Behind the Data

Understanding Repayment Amounts of Long-Term Mortgage Arrears Borrowers

David Duignan, Catharina Lawless and Aisling Menton*

November 2022

This Behind the Data introduces new data on the mortgage repayments made by primary dwelling households in long-term mortgage arrears. The dataset, covering banks, retail credit and credit servicing firms, shows a significant proportion of these borrowers not making any repayment. The data also shows that where there is cooperation between a borrower and a lender, borrowers can exit LTMA.

Introduction

A key focus of the Central Bank of Ireland (Central Bank) since the 2008 crisis, and again during the recent Covid-19 pandemic, was the resolution of non-performing mortgages. In recent years the level of mortgage arrears has declined, for a multitude of reasons including improving economic conditions, rising household incomes, supervisory engagement from the Central Bank, expansion of breadth of resolution options available to borrowers, and increased levels of proactive borrower engagement. Long-term mortgage arrears (LTMA) accounts are defined as those over one year in arrears. In 2021 alone, the number of LTMA accounts declined by 12 per cent. However, the number of accounts in LTMA remains elevated, at just under 27,000 (21,500 households approximately) or 4 per cent of all primary dwelling house (PDH) mortgages at end- 2021. The outstanding balance on these accounts was €5.7 billion. Research in 2021 showed that approximately one quarter of borrowers in LTMA are over age 60, which are potentially more challenging to resolve.

The new dataset covered in this paper supports a deeper understanding of the unresolved LTMA cases, and the associated level of repayments being made by these borrowers. The new data informed a particular supervisory focus during a period of intensified engagement with lenders which focused on driving further progress on LTMA reduction, given the negative consequences of having such a volume of LTMA outstanding in Ireland.

Categorising LTMA borrowers based on their observed repayment amounts, this paper will demonstrate the reduction recorded across different groups of borrowers. It will also highlight that around half of all accounts in LTMA made no repayment towards their mortgage in 2020 and 2021. Finally, this Behind the Data (BTD) will show that the remaining LTMA cases are increasingly concentrated in cases where no payment is being made at all.

The data

The new data being published today (Table 1) shows repayments made by borrowers towards their PDH mortgages as a proportion of the contractual amount over a 12 month period. This is defined as the amount that was paid to an account over the previous 12 months divided by the contractual (billed) amount for an account over that period. The contractual amount can be based either on full capital and interest repayment, or an implemented alternative repayment arrangement (ARA). For example, if a borrower’s contracted repayment was:

- €1,000 per month and all 12 payments were made in full, this was reported as 100% payment;

- €1,000 per month and €6,000 was paid over the year, this was reported as 50% payment;

- €1,000 for 6 months and subsequently an ARA was implemented for payment of €500 per month for 6 months. If this was paid in full each month then it was reported as 100%.

Data was submitted by banks, retail credit firms (RCF) and credit servicing firms (CSF). The coverage is therefore the same as the mortgage arrears and repossession statistics published by the Central Bank, but broader than some previous analysis on repayment amounts which focused primarily on retail banks. While the data is available for all borrowers, in this BTD we will focus on LTMA accounts.

Table 1. Mortgage Repayments Made by Accounts in LTMA, 2020 & 2021

|

2020

|

|

|

2021 |

|

|

| No. accounts

|

Paying 0% |

Paying < 50% |

Paying > 50% |

Paying 0% |

Paying < 50% |

Paying > 50% |

| Total |

14,980 |

7,798 |

7,802 |

14,173 |

5,941 |

6,652 |

| o/w not co-operating |

8,162 |

3,652 |

4,093 |

8,107 |

3,078 |

3,666 |

| 1-2 years arrears

|

1,052 |

1,898 |

2,113 |

1,108 |

1,313 |

1,830 |

| o/w not co-operating

|

357 |

715 |

1,000 |

460 |

486 |

894 |

| 2-5 years arrears

|

3,489 |

2,723 |

2,966 |

3,338 |

2,122 |

2,508 |

| o/w not co-operating

|

1,664 |

1,241 |

1,564 |

1,687 |

1,072 |

1,467 |

| 5-10 years arrears

|

6,435 |

2,428 |

2,043 |

5,490 |

1,902 |

1,716 |

| o/w not co-operating

|

3,707 |

1,246 |

1,132 |

3,316 |

1,175 |

1,014 |

| >10 years arrears

|

4,004 |

749 |

680 |

4,237 |

604 |

598 |

| o/w not co-operating

|

2,434 |

450 |

397 |

2,644 |

345 |

291 |

Over half of LTMA accounts making no repayments

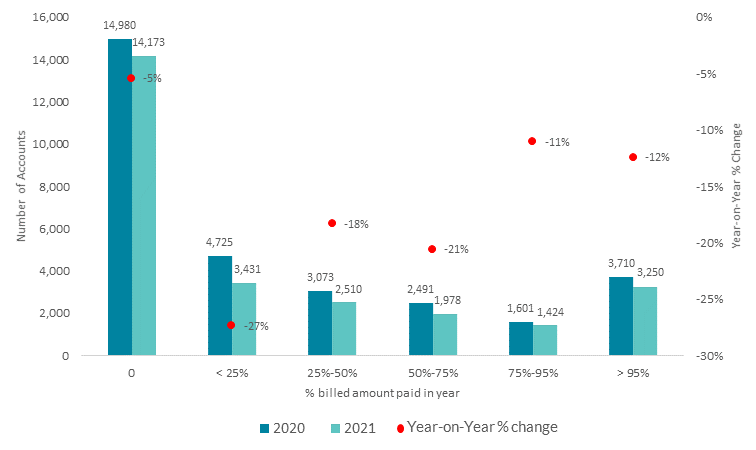

There was a reduction in the number of accounts in LTMA recorded across all repayment categories between 2020 and 2021 (Figure 1). In 2020, just under half of LTMA accounts made no repayment towards their mortgage. While there was a small reduction (5%) the following year, over 14,000 accounts in LTMA made no repayment in 2021. The average outstanding balance of accounts making no repayment in 2021 was €240,410 and the majority of these accounts were more than 5 years in arrears.

The largest declines in LTMA were in borrowers paying towards their mortgage, albeit still not at levels, in all cases, where repayments alone would have resolved the arrears (i.e. repayments were less than contracted amount). In 2021, just over 22 per cent of accounts paid some but less than 50 per cent of the contracted amount. The final quarter of LTMA accounts were paying more than 50 per cent towards their mortgage in both years.

Figure 1. LTMA Year-on-Year Repayment Comparison

Source: Central Bank of Ireland Data

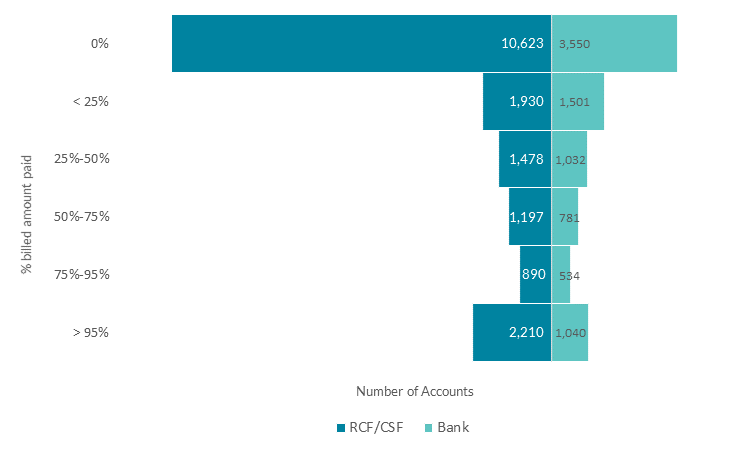

RCF/CSFs held three quarters of accounts that made no repayments in 2021, but accounted for the majority of LTMA resolutions

RCF/CSFs have played an increasingly important role in the Irish residential mortgage market, holding a significant proportion of PDH mortgages. At end-December 2021, these firms held 14 per cent of all PDH mortgages outstanding, but 65 per cent of LTMA PDH accounts.

RCF/CSFs held 75 per cent of accounts that made no repayment towards their mortgage in 2021, up from 58 per cent in 2020, mainly due to transfer of loans from retail banks (Figure 2). However, the overall reduction in LTMA accounts between 2020 and 2021 was mostly driven via accounts held by RCF/CSFs. When the impact of loan sales by retail banks is controlled for, banks and RCF/CSFs recorded a LTMA reduction of around 3 and 14 per cent in 2021 respectively. Supervisory analysis indicates that a driver of LTMA reduction at RCF/CSFs was meaningful engagement between borrowers and lenders to enable assessment of individual circumstances to agree a solution.

Figure 2: LTMA by Repayment – Bank & RCF/CSFs Split - December 2021

Source: Central Bank of Ireland Data

Levels of not co-operating borrowers decreased over 2021

A key step in reaching an agreement towards resolving mortgage arrears is engagement by both the lender and borrower. Lenders classify borrowers as “not co-operating” where the lender assesses them to fall within the specific criteria in the Code of Conduct on Mortgage Arrears (CCMA) for that classification. Borrowers are notified of this status via a letter notifying them that they have been categorised as not co-operating in accordance with provision 29 of the CCMA. In the context of this BTD, it is worth noting that the specific criteria for ‘not co-operating’ in the CCMA can be met in circumstances where a borrower is paying towards their mortgage and/or the engagement between lender and borrower is ongoing.

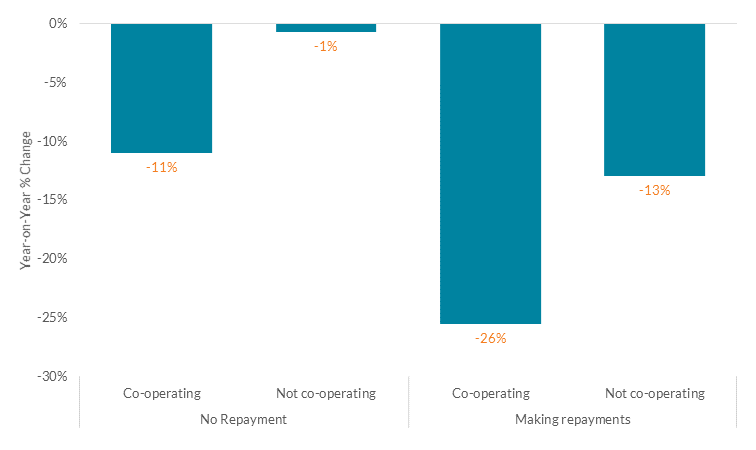

At end-2021, lenders had classified 15,000 (or 55 per cent) of all LTMA accounts as not co-operating, down from just under 16,000 accounts at end-2020. In its supervisory engagement over the last twelve months, the Central Bank took an approach of scrutinising the activities of lenders across different borrower categories based on repayments patterns (Figure 3). Special focus was placed on lenders’ steps to resolve LTMA for borrowers classified by the lender as co-operating and paying towards their mortgage, while also requiring lenders to continue to work on their borrower engagement strategies and innovate in terms of solutions that can be offered to borrowers.

Across all repayment levels, those accounts classified as co-operating recorded reductions in LTMA at a much higher rate than those classified as not co-operating. Of those borrowers already making some repayment, co-operating accounts were twice as likely as those not co-operating to record a reduction in LTMA (Figure 3). A stark difference in experience is between co-operating and not co-operating borrowers making no repayment in 2020 or 2021. Of not co-operating accounts, there was only a very minimal decline between the two reporting periods. Of the co-operating borrowers making no repayment, more than 1 in 10 accounts changed classification between two reporting periods, be it out of LTMA, commenced paying or became classified as not co-operating.

Figure 3: Annual Percentage Change in Number of LTMA Accounts, by Borrower Categories, 2021

Source: Central Bank of Ireland Data

Conclusion

The number of accounts in LTMA declined in 2021. Despite the welcome decline, the number of accounts in LTMA remains elevated. This BTD has shown that across all categories of borrowers, there was a reduction recorded between 2020 and 2021, i.e. regardless of whether the borrower was co-operating and/or making repayments towards their mortgage. The largest reduction between 2020 and 2021 was in the category of borrowers that were categorised as co-operating and paying, with these categories recording double digit reductions between 2020 and 2021. However, the reduction within the category of accounts making zero repayments was significantly less. Supervisory engagement identified that those accounts that left LTMA flowed into alternative repayment arrangements and/or other resolution steps during the period. This indicates the potential additional resolution to LTMA from cooperation between borrower and lender, even in cases where historic repayment is low. The data also show that as cases continue to resolve, the remaining LTMA cases are increasingly comprised of cases where no payment is being made at all.

*Email [email protected] if you have any comments or questions on this note. Comments from Colm Kincaid, David McDermott, Rory McElligott, John Scanlon and Maria Woods are gratefully acknowledged. The views expressed in this note are those of the authors and do not necessarily reflect the views of the Central Bank of Ireland or the ESCB.

See also: