Behind the Data

Investigating Household Deposits During COVID-19

Tiernan Heffernan, Simone Saupe and Maria Woods*

July 2020

Deposit growth soared during the COVID-19 pandemic but economic uncertainty and changes to income levels are likely to determine future savings preferences.

As the economic impact of COVID-19 continues to unfold, the extent and duration of the downturn is highly uncertain. In the most recent Quarterly Bulletin, the baseline forecast is for underlying domestic demand to decline by 9.5 per cent this year. The future paths of household income, consumption and savings are of particular interest to policy makers, given their role in determining the shape of the economic recovery.

Household deposits have increased sharply since the outbreak of the pandemic. In its recent Quarterly Economy Commentary, the ESRI has suggested that such elevated savings could support the economic recovery if Irish households choose to resume spending with these surplus savings.

Since the banking crisis, Irish households have strengthened their resilience by reducing indebtedness and building income and net worth. However, issues such as mortgage arrears as discussed in the latest Financial Stability Review could, by interacting with the emerging vulnerabilities pose challenges for certain households.

This “Behind the Data” focuses on a key element of household savings, namely household deposits and investigates their behaviour since the outbreak of the pandemic up to latest data at May 2020. Recent developments are compared to both the European experience and historical trends to provide important context for further analysis on household savings and economic growth.

Household deposits increase sharply during COVID-19 restrictions

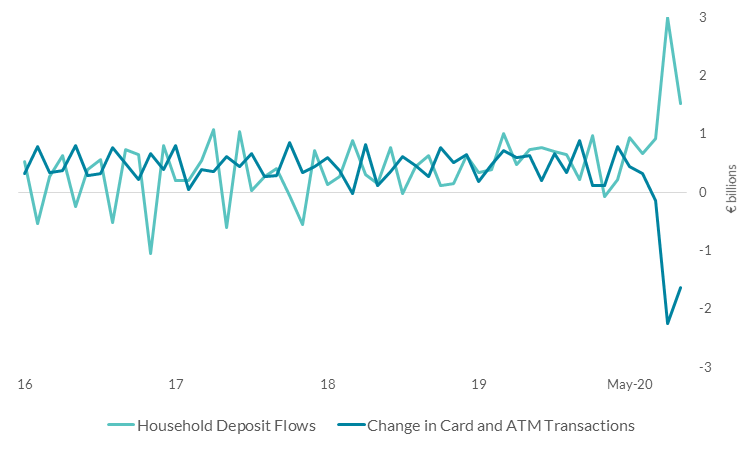

Household deposits surged in Ireland while measures to restrict the spread of COVID-19 were in place. Household deposits with banks and credit unions jumped by €3 billion in April and €1.5 billion in May respectively (Chart 1). The April inflow was the largest monthly increase in the history of the series and far exceeds the average monthly inflow since 2016 of €443 million.

This strong increase in deposits coincided with reduced spending opportunities due to the COVID-19 containment measures. Retail sales fell by around 45 per cent cumulatively in March and April 2020, while updated data from Hopkins & Sherman (2020) show a slow recovery in spending since late April (Chart 1). The most recent daily card payments data show a recovery in consumer activity which could reduce future deposit growth.

Chart 1: Household deposit flows and change in card and ATM transactions

Source: Central Bank of Ireland calculations.

Note: “Card and ATM Transactions” are calculated as the difference between total card and ATM transactions in a given month and the same month of the previous year.

Such robust increases in deposits occurred despite a drastic pick-up in unemployment and a sharp contraction in economic activity (Conefrey and Walsh, 2020). One reason for this may be the temporary government income supports and loan payment breaks agreed between lenders and borrowers (Kearns et al., 2020). While these supports may have prevented a drain on some deposit accounts, their short-term nature implies that a certain proportion of current deposit growth may be temporary.

Robust growth reflected to varying degrees across euro area

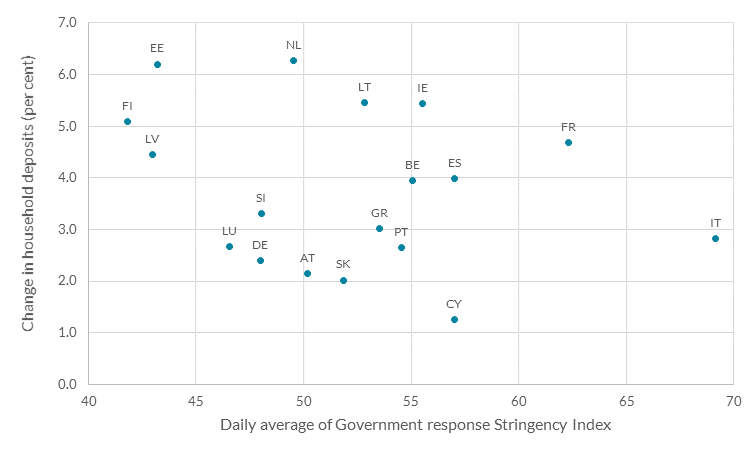

The rise in Ireland’s household deposits has been high relative to many euro area countries. Increases occurred across the bloc even though the outbreak and the relative stringency and duration of the government response measures differed across Europe (Hale et al. 2020 and Chart 2).

For some countries, like Ireland, Spain and France, strong cumulative growth in deposits since February coincided with strict or persistent containment measures. However, for others, deposits still increased substantially despite less stringent or persistent containment measures. (e.g. Finland, Latvia and Estonia).

Chart 2: Growth in household deposits and government response stringency index in euro area countries –January to May 2020

Source: ECB and Oxford COVID-19 Government Response Tracker (OxCGRT) in Hale et al. (2020).

Notes: The stringency index records strictness government responses, such as school closures and restrictions of movement, as well as income support measures, health system policies and testing regime. Data are not available for Malta.

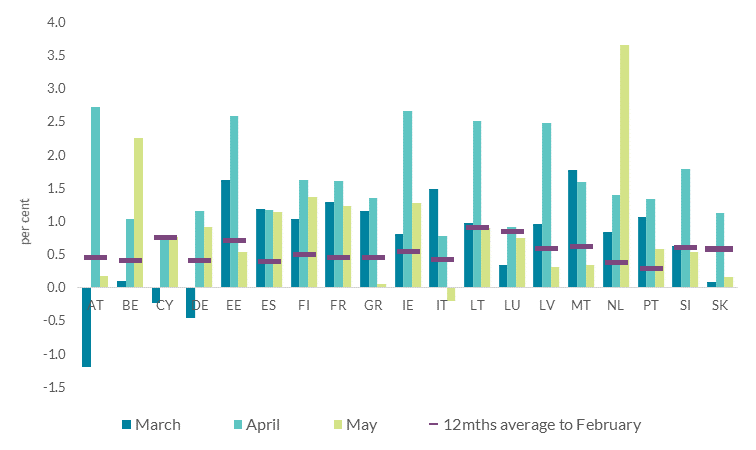

While all countries recorded positive deposit growth since February, the timing of the growth differs. In line with the peak in containment measures, all countries recorded increases in April that were well above the trends seen in the previous 12 months (Chart 3). Italy recorded a relatively strong increase in deposits in March with a decrease in May, reflecting their earlier outbreak. In Austria and Germany, household deposits declined in March with some suggestion of a higher demand for cash (Oesterreichische Nationalbank and Deutsche Bundesbank). Ashworth and Goodhart (2020), flag that the pandemic led to an increase in cash demand in a number of countries.

Chart 3: Monthly growth rates of household deposits across euro area countries, March to May 2020

Source: ECB and Central Bank of Ireland calculations

Source: ECB and Central Bank of Ireland calculations

Recent growth a continuation of a longer trend

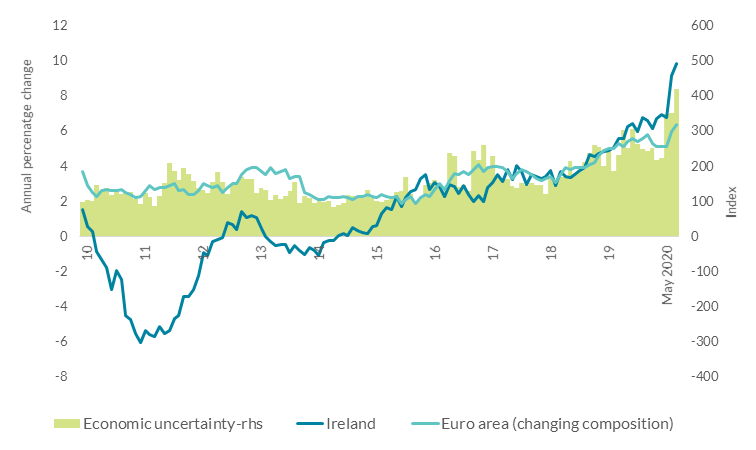

The sharp increase in Irish deposits since the onset of COVID-19 was exceptional, but household deposits were already growing at an accelerating rate throughout 2019 (Chart 4). The annual growth rate reached almost 7 per cent in February before jumping to 10 per cent in May. The growth in Irish deposits accelerated beyond the euro area figures in mid-2019, and since then exceeded the historical average since 2004 of 4.5 per cent.

This pre-COVID-19 deposit growth was at a time when economic conditions were very favourable. This was particularly the case in Ireland as the labour market neared full employment. While deposits may have grown for a number of reasons (e.g., certain households may have been saving for house purchase or other large expenses while others may have faced limited investment opportunities for rising wealth), savings for unexpected events (i.e., precautionary savings) may also explain this growth.

Economic uncertainty was also increasing prior to 2020 due to Brexit and rising geopolitical trade disputes (Chart 4). Such uncertainty may have created consumer caution and led to an increase in precautionary savings. These preferences could be further heightened at present given elevated economic uncertainty. LeBlanc et al., (2016) find that saving for unexpected events was the main individual motive for euro area households during the global financial crisis years.

Chart 4: Irish and euro area annual deposit growth and economic uncertainty

Source: Central Bank of Ireland, ECB and Davis, (2016).

Note: Global economic uncertainty index in Davis, 2016, “An Index of Global Economic Policy Uncertainty”, Macroeconomic Review, October.

Such growth in deposits also comes in spite of historically low deposit rates, especially on term deposits. Consequently recent years have seen a shift into overnight deposits such that their share has moved from half of outstanding deposits in 2012 to almost 85 per cent in May 2020. The overnight category is also the main driver of the recent strong growth figures.

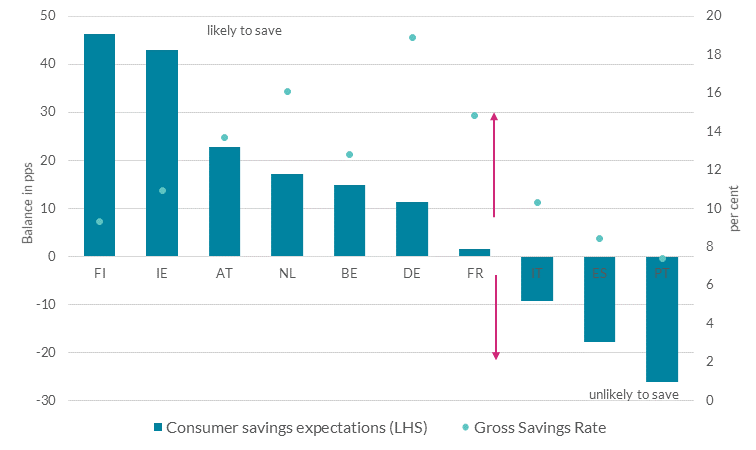

European Commission consumer survey data for June 2020 show that Irish households were among those European countries who, on balance had positive savings intentions over the following 12 months (Chart 5). Other traditionally high savings countries like the Netherlands, Austria, Germany and France were also in this category. By contrast, households in Italy, Spain, and Portugal had a relatively lower savings rate in 2019, and were on balance negative about the likelihood of savings over the next year.

Chart 5: Cross-country comparison of gross household savings rates (2019Q4) and savings expectations (June 2020)

Source: Eurostat, European Commission and Central Bank of Ireland calculations.

Note: Sample of countries selected based on availability of savings rate data. As part of the monthly European Commission’s harmonised Business and Consumer surveys, households are asked how likely they are to save over the next 12 months. Data are seasonally adjusted balance in percentage points. Balance is the difference between % positive and % negative answers.

Although recent exceptional deposit growth may, in part, be linked to limited spending opportunities and stable income due to COVID-19 related supports, it is clear that this growth is also a continuation of an upward trend in deposits driven by overnight deposits and coinciding with economic uncertainty. Such savings preferences may have been heightened by the current crisis given the scale and abrupt nature of the economic decline. Consumer caution and a preference for liquid assets could therefore continue to be a feature of deposit behaviour in the near term, especially for those who already have a savings habit. Conversely, if consumer sentiment rises and the recession is short-lived, the liquid funds will be readily available to depositors to consume or respond to any new financial pressures given the dominance of the overnight category.

The uneven impact of the crisis suggest that household-level studies will be useful to complement future analysis. Early research in Byrne et al, (2020), Beirne et al, (2020) and O’ Donoghue et al, (2020) shows different crisis impacts by employment sector, age and income distribution which would have implications for future savings capabilities.

Conclusion

This Behind the Data investigates household deposits – a key savings category – using both a cross-country and a historical perspective. Coinciding with the implementation of COVID-19 containment measures, household deposits increased markedly in Ireland. Reduced spending opportunities combined with income supports may have driven the excess growth. Such trends were reflected to varying degrees across euro area countries, although Irish figures were towards the higher end of deposit growth.

There is much uncertainty over the near term with regard to deposit growth and savings. Past preferences and consumer sentiment will be key. Irish households already had a significant savings habit with deposits rising above historical and European averages from 2019, despite low deposit rates. Such growth has coincided with rising economic uncertainty which has become further elevated in 2020. Therefore consumer caution may play a role in driving deposits in the near term. Latest European survey data for June 2020 suggest that Irish households, on balance, believe that they are likely to save over the next 12 months. The dominance of the overnight deposit category suggests that depositors will have access to funds if preferences change and depositors decide to spend or deal with any emerging debt.

Identifying the explanatory factors for recent deposit growth and seeing if they differ from the past will be important future work as further data become available.

*Email [email protected] if you have any comments or questions on this note. Comments from Sharon Donnery, Mark Cassidy, Rory McElligott, Reamonn Lydon, Caroline Mehigan, Kenneth Devine and Mark Channing are gratefully acknowledged. The views expressed in this note are those of the authors and do not necessarily reflect the views of the Central Bank of Ireland or the European System of Central Banks.

See also: