What’s Over the Horizon? Monetary Policy in 2023 and Beyond - Remarks by Governor Makhlouf at IIEA Dublin

05 December 2022

Speech

Good morning. I am delighted to be at the Institute of International and European Affairs today to share my views on the outlook for monetary policy.1

Supply chain disruptions, a rapid and strong post-pandemic rebound in demand, and war-related energy and food price shocks are contributing to unacceptably high levels of inflation in Ireland and the euro area.

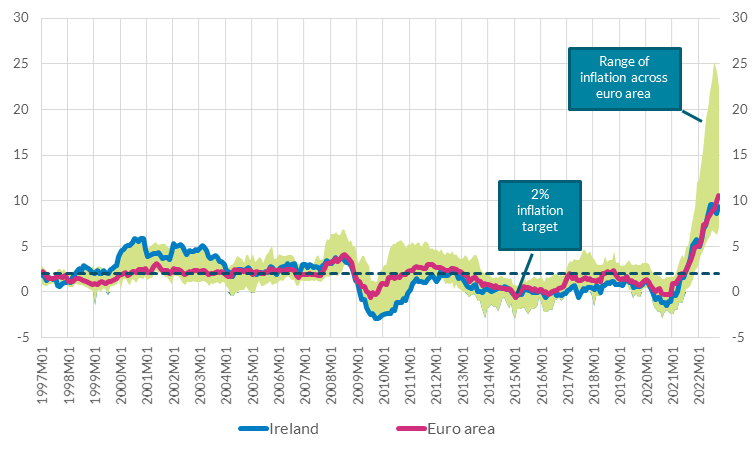

Inflation is far in excess of our 2% target, at 9% in Ireland and 10% in the euro area as a whole in November. Some euro area countries are experiencing inflation above 20%, in part because of a greater exposure to Russian energy imports.

High inflation is eroding real incomes, threatening resilience and economic stability, while tighter financial conditions are increasing the cost of credit and putting downward pressure on asset values.2 The ECB, like other central banks globally, has raised interest rates at an unprecedented pace in order to bring supply and demand back into balance, and return inflation sustainably back to our 2% target. The main ECB policy rate has increased from -0.5% in June to 1.5% in October, with further increases likely.

Chart 1: Headline inflation (annual percentage change)

Source: Eurostat

As I said in a recent speech at Social Justice Ireland, for monetary policy to be effective it has to be credible, and credibility and clear communication go hand-in-hand. And, with that in mind, today I will make the following points.

- First, to continue on our path to bring inflation back to our 2% target, I see a 50 basis point increase in interest rates as the minimum needed at our December meeting.

- Second, how much further do we need to go in terms of interest rate increases in 2023? We have to be open to policy rates moving into restrictive territory for a period. It is premature to be talking about the end-point for policy rates amid the prevailing levels of uncertainty.

- Third, while most of my remarks today relate to the ECB interest rates, the question of the size of the ECB balance sheet will be part of the policy discussion at the December meeting, and I want to say one thing about this. There are complex issues involved, but the justification for the expansion of the balance sheet – too low inflation and the risk of deflation – has ended, and it is time to look at reducing its size.

My remarks are divided into two sections, elaborating in the main on my first two points. I will return to the ECB balance sheet in future communications, but this will be after our Governing Council meeting in December, when, as President Lagarde has indicated, we will lay out the key principles for reducing the bond holdings in our asset purchase programme portfolio in a measured and predictable manner.

Near-term horizon: the ‘meeting-by-meeting’ approach

In July of this year, when the Governing Council of the ECB started raising rates, we emphasised a ‘meeting-by-meeting’ approach to policy decisions. This means relying on incoming economic and financial data to form a view of the economic outlook, and the appropriate policy stance given that outlook.

Of course, such an approach is nothing new. We always look at all the available information before making policy decisions. But ‘meeting-by-meeting’ helps to differentiate from the previous forward-guidance based approach, which relied on longer term commitments to a given policy stance, typically spanning several Governing Council meetings. Such an approach is clearly inappropriate in the current high-inflation, high-uncertainty, economic environment.

I could list many types of uncertainty that make the future economic outlook hard to predict. But for monetary policy at this time, I have in mind broadly three:

(1) uncertainty in relation to what the future holds;

(2) uncertainty in relation to how our policy transmits; and

(3) uncertainty about the extent of structural change that we are undergoing.

It is within this context of uncertainty that we are taking monetary policy decisions so for now a meeting-by-meeting approach is appropriate.

So what is the incoming data telling us?

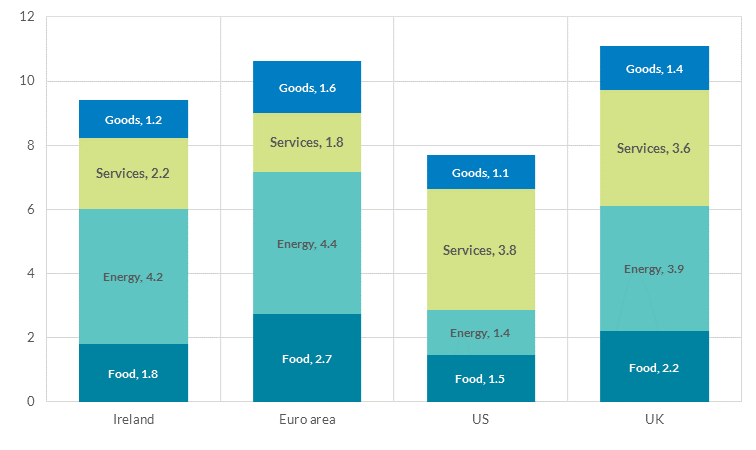

Headline inflation measures have continued to increase, partly reflecting the delayed pass-through from energy and commodity price shocks. Based on the recent flash estimates for November, two-thirds of headline inflation in the euro area is due to energy (3.8% of 10% inflation) and food (2.8%), far above its historical share of around 40%. But it would be wrong to ascribe our current inflation problem solely to supply shocks. As Philip Lane has shown, non-energy components of domestic inflation, accounting for over one-third of spending, are also very high by historical standards, driven by strong post-pandemic demand meeting still-constrained supply.

Chart 2: Components of inflation (per cent, October 2022)

Source: Eurostat (HICP for euro area and Ireland), OND (UK CPI) and BLS (US CPI-U)

Given the volatility in headline measures of inflation, we also pay close attention to underlying measures of inflation. Core inflation, which strips out energy and food prices, is at record high in the euro area at 5%. Over 80% of the items in the spending basket using to construct the price index are now showing price increases in excess of 2%, up from just 20% of items before the pandemic, and 50% a year ago. As price pressures broaden across the basket, the risks of persistently high inflation becoming embedded rises, and the case for tighter monetary policy becomes stronger.

High current inflation rates could give rise to more persistent inflation if they lead to inflation expectations rising significantly above our 2% target. What are the potential channels of such inflation persistence via expectations? One is via firms’ own price-setting behaviour, which, in a bid to preserve margins and in anticipation of high inflation in the future, set prices accordingly. Another cost-push channel is through wages. If higher inflation is expected to persist, then workers will understandably look for higher wages to preserve purchasing power, and employers may in turn raise their own prices.

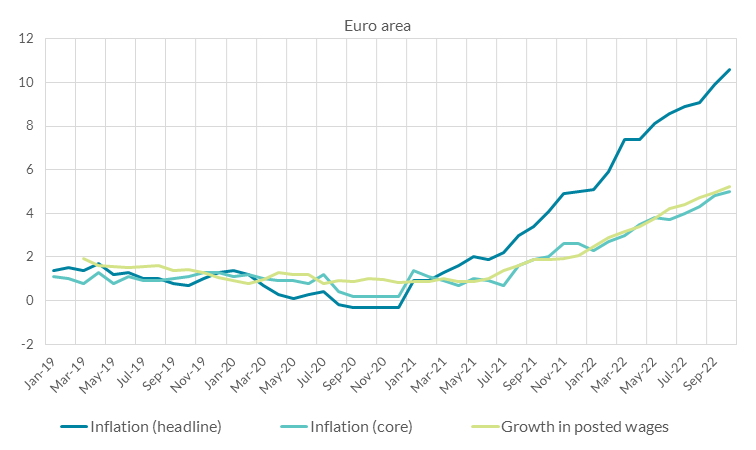

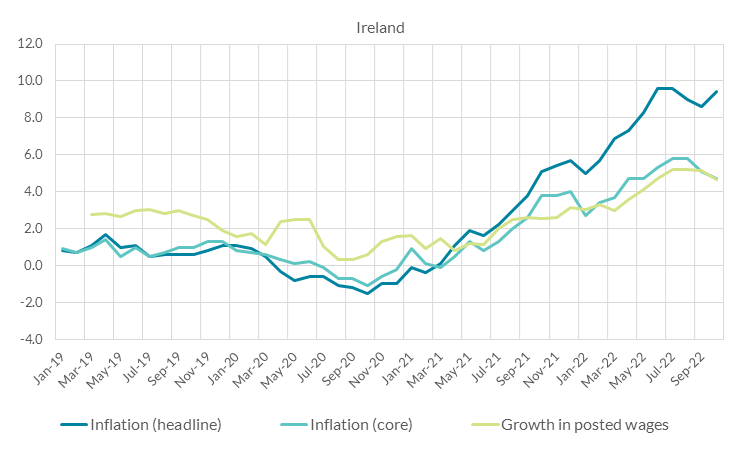

In the second quarter of this year, nominal wage growth in the euro area and Ireland was around 4%, higher than pre-pandemic growth rates, which were closer to 2% in 2018/19. However, it remains far below the rate of inflation.

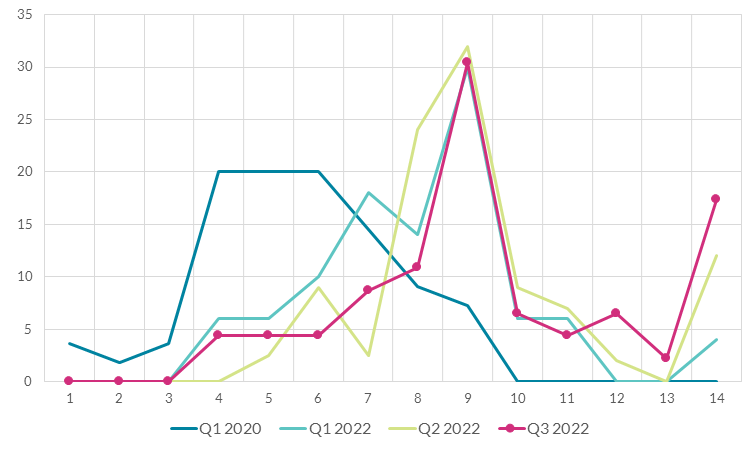

To complement official data we also analyse a more timely, forward-looking indicator of wage growth based on wages posted in job ads (PDF 841.17KB) (Chart 3). This shows the ‘hiring wage’ growing broadly in-line with core inflation at closer to 5% in both Ireland and the euro area, also well above pre-pandemic rates of growth of around 2%.

This data is telling us two things.

First, the labour market continues to look very tight, despite the weakening growth outlook.

And second, as the hiring wage relates to the marginal worker, i.e., job switchers or new hires, this 5% rate of growth in October likely represents an upper bound for the growth rate of average wages across the economy.

Chart 3: Growth in posted wages in job ads

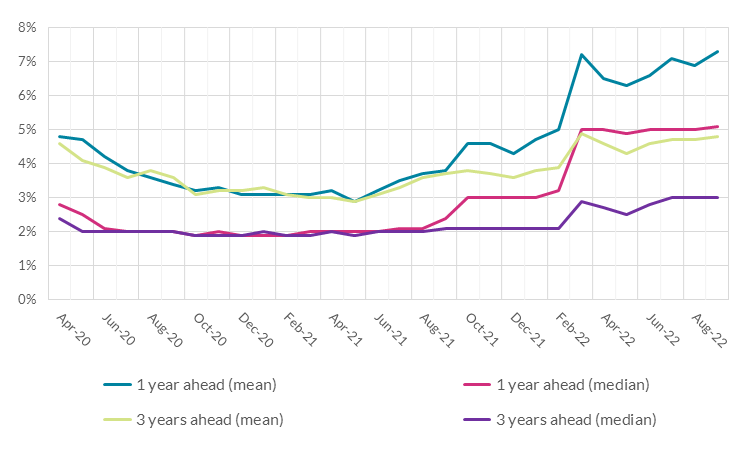

We also watch inflation expectations, and these have moved up alongside headline inflation. Notably, an increasing share of forecasters expect high rates of inflation (i.e., above 2.5% in Chart 4) over the medium term. This is a development that needs closely monitoring if, as some have suggested, it could be an early warning sign of inflation expectations moving away from our 2% target. Were expectations to become ‘dis-anchored’ in this way, it would make the task of sustainably returning inflation to our 2% target far more difficult, and preventing it is one of the reasons for the forceful monetary policy response.

Chart 4: Inflation expectations

Survey of professional forecasters - inflation expectations 5 years ahead, percentage in each bucket

Source: ECB, Consumer Expectations Survey. Last date is Sep 2022.

So it is clear that we needed to increase interest rates, and it is also clear that they will need to increase further. But having raised rates by a lot in a relatively short space of time, one challenge now is to gauge how and when we expect such changes in interest rates to impact economic activity. This is the well-known ‘long and variable lag’ of monetary policy. We take account of these lagged effects in our economic analysis, forecasting and modelling. In addition, surveys of firms, consumers, and financial market participants are useful complements to hard data, providing insight about expectations and future economic behaviour.

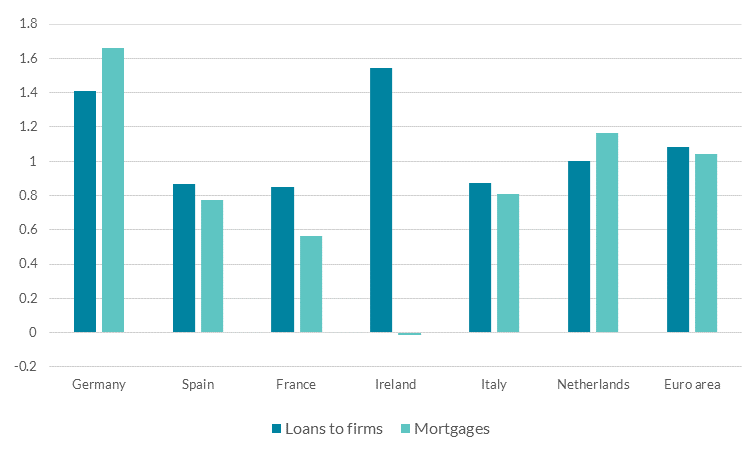

Our policy rate is a short-term rate, transmitted via financial markets to longer-term rates, impacting the cost of credit and asset prices which, in turn, influence prices via changes in spending and investment plans. Retail interest rates have increased sharply in the euro area during 2022. Mortgage interest rates are at their highest level since 2015. Loan volumes have been slower to respond, although recent data shows a fall-off in new lending for longer-term fixed-rate mortgages, and survey from data from the Bank Lending Survey also points to a softening of credit demand.

Chart 5: Changes in retail interest rates Jan-Sep 2022 (per cent)

New lending in selected euro area countries

Source: ECB

While thinking about the next policy decision, we also have to account for the three types of uncertainty. This is why the medium term horizon for monetary policy is key. With headline and core inflation at 10 and 5% in the euro area, there is clearly more work for monetary policy to restore price stability. So we will take our next decisions meeting-by-meeting for the time being. But we also need to start thinking about what lies ahead when some of this near-term uncertainty recedes and the impact of current supply shocks gradually fade over time.

Beyond the meeting-by-meeting approach – structural changes that could impact inflation dynamics

Looking ahead, the macroeconomic economic environment remains volatile and there is some work to do to gain a better understanding some of the key issues. Here, I would highlight three broad developments which will matter for inflation dynamics and monetary policy in the medium term.

First, our understanding of the inflationary dynamics related to supply shocks.

Second, whether structural changes stemming from geopolitical drivers – the so-called “deglobalisation” – and climate change will prove to have an impact on the dynamics of inflation, that is, over-and-above one-off price level effects.

And third, how fiscal and monetary policy will interact in the face of cost of living pressures.

The sequence of large supply shocks – first, COVID-19 related supply chain disruption and then energy and food prices, amplified by the aggression against Ukraine’s people and communities – resulted in inflation that has been far more persistent and broad-based than many had anticipated. We have to ask ourselves why this was the case.

For me, the monetary policy strategy of ‘looking through’ supply shocks has not fully withstood the test of the last two years.3 Supply disruptions in different parts of the global supply chains quickly passed through input prices, giving rise to more persistent and broad inflation, adding to the dis-anchoring risks I mentioned earlier.4

Some pandemic-related supply shocks have receded, such the recent large falls in shipping costs. Food and energy price developments, however, remain tied to evolution of the events in Ukraine. Over the medium term, Europe is unlikely to revert to a dependency on Russian energy. This means that supply will remain constrained until alternative energy sources are secured or developed. There are counter-balancing supply and demand factors at play here.

However, the relative sizes of the two shocks matters, and there remains much uncertainty around the projected paths. This matters for monetary policy as it targets demand.

The pandemic exposed the fragility of global supply chains that, up to then, had prioritised cost reduction. While globalisation should, in theory, allow for the sharing of risk internationally, a lack of diversification in supply chains created risks of its own.

However, even before the war in Ukraine, there were gradual shifts away from international cooperation. The backlash in some countries reflects, in part, the course globalisation has taken, in particular the perceived uneven distribution of benefits within and across countries.5More recently, countries have introduced industrial policies based on geo-political concerns that place a higher weight on security relative to efficiency, with the US explicitly pursuing a policy of “friend-shoring”.6

This type of regionalisation of the global economy may have positive effects on output in the short run. However, it could also give rise to further inflationary effects in the medium-term, given the importance of imports from lower-priced economies in maintaining low inflation rates in recent decades, especially in goods.7 In fact, in Ireland the swing from a more than two-decade run of goods deflation to now experiencing substantial goods inflation is a one reason for the higher inflation we have seen in recent months.8

Another consideration for inflation dynamics is climate change. The change in climate has already arrived with extreme weather events becoming increasingly common, with impacts on food supply and prices. Accelerating the green transition is the best way to limit our vulnerability to these, as well as to geopolitical events. The impact of the transition on prices remains uncertain in the medium term, but will depend crucially on the policies pursued by governments.9 Policies compatible with stable prices in the medium run would aim to suppress demand for fossil fuels, and stimulate investment in, and development of, renewable technologies.

Moving sooner allows for a more gradual and predictable implementation of these policy changes, and would greatly reduce the costs. However, the outcomes of the most recent COP (27) indicate that the risk of a disorderly climate transition remains. A slower pace of transition means that central banks and other policy makers will likely have to grapple with much larger energy and food price shocks, which as we have seen can have larger and more persistent impacts that previously understood.

Finally, how fiscal policy responds to high inflation is important, with consequent implications for monetary policy. While it is appropriate on both economic and social policy grounds to protect vulnerable households from shocks to energy, broad-based measures to support all households will serve to boost demand at a time when restraint is needed. This may necessitate a stronger response from monetary policy makers than would otherwise be the case to bring inflation back to target.10 It is clear that fiscal deficits in euro area countries are turning out to be larger than originally anticipated, in part due to these supports, and it is another area that will undoubtedly receive attention in the ECB staff ’s December forecasts. We also need to be conscious of building in ‘cliff-edge’ effects. That is, if fiscal actions now are merely delaying demand adjustments to a permanently higher price level, or, equally, postponing real wage adjustments into the future.

In terms of the current cost of living challenges, I reiterate my previous advice that “fiscal support measures to cushion the impact of higher energy prices should be temporary and targeted at the most vulnerable households and firms to limit the risk of fuelling inflationary pressures, [and] to enhance the efficiency of public spending and to preserve debt sustainability.” In the longer-term, fiscal policies that increase productivity, help to build supply chain resilience, and support the green transition will all help to contain price pressures.

Beyond the medium term - structural changes that could impact inflation dynamics

A key question is to what extent the supply shocks we have experienced over the last two years are structural. That is, have they permanently reduced aggregate supply to the extent that monetary policy has to work harder to bring demand and supply back into balance?

The rapid emergence of above-target inflation around the world has raised concerns that the era of low and stable inflation is coming to an end. Forces driving global growth in recent decades – which included technological advances, globalisation, and rapid population growth – were strongly disinflationary. These underlying forces have not gone away but they are now being counter-balanced by the large supply shocks we have seen in recent years, future supply shocks that could be coming our way, and the strong demand we have seen coming out of the pandemic.

The debate on the inflation regime that will shape the long-term will not doubt go through many iterations. Econometric models are the main tool to make longer-term forecasts beyond one year. But they are less well-equipped to address turning points, where transitions may be reliably identified only after they have happened ( BIS, 2022). To address this, central banks sometimes draw on unobservable concepts such as neutral or ‘equilibrium’ rate of interest to help understand where interest rates might end up after all shocks have faded away. The last thirty years had seen a marked decline in the neutral rate, or “R-star” (r*), as it is also referred to. When assessing the stance of monetary policy – essentially whether it is accommodative, restrictive, or balanced between the two ( Kaplan, 2018 (PDF 368.16KB)) – policymakers often talk about the policy rate relative to r* ( Fischer, 2016). For example, the Taylor rule prescribes a policy rate based on where output and inflation stand compared to their equilibrium rate (see, for example, Borio (2021) (PDF 216.5KB) and Brainard (2018)).

Such estimates do give us a framework within which to think about the longer-term structural forces that are driving inflation and an approach to assessing the monetary policy stance. These estimates also give us one perspective on the longer term drivers underpinning interest rates, and a potentially useful way of thinking about the counterbalancing structural forces that are at play.

However, in the context of current discussions about the future direction for interest rates, I would also highlight the practical challenges that arise for a policy maker using r* estimates that have been shown to be both highly uncertain, unstable, and often overly sensitive to the addition of new data points (see, for example, Beyer and Wieland, 2019 and Hamilton et al, 2016 (PDF 767.85KB)).

I remain cautious about over-relying on r* estimates to guide policy at this time of elevated uncertainty. Central banks can, and should, communicate about where they see their policy rates in relation to a range of r* estimates – and I emphasise a range rather than a point estimate – not least because it is a useful framework for thinking about structural change and longer-term economic narratives. However, in relation to the other uncertainties I have highlighted – the economic outlook, and how our policy is being transmitted to the real economy given this outlook – we need to pay close attention to the incoming data on real and financial developments that can impact inflation dynamics.

Conclusion

So what is over the horizon? Probably the most over-used phrase by central bankers recently has been ‘extreme uncertainty’. But that reflects the reality of a period that has seen a global pandemic, the closing down and re-opening of major economies, Russia’s war and an energy crisis, among other shocks. Amid that uncertainty, one thing is very clear, that the ECB is determined to deliver on its price stability mandate and we will continue to take the necessary steps at our forthcoming meetings.

1 With thanks to Reamonn Lydon, Gillian Phelan, and Robert Kelly for their contributions to these remarks.

6 See remarks by Secretary of the Treasury, Janet Yellen, at Microsoft in New Delhi.

7 On the macroeconomic implications of reshoring, see Clancy, D. et al. (forthcoming), “Reshoring production in small open economies.”