Managing the medium term debt challenge

03 July 2020

Blog

Today, we published our third Quarterly Bulletin (QB) of the year, which outlines our latest analysis for the Irish economy. The effects of COVID-19 are of course a prominent focus in the QB, both in the short term and medium term. The outlook is very uncertain. The path ahead for the economy will depend on the future path of the virus, the degree to which containment measures need to remain in place or be re-introduced, the immediate and longer-lasting effects on behaviour and economic activity, the damage to the productive capacity of the economy and the pace at which activity normalises. Given the scale of uncertainty, two different scenarios are outlined in the QB.

Our baseline scenario sees output recovering to its pre-crisis levels by 2022. However, this will still mean that activity is well below where it would have been without the economic shock from COVID-19. In our severe scenario, output does not fully recover by 2022 and remains about 5 per cent below its pre-crisis level. So, the recovery will come but it will be more gradual.

In this post, I want to focus more on the medium-term outlook for the economy, and particularly on how policymakers can respond moving forward, now that we have passed through the first few months of this shock.

The initial response

The economic shock from the global pandemic has been swift and severe for Ireland and for countries around the world. As I’ve said in previous blogs, government actions are essential in such a crisis, most obviously to save lives by supporting health systems, and by deploying measures to mitigate the economic impact by supporting households and businesses. The government’s response has focused on three broad categories of spending: providing enhanced income supports for those whose employment has been affected by the pandemic; business supports in the form of direct and indirect funding; and additional health spending.

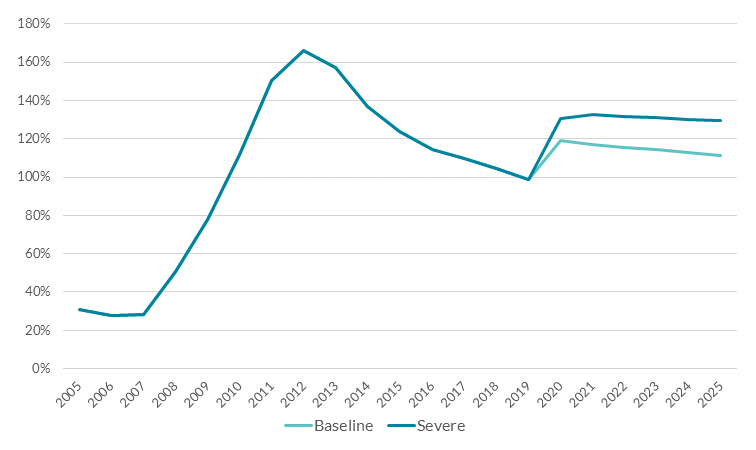

In total, the cost of direct supports this year are estimated to be around €9 billion, with a further €7 billion being made available through indirect supports such as credit guarantees and rate deferments. The scale of support provided, domestically and globally, has helped to contain the effects of the economic downturn. But of course, this support has led to a sharp deterioration in the public finances (see Figure 1).

I believe the fiscal measures taken to date have been both warranted and necessary and, for now, the cost of financing the additional debt is low. However, higher debt levels come with risks and the Irish economy will be more vulnerable to future shocks, whether to growth or to changes in interest rates. The current supports have cushioned the economic hardship felt by many. However, they are temporary in nature, and the focus must now move to when they can be unwound or adjusted. As the economy gradually recovers, we need to ensure that support is targeted to where it is needed the most.

Figure 1: General government debt as a percentage of GNI*

Source: CSO, Central Bank of Ireland Calculations

Debt sustainability

The overall level of debt matters but its sustainability will depend on a number of factors, including the growth rate of the economy, funding costs, debt structure and contingent liabilities.

Indeed, although Ireland’s debt-to-GNI* ratio is lower than it was in 2012, it is higher than at the onset of the last crisis over a decade ago (see Figure 1). However, I believe that the country is currently in a much stronger position to deal with the effects of the present shock. The cost of servicing debt remains manageable, supported by monetary policy (which I have written about in previous blogs). In the short term, the Government also has significant resources available, including large cash balances.

Figure 1 outlines how the debt-to-GNI* ratio may evolve based on our scenario analyses. In both cases, the ratio increases sharply before stabilising and declining, albeit more slowly in the severe scenario. The decline in the debt ratio in the medium-term is driven by a resumption of economic growth, low interest rates and favourable deficit-debt adjustments, which are sufficient to offset the negative impact of running primary deficits.

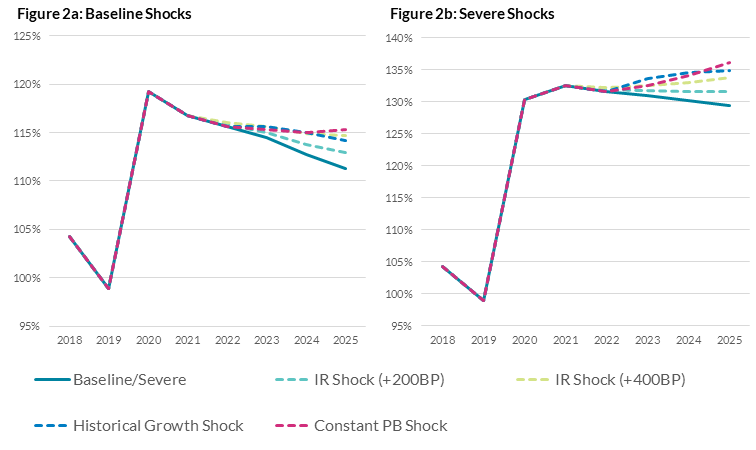

However, taking a more detailed look at debt dynamics shows the sensitivity of these scenarios to economic and fiscal assumptions, particularly changes in interest rates, growth rates and the budget balance. Figures 2a and 2b outline a number of alternate paths for debt-to-GNI* based on changes in these assumptions. We can see particularly in the severe scenario how increases in interest rates or lower growth could mean debt-to-GNI* is still increasing in 2025.

Source: Irish Debt Dynamics over the Medium Term, Box F, Quarterly Bulletin 3 - July 2020.

I have written to the Minister for Finance (PDF 341.84KB) today, outlining my views on the economic outlook and where I think policy should focus.

Aside from COVID-19, as a small open economy, Ireland is vulnerable to other external shocks, such as changes to international taxation policies (that could result in lower corporation tax revenues). This means all policymakers, firms and households have to plan carefully to ensure we maintain the necessary resilience to shocks.

Conclusion

The fiscal response to the current crisis has been entirely necessary to support the response to the pandemic and its impact on households and firms. As I’ve said before, timely, targeted and temporary measures are essential to cushion the shock and support the recovery from COVID-19. Policy should continue to focus on supporting the productive capacity of the economy and avoiding scarring effects such as long-term unemployment. However, as we move from the initial phase of this crisis, policymakers must consider how to ensure the public finances remain on a sustainable footing. There may be a need to transition from the support measures currently in place to ones that address structural challenges and support a quicker, stronger and more sustainable recovery.

The rise in the government deficit and debt ratios was both warranted and necessary and is, currently, affordable. But the high level of debt leaves government finances vulnerable to future shocks. It will be important for the government to provide a clear, credible and time-bound return to much lower and sustainable deficit and debt positions.

The country’s ability to withstand the immediate impacts of the COVID-19 shock is partly a result of policy actions over the last decade. There needs to be a continued focus on building economic resilience to future shocks, including a more sustainable debt position but also the longer term structural changes that would help to manage the challenges of international tax reform, the longer-term implications of the UK’s withdrawal from the EU and climate change (among others).

Gabriel Makhlouf

Read More