The euro area outlook, fiscal policy and the ECB’s review

16 September 2020

Blog

Looking back to the early months of the COVID-19 pandemic, I’m sure many of us hoped that we were living through a relatively short-lived phenomenon. Of course, this has proven to not be the case and learning to live with the virus will be an ongoing challenge for some time to come. In today’s blog I want to give you an overview of the outlook for the euro area, highlight my suggested priority areas in advance of the Government’s Budget next month and comment on the interaction between monetary and fiscal policy.

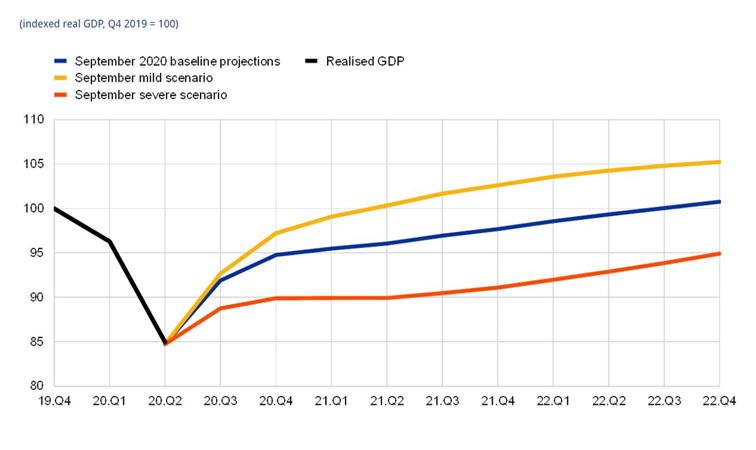

The pandemic brought on a swift and steep downturn in economic activity. Last week’s (virtual) meeting of the ECB’s Governing Council discussed the September ECB staff projections which showed output would not fully recover until late 2022 (in the baseline scenario). The euro area economy contracted sharply in the second quarter of this year (as was to be expected) but more recent incoming data and survey results indicate a continued recovery and point to a strong rebound in GDP growth in Q3. Notwithstanding that, economic output remains well below pre-pandemic levels.

Figure 1: September ECB Staff Projections

Realised and projected output

Source: ECB

Source: ECB

The Central Bank will be publishing its own updated projections for the Irish economy next month.

Pre-Budget letter

The euro area outlook and monetary and fiscal policy mix provides the canvas for domestic policy and earlier this month I wrote to the Minister for Finance in advance of October’s Budget. In my letter, I suggested three areas that deserved careful consideration.

First, policy should focus on supporting the productive capacity of the economy, mitigating scarring effects such as long term unemployment and reducing the risk that otherwise viable firms become insolvent (while also recognising that some firms will not be viable and that it’s not in the community’s interest that it supports loss-making enterprises). Given the sharp increase in the numbers out of work, labour market activation and training programmes can have a positive impact, as can bringing forward planned investment programmes where possible. It’s also important to retain a long-term perspective when it comes to investment. The social return from high-quality public investment accrues over many decades and the improvements it brings are more likely to be felt gradually rather than instantaneously. This means maintaining a steady pace of public investment over time, in both good times and bad.

Second, the rise in the deficit and debt ratios has been both warranted and necessary but a path to lower and more sustainable levels will eventually have to be taken. Assuming that the supports introduced are temporary in nature, favourable debt dynamics in the coming years should support a decline in the public debt ratio. But the current high levels of public debt mean the economy is more vulnerable to future shocks with less room for manoeuvre if circumstances change. Once the outlook is clearer, the Government will need to provide a clear, credible and time-bound return to much lower and sustainable deficit and debt positions.

Third, there needs to be a continued focus on addressing longer-term challenges – such as the ageing of the population and its implications for the growth of the economy and the cost of pensions and healthcare – as well as building resilience to future shocks (not least the need to make the transition to a low carbon economy). Policy should be framed to meet such challenges as failing to address them would, ultimately, be more costly. I have suggested that the Government should consider broadening its medium-term expenditure framework so that longer-term intergenerational issues are recognised explicitly, explained to the community and addressed in a planned and managed way.

Interplay between monetary and fiscal policy

The Government’s fiscal policy and that of other euro area governments – and the actions of central banks – have been critical in stabilising the economy. The issue of how fiscal and monetary policy interact will be one of the many issues in the review that my Governing Council colleagues and I have embarked on.

The review of our monetary policy strategy is an opportunity to take stock of structural shifts in the economy, and how the environment we operate in might have changed, including as a result of the pandemic. While the Governing Council of the ECB take its monetary policy decisions based only on its mandate for price stability, the interaction between monetary and fiscal policy has become more important as our low real equilibrium interest rates has meant fiscal policy has become more important for macroeconomic stabilisation.

An Economic Letter (PDF 323.45KB) published by the Central Bank this week discusses the interplay between monetary and fiscal policy. Fiscal policy has been the primary vehicle for supporting firms and households through the current crisis and the capacity of governments to respond is intrinsically linked to monetary policy. As government debt levels increase, questions surrounding fiscal sustainability inevitably arise. However, debt becomes more affordable as monetary policy eases and debt servicing costs fall.

While monetary and fiscal policy do interact, it is important to note that the euro area’s institutional structure was designed to prevent ‘fiscal dominance’ and ensure central bank independence. By fiscal dominance, I mean a scenario where the fiscal authority independently sets its budget and the monetary authority is forced to create money to satisfy government spending, without regard for price stability. History has shown that this approach is likely to result in distorted markets, moral hazard and low growth. The long-term inflationary consequences of excessive money creation is the reason that over the past 60 years, many countries have moved to establish and maintain independent central banks. This situation can be referred to as ‘monetary dominance’, whereby the monetary authority independently sets policy to fulfil its (price stability) mandate and controls inflation without government interference. My colleague, Isabel Schnabel, discussed these issues for the euro area in a recent speech.

How this interaction works in practice – especially in a relatively fragmented (by design) institutional structure – will be an important part of our strategy review as we assess the implications for monetary policy.

Gabriel Makhlouf

Read more