Chapter 4B: Client Financial Instrument Calculation

1. An investment firm should be in a position to demonstrate, upon request, evidence of a calculation and the date upon which such calculation was prepared; this evidence can be maintained in electronic form.

2. An investment firm should ensure that each calculation has relevant supporting backup material to validate the figures in the calculation.

Client financial instrument calculation

3. Accurate books and records are the cornerstone of the Client Asset Requirements (CAR). It is essential that an investment firm be in a position to accurately identify the balance of client financial instruments which it should be holding on behalf of each individual client, so that client financial instruments can be swiftly returned to the correct client, particularly in the event of that investment firm’s insolvency.

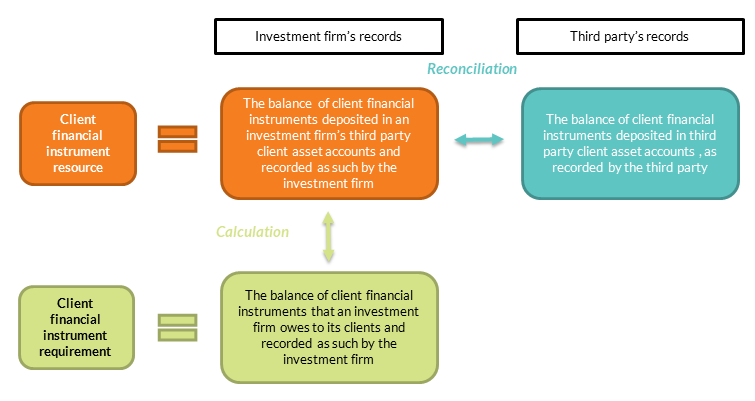

4. The purpose of the client financial instrument calculation required under Regulation 58(2) of the CAR is to determine whether an investment firm has segregated the necessary balance of client financial instruments to meet its obligations to each individual client.

5. In order to perform the client financial instrument calculation, an investment firm must, on at least a monthly basis, calculate its client financial instrument resource and client financial instrument requirement and ensure they are equal.

6. An investment firm’s client financial instrument requirement is the investment firm’s own internally held record of the balance of client financial instruments that it owes to each of its clients (e.g. a client ledger).

7. An investment firm’s client financial instrument resource is the investment firm’s own internally held record of the client financial instruments it has deposited in third party client asset accounts or otherwise been entrusted with (i.e. internally maintained custodian/nominee records).

Calculating the client financial instrument requirement

8. In order to calculate its client financial instrument requirement, an investment firm must be capable of producing a record of its clients and the balance and type of each client financial instrument it owes to each individual client.

9. When calculating the client financial instrument requirement, an investment firm should include both dematerialised and physical client financial instruments it holds on behalf of clients.

Calculating the client financial instrument resource

10. In order to calculate its client financial instrument resource, an investment firm must be capable of producing a record of the client financial instruments it has been entrusted with.

11. When calculating the client financial instrument resource, an investment firm should include the following where applicable:

- Client financial instruments deposited in third party client asset accounts;

- Dematerialised client financial instruments that the investment firm holds in custody itself (i.e. those client financial instruments that have not been deposited with a third party); and

- Physical client financial instruments that the investment firm holds.

Adjustments

12. In calculating its client financial instrument resource and client financial instrument requirement, an investment firm should consider whether its internal records require any adjustments to reflect reconciliation differences identified through the performance of the reconciliations required by Regulation 57 of the CAR.

13. An example of where an adjustment might be required is to account for an IT issue/systemic error, resulting in the client financial instrument belonging to one client being used to fulfil a transaction being performed on behalf of another client. It is essential that such errors be accounted for as they may give rise to a shortfall at a client level even though there is no apparent shortfall at an aggregate level.

14. In the context of the reconciliation of physical client financial instruments, where an investment firm identifies that a physical financial instrument is missing, this should be reflected in the client financial instrument resource.

Comparing the client financial instrument resource and client financial instrument requirement

15. Once an investment firm has calculated its client financial instrument resource and client financial instrument requirement, it should compare them to ensure they are equal. It is acknowledged that where an investment firm derives its client financial instrument resource and client financial instrument requirement from the same source of information (i.e. relies on integrated systems), there is unlikely to be any difference between the two.

16. For those investment firms that derive the client financial instrument resource and client financial instrument requirement from separately maintained sources, this comparison will serve as an important control to identify potential differences between the two sets of records.

17. Alternatively, investment firms may perform a “three way” process (i.e. by comparing internal client records to internal bank/custodian/nominee records to third party statements) for the purpose of satisfying the requirement to perform the client financial instruments calculation, as long as the investment firm can evidence that this achieves the objective of ensuring that the client financial instrument resource and the client financial instrument requirement are equal.

18. An investment firm should document the method it uses to perform the client financial instrument calculation in its Client Asset Management Plan (CAMP).

Frequency of conducting the client financial instrument calculation

19. Investment firms, regardless of system capabilities, will be required to complete the client financial instrument calculation on at least a monthly basis. This represents a minimum standard.

20. Investment firms are expected to regularly assess the frequency at which they perform the client financial instrument calculation and consider whether the frequency continues to be appropriate or if the client financial instrument calculation should be conducted on a more frequent basis.

21. When determining the frequency at which it will undertake the client financial instrument calculation, an investment firm should have regard to:

- The frequency, number and value of transactions which the investment firm undertakes in respect of a client financial instrument; and

- The risks to which the client financial instruments are exposed, taking into account the nature, scale and complexity of the investment firm’s business and where and with whom client financial instruments are deposited.

22. Investment firms should retain sufficient records to illustrate and explain any decision taken to determine the frequency of the client financial instrument calculation.

23. The investment firm’s rationale for the frequency of conducting the client financial instrument calculation should be documented in the CAMP.

24. An investment firm should have procedures in place to monitor, on an ongoing basis, the frequency of transactions, and utilise this information in determining whether the client financial instruments calculation should be performed on a more frequent basis.

Shortfalls and excesses in client financial instruments

25. Shortfalls and excesses in client financial instruments may be identified by investment firms through the performance of the client financial instrument calculation.

Shortfall in client financial instruments

26. A shortfall occurs when an investment firm’s client financial instrument resource is less than its client financial instrument requirement (i.e. the balance and type of client financial instruments is not sufficient to meet its obligations to its clients).

27. Shortfalls should be addressed as soon as possible in order to ensure no detriment to the client. An investment firm should address any shortfall by the earlier of the following:

- The point in time at which the cause of the shortfall is established; or

- Within five working days of identification of the shortfall.

28. Where a shortfall (deficit) is identified, the investment firm must effect a transaction to deposit money or financial instruments from the investment firm’s own assets, or a combination of both, into a third party client asset accounts to cover the shortfall. This need not be deposited in the same third party client asset account or with the same third party (i.e. where an investment firm identifies a shortfall in client financial instruments in a third party client asset account, and the firm does not have a third party client asset account with the same third party for client funds, the investment firm can address the shortfall by depositing money from its own assets into another third party client asset account (that holds client funds) with a different third party).

29. Once an investment firm has deposited such money, financial instruments, or combination of both into a third party client asset account for the purpose of addressing a shortfall, those assets will be considered to be client assets.

30. The value of a shortfall in client financial instruments may be determined by the previous day’s closing mark-to-market valuation or the most recently available valuation.

31. Where the value of the shortfall changes, the investment firm should adjust the money or financial instruments from its own assets to cover the shortfall accordingly.

32. Where a shortfall arises as a result of a breach of the CAR, investment firms are required to report such breaches to the Central Bank in a timely manner, regardless of whether any resultant shortfall has been addressed.

33. An investment firm should document its policy with respect to funding shortfalls in client financial instruments (i.e. whether it uses money or financial instruments from the investment firm’s own assets, or a combination of both), and include a hyperlink (or other such pathway) to this document in the CAMP.

Excesses in client financial instruments

34. An excess occurs when an investment firm’s client financial instrument resource exceeds its client financial instrument requirement (i.e. the balance and type of client financial instruments segregated exceeds its obligations to its clients).

35. When an investment firm identifies an excess in client financial instruments, consideration should be given to the investment firm’s obligations under Regulation 58(6) and 58(8) of the CAR.

36. Where an excess (surplus) is identified, the investment firm must effect a transaction to withdraw the excess from the third party client asset accounts. Subject to Regulation 51(8), an investment firm should address any excess in client financial instruments by the earlier of the following:

- The point in time at which the cause of the excess is established; or

- Within five working days of identification of the excess.

37. Where an excess arises as a result of a breach of the CAR, investment firms are required to report such breaches to the Central Bank in a timely manner, regardless of whether any resultant excess has been addressed.

General

38. Shortfalls and excesses may arise as a result of timing issues (i.e. differences in timing between an investment firm and a third party recognising the same transaction). Such timing differences should correct themselves over time, once the parties have recognised the transaction.

39. If an investment firm, where justified, concludes that a party other than the investment firm is responsible for a shortfall or excess, regardless of any dispute with that other party or that the discrepancy is due to a timing difference between the accounting systems of that other party and that of the investment firm, the investment firm must take all reasonable steps to resolve the situation without undue delay with the other party.

40. Until the shortfall or excess is resolved, the investment firm should consider whether it would be appropriate to notify the affected client(s) of the situation. In considering whether it should notify affected client(s), an investment firm should have regard to its obligations to act honestly, fairly and professionally in accordance with the best interests of its clients.

Outsourcing the performance of the client financial instrument calculation

41. Where an investment firm outsources the performance of its client financial instrument calculation, it should maintain appropriate oversight to ensure that the outsourced service provider has appropriate processes, systems and controls for the performance of this activity. This would also apply where the outsourced service provider is part of the same group as the investment firm.

42. The investment firm should maintain a written record to evidence its oversight of the outsourced calculation process.

Figure 1: Calculation and reconciliation of client financial instruments deposited with a third party

Issued: 4 July 2023

Last revision: 4 July 2023