Behind the Data

How has the COVID-19 Pandemic Affected Daily Spending Patterns?

Andrew Hopkins and Martina Sherman

April 2020

New data reveals consumers spending less on cards and making fewer ATM withdrawals as COVID-19 pandemic continues.

While the outbreak of COVID-19 and associated public health measures has had a dramatic effect on day-to-day life in Ireland, it has also had a marked impact on how we are spending our money.

New data published by Central Bank of Ireland has found that spending on credit and debit cards initially increased as the government announced the first set of containment measures on 12 March, before falling in the second half of the month. Meanwhile, the daily value of cash withdrawals from ATMs collapsed by 40 per cent over the same period.

The new figures are contained in an insightful real-time dataset which examines the developments in retail card spending in the weeks after the first confirmed case of COVID-19 in the Republic of Ireland.

During this fast-moving crisis, there is a need for timely, high frequency data to better understand the impact of the emergency measures on personal expenditure and economic activity. Most information used to monitor economic activity is of low frequency and available with a lag, such as monthly or quarterly at T+ 1 month. As part of the our wider work on developing a number of real-time indicators of economic developments during the current crisis, a daily collection of debit and credit card payment data was therefore established to assist with monitoring retail spending activity.

This “Behind the Data’” note looks at how our spending habits have changed since the emergence of the COVID-19 pandemic in Ireland.

The Data

The new daily card payments data, which is published alongside this note and will be updated weekly, relates to all point of sale transactions covering both online and in person transactions (pin and contactless), and ATM withdrawals. The data is a subset of the existing monthly Credit & Debit Card Statistics, allowing for comparison with previous months.

The data captures spending and numbers of transactions on euro-denominated credit and debit cards issued to Irish consumers and businesses. While only cards issued by the largest Irish issuers of credit/debit cards are included (representing 98 per cent of card transactions), their spending patterns in real-time during this period brings useful insights, which would not be attainable with lower-frequency data. Studies from the ECB, Reserve Bank of Australia, Federal Reserve and Bank of Italy also show the benefits of high-frequency retail transactions data as early indicators of household consumption and economic activity.

Spending Patterns Since the Beginning of the Pandemic in Ireland

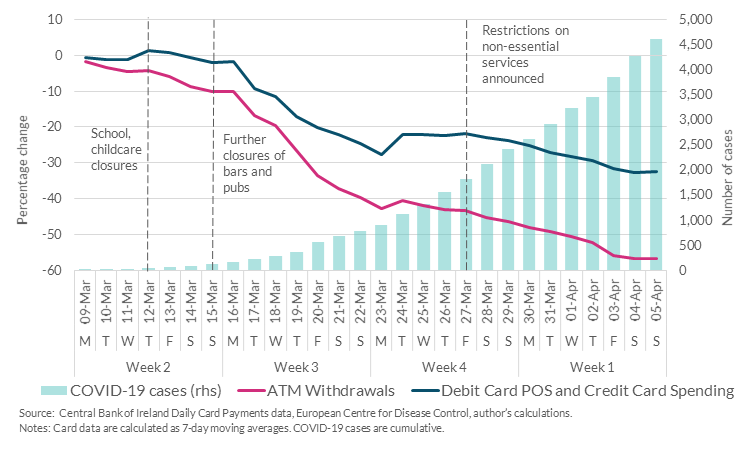

Less than two weeks after the first case of COVID-19 was confirmed in Ireland, the Government announced the first set of restrictions to contain the spread of the virus, with school and childcare closures on 12 March 2020. The impact of the announcement on spending behaviour is clearly reflected in the daily card payments data. By the end of March, retail card spending (point of sale and credit card) had declined by 27 per cent when compared with the first week of March, and cash withdrawal amounts had almost halved (Chart 1).

Chart 1: Decline in card spending and cash withdrawal over March

(% change on first week of March)

Spending activity on cards initially increased by 790,000 additional transactions (22 per cent) on Thursday 12 March, relative to the average of the previous 11 days, as multiple media outlets reported bulk buying following the Government announcement the same day. These additional transactions equate to an additional €42 million spending by Irish consumers, when compared with the average over the first 11 days of the month. ATM withdrawals, however, were down 10 per cent by the end of same week (Chart 1).

The value of both card spending and ATM withdrawals declined rapidly from 16 March, in part due to the St Patrick’s Day Bank Holiday. By the time the stay-at-home order was announced on 27 March, the value of card spending had already declined by over one-fifth since the first week of March, while the value of ATM withdrawals was down over 40 per cent.

This pattern of declining spending and cash withdrawals has continued into the first week of April, with card spending down by almost one-third and ATM withdrawal amounts down 57 per cent on the first week of March. If the current level of spending and ATM withdrawals were to continue for the remainder of April 2020, it is estimated that overall card spending and cash withdrawals would be €2.6 billion (or 40 per cent) lower than in comparison with April 2019.

Cash Withdrawals Down €429 Million on March 2019

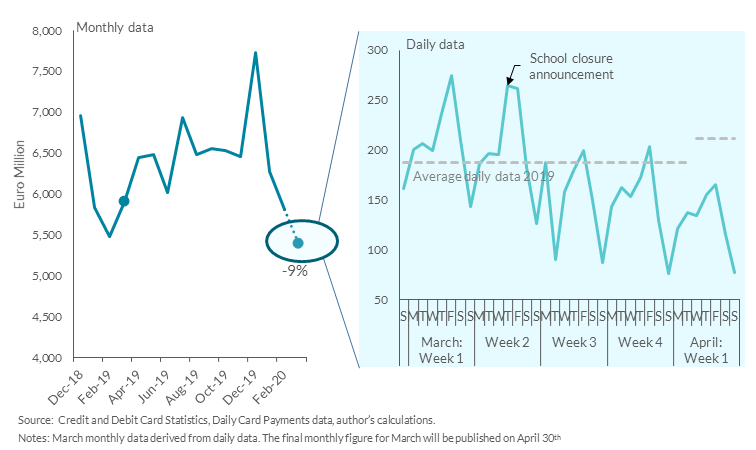

Total card transactions (including ATM usage) for March amounts to €5.4 billion (Chart 2). This represents a decline of 9 per cent when compared with March 2019, and is mainly owing to a marked decline in ATM cash withdrawals.

Chart 2: Retail card payments down year-on-year with significant daily volatility

There is much volatility within the daily data, however, characterised by the timeliness of the government announcements as mentioned above. The value of transactions also varies greatly depending on which day of the week spending occurs (Chart 2).

An obvious weekly cycle is evident consisting of daily spending increasing throughout the week, peaking on a Friday, before declining to a low point on a Sunday. A working paper by the Bank of Canada also identifies a similar weekly cycle of peaks and troughs for debit card transactions and notes that high-frequency data can be very useful for monitoring expenditure patterns around extreme events.

To circumvent such days of the week effect, a seven-day moving average can reduce such effects when looking at longer term trends, as in Chart 1. The daily effect appears to have been sustained even after the stay-at-home government advice. This trend has also continued into the first week of April, although the Friday peak is less than previous Fridays. Spending is also down significantly on the daily average for April of last year.

Average Cash Withdrawal Amount Increased Since the Pandemic

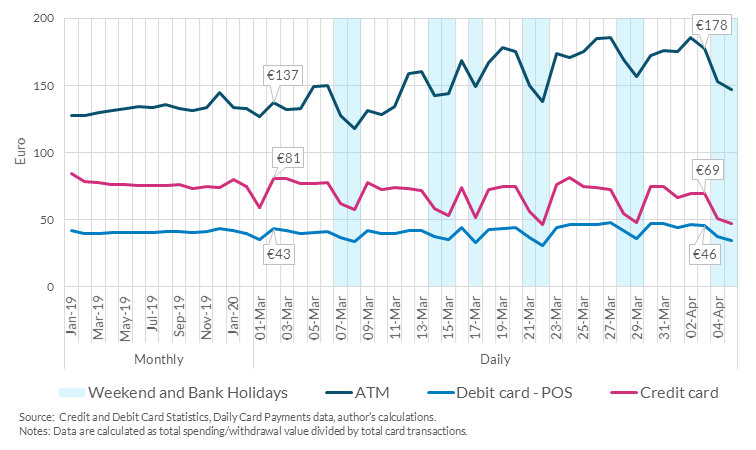

The average ATM cash withdrawal amount has increased markedly in the days around and since the school closures announcement on 12 March. This was combined with a lower number of transactions at ATMs, suggesting that people were concentrating their cash withdrawals into a small number of ATM visits. While total ATM cash withdrawal amounts were down over half when compared with the first week of March (Chart 1), the amount withdrawn per transaction increased substantially. The average withdrawal increased from €137 in the first week of March to around €178 by the first week of April. In the previous twelve months, the average withdrawal was relatively stable and equated to around €133 per transaction.

Chart 3: Average ATM cash withdrawal increasing

The average daily spend per debit card point of sale transaction was largely in-line with previous months, albeit increasing slightly at the end of the month. Credit card transactions have declined slightly, providing tentative evidence that larger purchases have reduced.

Conclusion

In fast-moving crises like the current pandemic, timely, high frequency data can assist with impact assessment of the crisis on underlying consumer demand and spending behaviour, which may be less obvious in less-timely monthly or quarterly data.

The daily card payments data presented in this “Behind the Data” reveal that overall, March was a month of two halves with respect to retail spending. The first half characterised by an increase in card usage and spending, while the announced restrictive measures had a dramatic impact on spending patterns in the second half of the month. A rise in the average cash withdrawal over the month suggests that while less cash may be demanded overall, customers may be choosing to limit their ATM visits.

As more data points are collected, some areas for further analysis include the potential for using the high-frequency data as a leading indicator for other economic activity series, and investigating a days of the week and seasonality effect.

Email [email protected] if you have any comments or questions on this note. With thanks to Ciaran Meehan for excellent data assistance. Comments from Rory McElligott, Maria Woods, Mark Cassidy and Reamonn Lydon are gratefully acknowledged. The views expressed in this note are those of the authors and do not necessarily reflect the views of the Central Bank of Ireland or the ESCB.

See also: