Consumer Protection Code Review

Page last updated: 24 March 2025

Central Bank of Ireland has completed a comprehensive review of the Consumer Protection Code 2012.

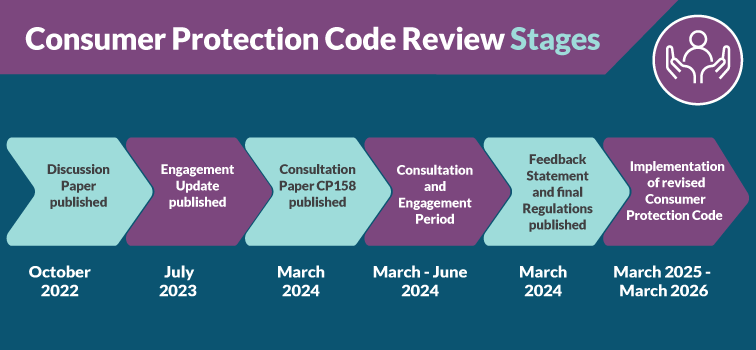

We began a three-month Public Consultation in March 2024, which provided an opportunity for stakeholders to provide feedback on our proposals to update the Consumer Protection Code.

This Public Consultation followed extensive engagement with stakeholders on our October 2022 Discussion Paper (PDF 2.21MB), which informed the proposals set out in our Public Consultation.

The purpose of our review was to modernise the Code to ensure it is fit-for-purpose and continues to protect consumers of financial products today and in the future, and that it enhances clarity and predictability for firms on their consumer protection obligations.

Following our review, the Consumer Protection Code 2025 was published on 24 March 2025. The revised Code includes a targeted package of protections that reflect how consumers are accessing financial services today.

These protections cover areas such as digitalisation, informing effectively, mortgages and switching, unregulated activities, frauds and scams, vulnerable circumstances and climate risk.

In concluding our review, we have also published a Feedback Statement, which outlines the rationale for our approach to the updates in the revised Consumer Protection Code.

Explore our Feedback Statement

Chapter 1 of the Feedback Statement sets out the approach that we took to reviewing the Consumer Protection Code, outlining the key proposals that we consulted on, and gives details on the consultation process that we embarked upon.

Read Chapter 1 in full

Note: The direct pdf page links do not work for users who are browsing on Safari

Chapter 2 provides an overview of the feedback received on the principal policy proposals set out in CP158 and the Central Bank’s response to this feedback. This includes feedback on a range of issues including Securing Customers’ Interests, Digitalisation, Informing effectively, Mortgage credit and switching, Unregulated activities, Frauds and scams, Vulnerability and Climate risk.

Read Chapter 2 in full

Note: The direct pdf page links do not work for users who are browsing on Safari

Chapter 3 provides an overview of the feedback received on the additional policy proposals set out in CP158 (including proposals on consumer credit, SME protections, insurance, and investments and pensions) together with the Central Bank’s response.

Read Chapter 3 in full

Note: The direct pdf page links do not work for users who are browsing on Safari

Chapter 4 provides an overview of our consideration of benefits and costs together with a summary of the feedback received on this and our response to this feedback.

Read Chapter 4 in full

Note: The direct pdf page links do not work for users who are browsing on Safari

Chapter 5 sets out the next steps including information on implementation and timing.

Read Chapter 5 in full

Note: The direct pdf page links do not work for users who are browsing on Safari

Annex 1: Table of Changes Post-Consultation provides an overview of the changes made since the consultation, in a tabular format.

Read Annex 1 in full

Note: The direct pdf page links do not work for users who are browsing on Safari

The revised Code is made up of two regulations. The Standards for Business and Supporting Standards for Business (under section 17A of the Central Bank Reform Act 2010), and the Consumer Protection Regulations (under section 48 of the Central Bank (Supervision and Enforcement) Act 2013.

The Consumer Protection Regulations (section 48 regulations), which make up the body of the revised Code, contain a range of general and cross-sectoral requirements, along with sector-specific requirements, the majority of which reflect the existing requirements, along with some enhancements and some new additions.

View the Section 48 Regulations

In order to achieve further clarity and predictability for firms around their obligations to secure the interests of their customers, and to protect consumers in vulnerable circumstances, dedicated guidance documents have been produced. The General Code Guidance provides guidance for firms to support implementation of the broader requirements of the Revised Code. This guidance incorporates and updates the existing Code guidance, as well as including new guidance on the changes under the Revised Code that has been informed by feedback received during the consultation process.

Read all Guidance on the Consumer Protection Code

How was the review conducted?

The review was conducted in three phases:

In October 2022, we published a Discussion Paper, seeking views on the issues emerging for consumers in the changing financial services landscape.

An extensive six-month engagement programme with our stakeholders followed, including roundtables, bilateral meetings, and an online public survey.

The response to this engagement programme was very positive and has given us a deeper understanding of the issues facing consumers of financial services.

In July 2023 we published an update on this engagement to share what we have learned so far and what we will do next. We also published the individual responses received to our Discussion Paper, along with the results of an online public survey, which was open on our website between December 2022 and April 2023.

In March 2024, we published a Consultation Paper on the Consumer Protection Code. The Consultation Paper provided an opportunity for stakeholders to provide feedback on how we were proposing to update the Code.

The proposals in the Consultation Paper included:

- Providing clarity for firms on their existing consumer protection obligations

- Modernising and updating the Code to enhance protections for consumers of financial services today and into the future

- Consolidating other consumer protection requirements into the Code and converting the Code into regulations to provide an integrated consumer protection framework

- Supporting consumers and firms in accessing and navigating the Code through the provision of online supports and guides.

The Consultation Paper was open for feedback for three months until 7 June 2024.

Following the public consultation, we considered the feedback from our stakeholders before publishing the final revised Consumer Protection Code alongside a feedback statement outlining our consideration of feedback received.

The revised Code is subject to a 12-month implementation period, with the new rules taking effect from 24 March 2026. This means that firms will have 12 months to ensure they are in a position to comply with the Code.

To support implementation, Central Bank of Ireland has published a range of supporting materials, including guidance and navigation tools, and we will continue to engage with industry during the implementation period to support effective implementation of the revised Code.

Further evolution of the Consumer Protection Code

We will consider further enhancements to the Code in response to ongoing developments at a domestic and European Union (EU) level. For example, we may enhance the Code based on anticipated domestic and EU measures relating to Access to Cash, the National Payments Strategy, the EU Retail Investment Strategy (RIS) and the evolution of the EU Payment Services Framework. At a domestic level, we will consult on the full application of the Code to credit unions, in order to ensure their members are afforded the same protections as other consumers.

Related Research

As part of the review of the Consumer Protection Code, we conducted consumer research to help us further understand the perspectives of those who rely on the protections of the framework.

The findings from our research, alongside the results from our online survey, our own analysis and feedback provided by our stakeholders through our Discussion Paper engagement, informed our policy considerations and the development of our policy proposals that are outlined in the Consultation Paper on the Consumer Protection Code which was published on 7 March.

To find out about our findings from our consumer research, read our Consumer Research Report (PDF 1.04MB).

As part of our engagement on the review, we also took to the streets of Dublin to find out what members of the public thought about a range of consumer topics. Watch the videos below.

Transcript of the "Word on the Street video (PDF 120.5KB)"