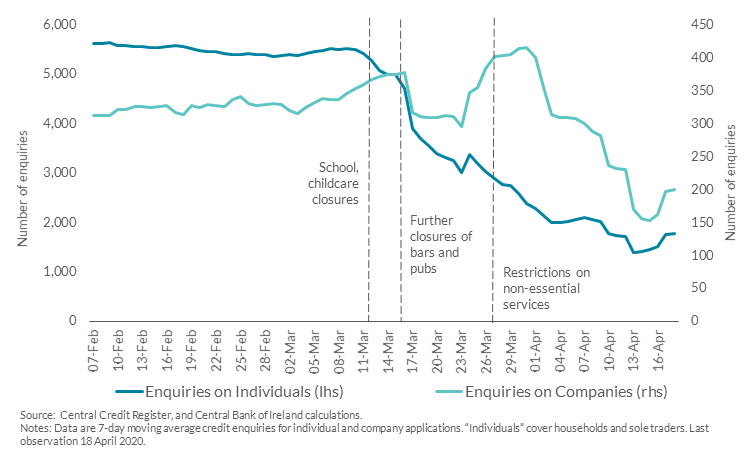

Coinciding with the increase in confirmed cases of the COVID-19 virus, and the introduction of essential containment measures, credit enquiries for new lending applications fell in March 2020. By the end of the month, the total level of enquiries had decreased by 20 per cent compared to February. By mid-April, credit enquiries averaged around 2,000 per day compared with around 5,800 per day in February.

Overall individual credit demand, which is the majority component of total enquiries, appears to have fallen sharply since mid-March (Chart 1). Similarly, despite a brief-pick-up in company-related enquiries around the quarter end, the latest figures up to 18 April suggest lower daily loan applications than in February.

Chart 1: Decline in Credit Enquiries for New Loan Applications

Credit Demand by Individuals Falls

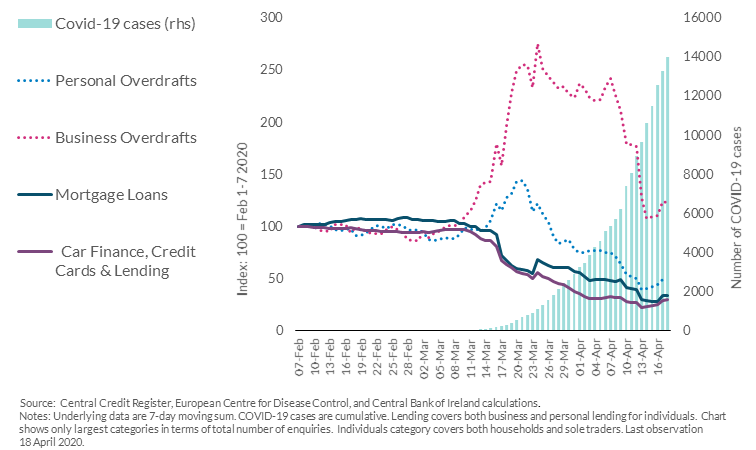

These new enquiries data indicate that credit demand may have declined for mortgage and new consumption loans since the outbreak of COVID-19 in Ireland (Chart 2). Current restrictions may also be limiting market activity in the housing and large consumer purchase categories, as well as travel and holiday borrowing.

Enquiries related to new mortgage applications for individuals fell by almost a fifth between February and March 2020. If such trends continue, there may be implications for demand in the housing market in the coming months. Lending for house purchase continued to increase during March, however, indicating that sales that were at an advanced stage may be proceeding (Money and Banking Statistics, March 2020).

Although personal loans accounted for half of credit enquiries in March, this category declined by about 25 per cent over the month, suggesting a lower appetite for new debt. Similarly, applications for new credit cards and car finance products reduced during the month (Chart 2). A precautionary pull back from non-essentials could explain these trends. The movement restrictions have also limited discretionary spending opportunities (Hopkins and Sherman, 2020).

Chart 2: Less demand for mortgages and other types of personal debt but some increases in overdraft applications since February 2020

By contrast, enquiries related to overdrafts and in particular, those for business purposes did increase during March relative to February before falling back in early-April. Following the school closures on 12 March, enquiries related to personal overdrafts initially increased but have since reduced. While overdrafts are typically a small component of both outstanding household lending (i.e., 3 per cent) and of credit enquiries, higher applications suggest either cash-flow concerns or precautionary behaviour during March.

The reduction in demand for personal loans and mortgages for example, and the increase in demand for overdrafts highlight the different experiences of individuals and households at present (See Beirne et al, 2020).Many are still in employment and may not be cash-constrained. This cohort will still be affected by the prevailing uncertainty and engage in precautionary behaviour by cutting back on planned purchases such as holidays, property and cars. Also, their ability to consume may be reduced by the containment measures during this period. Many others have lost their jobs or face reduced wages. While these people may also defer credit demand for new purchases, increased short term cash-flow challenges could arise which may, in part, be helped by bank loans such as overdrafts in addition to new government supports.

Company Loan Applications Dominated by Overdrafts

In contrast to consumers, overall company financing needs increased by one-fifth in March, mainly owing to overdraft requests. However, up to mid-April, the number of business-related enquiries was less than in February.

Given the challenging scale of the economic shock, an increase in company finance demand could be expected. From existing data, we know that firms operating in the primary, manufacturing, hotels and restaurants, and wholesale and retail sectors are most reliant on bank financing. Given that the accommodation, retail trade, food and beverage sectors have been particularly impacted by the government containment measures, an increase in the financing needs of businesses could result. Among SMEs, McGeever, McQuinn and McCann (2020) points to a potential increase in new credit demand if internal funds and existing committed credit lines prove insufficient to cover non-labour expenses and for contingencies. Government supports may also bridge financing shortfalls; the first Business Impact of COVID-19 Survey revealed that almost half of respondent enterprises (incl. SMEs) had used the Temporary COVID-19 Wage Subsidy Scheme.

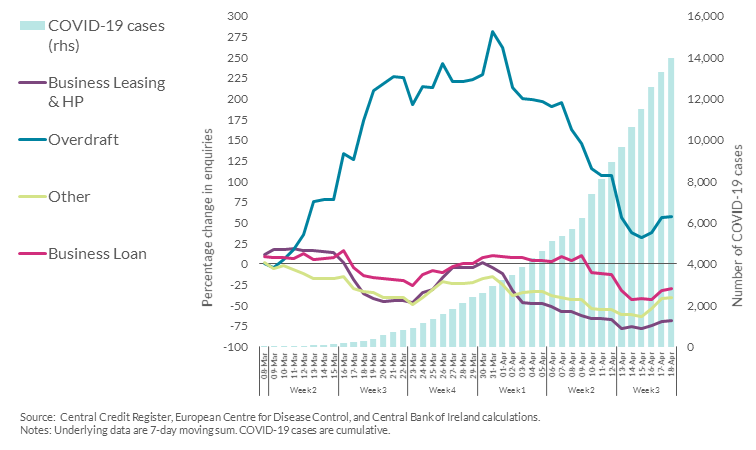

While these data do not cover existing credit lines, new overdrafts could be one type of credit requested “on a contingency basis”. Business overdraft enquiries increased significantly from mid-March following the initial government announcement, and peaked in the final week of March with a 280 per cent increase on the final week of February (Chart 3). Lenders made enquiries on an average of 185 overdrafts each day during the final week of March, markedly up on an average of 60 each day during the last week of February. By the middle of April, overdraft requests, while still elevated, had come back to around 70 applications on average per day. In total, since 9 March, lender enquiries on overdraft applications account for one-third of all applications.

Loan applications for other popular forms of business credit such as term loans, leasing arrangements and hire purchase agreements declined in the week immediately following the closures of schools, childcare facilities, and pubs and bars (Chart 3). Term loans and particularly leasing applications actually increased in the days leading up to the initial restrictions announced on 12 March, perhaps reflecting contingency planning and the increased need for remote working equipment.

Chart 3: Companies Overdraft Applications up Significantly on February

(% change on corresponding week in February)

While April data so far indicate a reduction in firm credit demand compared to February (Chart 3), there is continuing strong demand for overdraft facilities. Excluding overdrafts, business finance applications are down 41 per cent in the first few weeks of April, compared to the equivalent period in February.

Such loan application trends may suggest that firms are reducing typical investment activity and are either maintaining a precautionary position or are facing financial pressures. Recent data for March additionally show a monthly increase of €2 billion (3 per cent) in non-financial corporate deposits with the Irish banking system. The Bank Lending Survey in April also shows similar patterns, with Irish banks reporting less demand for long-term loans and for fixed investment purposes in 2020 Q1 while some increases in loan demand for inventories and working capital were noted.

Conclusion

Real time, high-frequency data can help policy makers and risk analysts during this time of economic uncertainty associated with the required precautionary COVID-19 measures. This “Behind the Data” introduces a daily proxy for credit demand which can shed light on the financing needs of the Irish private sector between February and mid-April 2020. As the pandemic unfolded in Ireland and restrictions were introduced, new loan demand appeared to decline for mortgages and other forms of personal debt. Lender enquiries on new overdraft applications, from both individuals and firms mainly for business purposes, however increased quite sharply during March before falling back up to early-April. Precautionary motives and/or cash-flow concerns may explain these developments. As new data are collected, seasonality and possible links to new lending data will be investigated.

*Email [email protected] and [email protected] if you have any comments or questions on this note. With thanks to Brigid Lanigan for assistance with the dataset. Comments from Mark Cassidy, Reamonn Lydon, Vasileios Madouros, Caroline Mehigan, Brigid Lanigan, John Connolly, Susan Robertson and Mark Channing are gratefully acknowledged. The views expressed in this note are those of the authors and do not necessarily reflect the views of the Central Bank of Ireland or the ESCB.

See also: