Quarterly Bulletin No.4 2016

06 October 2016

Quarterly Bulletin Categories

Quarterly Bulletin No. 4 2016 was published on 06 October 2016.

Read the full Quarterly Bulletin No. 4 2016 (PDF 2.58MB) or access the individual sections below.

Read the Quarterly Bulletin No.4 2016 Press Conference Transcript 06.10.2016 (PDF 310.73KB)

Forecast Summary Table

View the QB4 2016 Forecast Summary Table (PDF 29.44KB)

Comment

Read the full QB4 2016 Comment (PDF 32.23KB)

Click on the image above to watch Chief Economist Gabriel Fagan discuss Quarterly Bulletin No. 4 2016.

Tá leagan Gaeilge den QB4 2016 An Timpeallacht Gheilleagrach (PDF 27.95KB) ar fáil anseo.

Domestic Economy

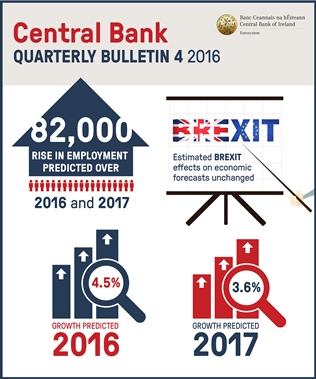

Irish GDP is forecast to grow by 4.5 per cent this year reflecting a reduced contribution from exports together with some moderation in the growth of domestic demand. A downward revision to projected GDP growth this year is mainly accounted for by a weaker external performance. Risks to the outlook for the economy remain firmly weighted to the downside and mainly relate to external factors.

Read the full chapter: QB4 2016 Domestic Economy (PDF 527.25KB)

Financing Developments in the Irish Economy

Irish financing conditions continued their gradual improvement over recent months, assisted by the ongoing economic recovery and favourable ECB monetary policy decisions. Although Irish households and small and medium enterprises (SMEs) continue to reduce high debt levels, new mortgage, consumer and SME loan drawdowns increased over the first half of 2016. However, despite the recent decline in all interest rate types, Irish rates remain high by euro area standards.

Read the full chapter: QB4 2016 Financing Developments in the Irish Economy (PDF 614.48KB)

Developments in the Euro Area Economy

The euro area stabilised during the third quarter although inflation and price pressures remains muted. During the second half of 2016, the euro area’s recovery is expected to continue. The immediate impact of the U.K’s referendum result to leave the E.U. has been less disruptive than many anticipated. Nonetheless, uncertainty regarding the new economic and financial agreements that will be reached between both entities is the main risk overshadowing the euro area’s recovery.

Read the full chapter: QB4 2016 Developments in the Euro Area Economy (PDF 403.15KB)

Signed Articles

Rental markets, savings and the accumulation of mortgage deposits

by Conor Kelly and Fergal McCann

Click on the image above to watch Fergal McCann discuss his Signed Article.

This piece looks at the ability to save a deposit to purchase a house while renting in Ireland. Rising rent costs, increasing purchase prices and new mortgage regulations have all impacted the time horizon over which households can expect to save for a deposit. Using rental and purchase price data we calculate the length of time it would take to save for a three-bedroom house deposit in Ireland while renting a two-bedroom apartment. We then compare the results both pre and post introduction of the mortgage regulations.

Read the full Signed Article:Rental markets savings and the accumulation of mortgaged deposits (PDF 351.84KB)

New Data Collection on Special Purpose Vehicles in Ireland: Initial Findings and Measuring Shadow Banking

by Dominic Barrett, Brian Godfrey and Brian Golden

This article introduces a new dataset covering non-securitisation special purpose vehicles reported to the Central Bank. The new database covers 822 vehicles with assets of €324 billion in Q4 2015 and fills an important data gap in coverage of the non-bank financial sector. The article focuses on the wide diversity of activities, country and sector links within complex vehicle structures and allows for a more refined measure of shadow banking activity in Ireland.

Read the full Signed Article: New Data Collection on Special Purpose Vehicles in Ireland - Initial Findings and Measuring Shadow Banking (PDF 252.73KB)

Option Implied Probability Density Functions: Methodology and Use in Understanding Investor Sentiment

by Seamus O'Donnell and Mary O'Keeffe

In recent years there has been lots of research into the extraction of information from the options market. This signed article presents a modelling approach which depicts estimates of future movements of an asset price, as priced by investors. They are of benefit as they incorporate information from the full distribution of investor beliefs. The purpose of this article is to demonstrate the benefits of such models and provide guidance on how they may be constructed and interpreted.

Read the full Signed Article: Option Implied Probability Density Functions - Methodology and Use in Understanding Investor Sentiment (PDF 295.53KB)

Statistical Appendix

View the full QB4 2016 Statistical Appendix (PDF 24.73KB)