Domestic demand continuing to support a strong Irish economy, Brexit risk remains – Central Bank

12 October 2017

Press Release

- Irish economy continues to grow at a solid pace, supported by strong and broad-based growth in full-time employment, incomes and consumer spending

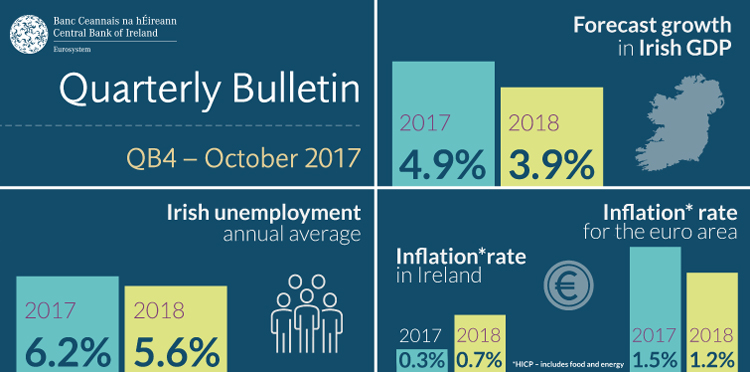

- Forecasts for GDP growth raised slightly: 4.9 per cent for 2017 (+0.4 per cent), 3.9 per cent for 2018 (+0.3 per cent)

- External uncertainty continues to pose risks, including Brexit, exchange rates and global economic and trading conditions

The Central Bank of Ireland has today published its fourth Quarterly Bulletin for 2017 . The Bulletin examines recent trends in the domestic economy and provides the Central Bank’s forecasts for the Irish economy and its views on domestic macroeconomic policy issues.

The Bulletin reports:

- Modified domestic demand is forecast to grow by 4.2 per cent this year and by 3.9 per cent next year, revised down slightly in light of consumption data from earlier in the year

- Export growth for 2017 is revised down slightly to 4.9 per cent, following weak contract manufacturing exports in the first half of the year

- Investment in building and construction continues to recover strongly with housing construction up by 31.8 per cent in 2017, although this comes from a very low base

- However, new house completions are unlikely to reach initial projections with 18,000 units forecast for 2017 and 21,000 in 2018

- Inflation remains subdued and the lowest in the euro area. The Harmonised Index of Consumer Prices (HICP) is expected to grow by 0.3 per cent in 2017 and 0.7 per cent in 2018

Chief Economist Gabriel Fagan, said: “The economic outlook for Ireland remains strong, boosted by employment, wage growth and consumer spending. The growth in full-time employment is particularly notable and outpaces overall employment growth as part-time work increasingly becomes full-time. Although overall employment growth is revised down slightly, we predict that the numbers in work will rise by 90,000 by the end of next year while the unemployment rate will fall to 5.6 per cent.”

Reflecting the relatively high proportion of goods imports which come from the UK, pass-through from the post-referendum sterling weakness has contributed to downward pressure on goods price inflation, which is persistently negative and is largely offsetting higher prices for services, keeping overall HICP inflation close to zero.

Mr Fagan continued: “Goods price inflation is set to be persistently negative, largely due to the lagged effects of sterling depreciation. This results in an overall level of consumer price inflation that is low by historical standards, helping to underpin real household income and consumption.”

In exports, external demand continues to look positive for 2017 and 2018, with the outlook for demand from Ireland’s main trading partners up modestly since the previous Bulletin. However, the recent appreciation of the euro against the dollar and sterling is likely to dampen exports somewhat. The Bulletin also examines Ireland’s current account balance with the UK. Whilst volatile, one notable aspect is the scale of Ireland’s trade surplus in services with the UK.

Mr Fagan concluded: “The impact of Brexit to date has been fairly muted and mainly felt through the effects of a weaker pound. Far from dampening consumer sentiment, Brexit is keeping the costs of many imported goods down. Although this is good news for many Irish consumers, we must not underestimate the threat that Brexit poses to our longer-term prosperity given our exposure to the UK economy.”

A short video of the Chief Economist, Gabriel Fagan, discussing the Quarterly Bulletin, is available on the Central Bank’s YouTube channel.