Chapter 4A: Client Funds Calculation

1. An investment firm should be in a position to demonstrate, upon request, evidence of a calculation and the date upon which such calculation was prepared; this evidence can be maintained in electronic form.

2. An investment firm should ensure that each calculation has relevant supporting backup material to validate the figures in the calculation.

Client funds calculation

3. Accurate books and records are the cornerstone of the Client Asset Requirements (CAR). It is essential that an investment firm be in a position to accurately identify the balance of client funds which it should be holding on behalf of each individual client, so that client funds can be swiftly returned to the correct client, particularly in the event of that investment firm’s insolvency.

4. The client funds calculation required under Regulation 58(1) of the CAR is a daily process designed to determine whether an investment firm has segregated the necessary balance of client funds to meet its obligations to clients. It is a separate and distinct process from the client funds reconciliations required under 57(1) and 57(2) of the CAR.

5. Where the balance of client funds segregated does not meet an investment firm’s obligations to its clients, the purpose of the daily calculation is to identify this shortfall in client funds. Where the balance of client funds segregated exceeds what is necessary to meet an investment firm’s obligations to its clients, the purpose of the daily calculation is to identify this excess.

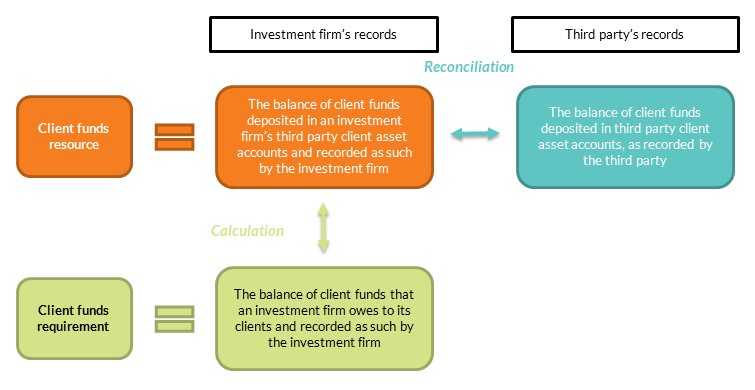

6. In order to perform the client funds calculation in respect of the previous working day, an investment firm must first calculate its client funds resource and client funds requirement as at close of business on the previous working day.

7. The client funds calculation should be performed using values from an investment firm’s own internal records, (e.g. values in its client ledger and bank ledger rather than values contained in statements received from a third party). However, as set out in Regulation 58(3) of the CAR, it is recognised that the values from an investment firm’s own internal records may have been reconciled with statements from a third party.

8. The client funds requirement represents the balance of client funds an investment firm should be holding on behalf of its clients, as recorded by the investment firm (e.g. in a client ledger), appropriately adjusted, as necessary by any reconciliation differences identified through the performance of the client funds reconciliation.

9. The client funds resource represents the total balance of client funds deposited in third party client asset accounts, as recorded by the investment firm, appropriately adjusted, as necessary by any reconciliation differences identified through the performance of the client funds reconciliation.

10. Once an investment firm has calculated its client funds resource and client funds requirement, it can perform the daily calculation by comparing the two balances to identify any shortfall or excess in third party client asset accounts.

11. The client funds calculation represents a minimum standard that must be applied by investment firms. In addition to the client funds calculation, investment firms may have processes in place to monitor transactions on a real time basis.

12. Where client fund shortfalls or excesses are identified, investment firms are required to deposit money from the investment firm’s own assets into the third party client asset account (in the case of a shortfall), or withdraw surplus money from the third party client asset account (in the case of an excess). The expectation is that shortfalls and excesses in client funds should be temporary in nature and only arise due to unexpected or unforeseen circumstances.

Calculating the client funds requirement

13. The following is a non-exhaustive list of client fund balances an investment firm should include when calculating the client funds requirement:

- Individual client balances;

- Any balances which have been returned to clients but have not yet cleared in the third party client asset account (e.g. uncashed cheques or unallocated funds);

- Dividends and any security lending fees earned by the client;

- Any receipts of money that the investment firm has segregated as client funds in accordance with Regulation 50(6); and

- Any money from the investment firm’s own assets which the investment firm has deposited in a third party client asset account to address a shortfall in client financial instruments which is not attributable, or cannot be attributed to, an individual client.

14. When calculating the client funds requirement, an investment firm should exclude individual client balances which are negative (i.e. debtors).

15. If a client has a balance on both the investment firm’s debtor and creditor ledger, a credit can be reduced by the amount of the debit for that specific client.

Margined transactions

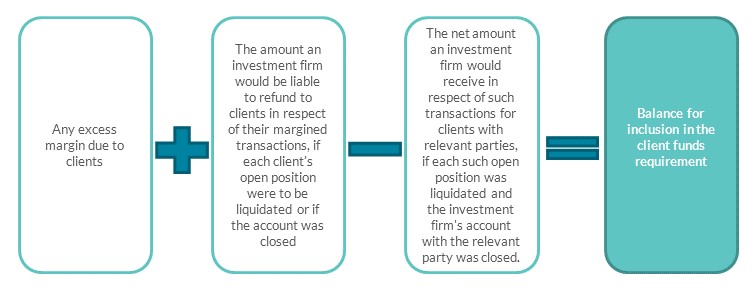

16. An investment firm entering into Securities Financing Transactions (SFTs), such as collateralised margin lending, should also include the result of the following equation when calculating its client funds requirement:

- Any excess margin due to clients; Plus

- The amount an investment firm would be liable to refund to clients in respect of their margined transactions, if each client’s open position were to be liquidated or if the account was closed; Less

- The net amount an investment firm would receive in respect of such transactions for clients with relevant parties, if each such open position was liquidated and the investment firm's account with the relevant party was closed. Negative balances should be deducted from positive balances; if negative balances are greater than positive balances, this figure should be treated as zero for the purpose of calculating the client money requirement.

Client funds yet to be deposited in a third party client asset account

17. Where an investment firm holds client funds received in the form of cash, cheques or payment orders but has not yet deposited those client funds in a third party client asset account, the investment firm should exclude those balances when calculating its client funds requirement. If those balances were to be included in the calculation of the client funds requirement this would give rise to a shortfall. A shortfall would arise because the client funds requirement will be increased by the amount received in the form of cash, cheques or payment orders but the client funds resource would remain unchanged since those balances have not yet been deposited in the third party client asset account.

18. Despite the fact these balances should not form part of the investment firm’s client funds requirement, the investment firm should maintain a record for all receipts of client funds in the form of cash, cheques or payment orders but not yet deposited in a third party client asset account (e.g. a cheque log).

19. The investment firm should document the approach it takes with respect to client funds yet to be deposited in a third party client asset account in the Client Asset Management Plan (CAMP).

Calculating the client funds resource

20. An investment firm must be capable of producing records of the balance of client funds deposited in third party client asset account(s), in order to calculate the client funds resource for a particular working day.

21. When calculating the client funds resource, an investment firm may choose to convert its client funds balances to a base currency (using the Central Bank rate for that day or any other established automatic rate feed), or conduct separate calculations on a currency by currency basis.

22. An investment firm should ensure that its client funds resource includes the aggregate balance of client funds that have been deposited in third party client asset accounts.

Client funds yet to be deposited in a third party client asset account

23. By definition, the client funds resource should exclude money (cash, cheques, payment orders, etc.) that has been received by the investment firm, but not yet deposited in a third party client asset account (e.g. where an investment firm receives client funds in the form of a cheque but has not yet deposited that cheque in a third party client asset account, this should not be included in the client funds resource).

Adjustments

24. When calculating its client funds resource and client funds requirement, an investment firm should consider whether its internal records require any adjustments to reflect reconciliation differences identified through the performance of the client funds reconciliation. Reconciliation differences should be captured in order to ensure an investment firm has an accurate picture of its client funds resource and client funds requirement.

25. Adjustments to internal ledgers may require manual intervention and therefore may increase operational risk; consequently robust systems and controls are needed in relation to making and approving adjustments. While it may be valid to make adjustments in certain circumstances, an investment firm’s processes and controls should be designed to minimise the need to make adjustments.

26. The following examples, while not exhaustive, seek to illustrate some scenarios where reconciliation differences identified through the performance of the client funds reconciliation should be incorporated into the calculation of an investment firm’s client funds resource and client funds requirement in order to ensure the accuracy of the client funds calculation.

- An example of where an adjustment might be required is where money is received into a third party client asset account, but it is not clear if that money is client funds, or there is insufficient documentation to identify the client who owns such money. In accordance with Regulation 50(6) of the CAR, the investment firm must be prudent and treat such funds as client funds. Therefore, until such time as that money is confirmed to be client funds, it should be reflected by way of adjustment to the client funds resource (because it has increased the balance in the third party client asset account) and the client funds requirement (because it may be for the benefit of clients).

- As a further example, an adjustment might be required where a bank charge is levied on a third party client asset account creating a reconciliation difference. This type of reconciliation difference will need to be reflected in the client funds resource, (because it has decreased the balance in the third party client asset account) but not in the client funds requirement (because the bank charge is not a transaction for the benefit of a client).

Shortfalls and excesses in client funds

27. A shortfall occurs when an investment firm’s client funds resource is less than its client funds requirement.

28. Where a shortfall (deficit) is identified through the performance of the client funds calculation, the investment firm must effect a transaction to deposit money from the investment firm’s own assets into the third party client asset accounts to meet the shortfall.

29. An excess occurs when an investment firm’s client funds resource is greater than its client funds requirement. Where an excess (surplus) is identified through the performance of the client funds calculation, the investment firm must effect a transaction to withdraw the excess funds from the third party client asset accounts.

30. Any transaction required to address a shortfall in client funds must be effected by the investment firm by close of business on the day on which the client funds calculation is performed.

31. An investment firm should address any excess in client funds within five working days of the day to which the client funds calculation relates. When an investment firm identifies an excess in client funds, consideration should be given to the investment firm’s obligations under Regulation 50(6) of the CAR.

32. An investment firm should define a level at which deposits/withdrawals required to address a client fund shortfall or excess are considered material and must be reported to the Central Bank in accordance with Regulation 76(1)(e) of the CAR.

33. Where a shortfall or excess arises as a result of a breach of the CAR, investment firms are expected to report such breaches to the Central Bank regardless of whether any resultant shortfall or excess has been addressed.

34. Shortfalls and excesses may arise as a result of timing issues (i.e. differences in timing between an investment firm and a third party recognising the same transaction). Such timing differences should correct themselves over time, once the parties have recognised the transaction.

35. If an investment firm, where justified, concludes that a party other than the investment firm is responsible for a shortfall or excess, the investment firm must take all reasonable steps to resolve the situation without undue delay with the other party. This should be done regardless of any dispute with that other party or whether the discrepancy is due to a timing difference between the accounting systems of that other party and that of the investment firm.

36. Until the shortfall or excess is resolved, the investment firm should consider whether it would be appropriate to notify the affected client(s) of the situation.

37. In considering whether it should notify affected clients, an investment firm should have regard to its obligations under Regulation 31(1)(a) of the MiFID Regulations to act honestly, fairly and professionally in accordance with the best interests of its clients.

38. If the client funds requirement is equal to the client funds resource, then no action is required.

Outsourcing the performance of the client funds calculation

39. Where an investment firm outsources the performance of its client funds calculation, it should maintain appropriate oversight to ensure that the outsourced service provider has appropriate processes, systems and controls for the performance of this activity. This would also apply where the outsourced service provider is part of the same group as the investment firm.

40. The investment firm should maintain a written record to evidence its oversight of the outsourced calculation process.

Diagrams

Figure 1: Calculation and reconciliation of client funds deposited with a third party

Examples: Client funds calculation

Table 1: Calculating the client funds requirement

|

Client funds requirement

|

|

List of client balances

(e.g. as set out in the investment firm’s client ledger)

|

EUR

|

|

|

10,000

|

|

|

30,000

|

|

|

40,000

|

|

|

20,000

|

|

Total creditors (E)

|

100,000

(A+B+C+D)

|

|

Unpresented cheques (F) *

|

50,000

|

|

Adjustments to reflect reconciliation differences (G)

|

0

|

|

Client funds requirement

|

150,000

(E+F+G)

|

* Cheques issued to clients but not yet cleared. These cheques remain client funds until such time as they are presented by the client and the associated balances have been debited from the third party client asset account and credited to that client’s own account.

Table 2: Calculating the client funds resource

|

Client funds resource

|

|

List of third party client asset account balances from the investment firms own records (e.g. as set out in the investment firms bank ledger)

|

EUR

|

- Omnibus client asset account held in Bank X (A)

|

50,000

|

- Omnibus client asset account held in Bank Y (B)

|

25,000

|

- Individual client asset account held in Bank Z (C)

|

25,000

|

|

Total client fund balances in third party client asset accounts (D)

|

100,000 (A+B+C)

|

|

Unpresented cheques (E)

|

50,000

|

|

Adjustments to reflect reconciliation differences (F)

(e.g. fees due to the investment firm that were paid into the third party client asset account in error)

|

500

|

|

Client funds resource

|

150,500 (D+E+F)

|

Table 3: Client funds calculation

|

Client funds calculation

|

|

Client funds requirement (A)

|

150,000

|

|

Client funds resource (B)

|

150,500

|

|

Result (Equal, shortfall or excess)

|

500 (A-B)

|

- In this example, the client funds resource exceeds the client funds requirement meaning there is an excess of client funds in the third party client asset account.

- In accordance with Regulation 58(5) of the CAR, the investment firm shall withdraw from the third party client asset account, promptly and in any event within five working days from the date to which the calculation relates, such money from a third party client asset account as is necessary to ensure that the client funds resource is equal to the client funds requirement. Therefore, in this illustrated example the investment firm must withdraw the €500 excess from the third party client asset account.

- By withdrawing the €500 excess, the investment firm ensures that the client funds resource is equal to the client funds requirement, meeting the requirement under regulation 58(1) of the CAR.

Issued: 4 July 2023

Last revision: 4 July 2023