Mortgage Measures

17 June 2021

Blog

We published our first Financial Stability Review of 2021 (PDF 2.12MB) this week. It sets out our views on the most material macro-financial risks facing the Irish economy and our judgments on the resilience of various sectors, along with a number of macroprudential policy decisions. I outlined some high level points about the review in my opening statement (PDF 241.32KB), and in this post I will discuss one of our macroprudential policies in greater detail, our mortgage measures.

We use our macroprudential policies to try and achieve our aims with respect to financial stability, namely that the domestic financial system can absorb, rather than amplify adverse shocks, and that banks in particular can continue to serve households and businesses through times of stress. The mortgage measures are an integral and permanent part of Ireland’s macroprudential policy framework.

The Central Bank’s Mortgage Measures

In short, the mortgage measures are designed to ensure that banks and other lenders lend money sensibly. They are also designed to curb debt levels from becoming unaffordable and prevent excess credit from building up within the Irish financial system.

When the Central Bank first introduced the measures in 2015, it was in the context of a recovering housing market, following a severe cycle of growth and collapse. House prices quadrupled in the decade before 2007 and then fell for 20 consecutive quarters, halving in value. By 2015, the economy was coming out of the financial crisis and this was a time of emerging imbalances in the housing market, with house prices increasing by around 15 per cent year-on-year nationally and by around 25 per cent in Dublin, generally attributed to supply shortages (PDF 1.49MB).

In introducing the measures, we noted that risk management by lenders and borrowers should be supplemented by a set of simple rules that increase resilience to sudden changes in housing prices and help avoid the mistakes of the past. The mortgage measures were introduced early in the economic cycle.

Our mortgage measures aim to ensure two things: first, that banks and borrowers are resilient to adverse events, and second, that house prices and credit do not evolve with damaging pro-cyclicality. In the build-up phase I mention above, loose credit conditions fuelled house price growth well in excess of income growth. At the peak in 2007, 20 per cent of loans had a loan-to-income ratio greater than 5, while more than 10 per cent of loans had a zero or negative down payment. In short, the mortgage measures are in place to reduce the risk that such a credit-fuelled house price boom re-emerges in Ireland. As a result, they are key to our objectives of ensuring monetary and financial stability and that the financial system operates in the best interests of the community.

We review the effectiveness of the mortgage measures every year against their stated objectives. As part of that regular review, we look at the calibration of the measures and take into account wider housing and mortgage market developments. Several changes to the calibration and functioning of the mortgage measures have taken place over the years because of this annual review.

The mortgage measures have been effective in strengthening bank and borrower resilience. We’ve seen that most clearly during the pandemic when almost half of all workers relied on the State for some of their income. By mid-summer 2020, payment breaks were granted on more than €10.8 billion of mortgage debt (11.5% of overall balance) in the domestic banking system. Loans originating before the introduction of the mortgage measures accounted for 72% of these payment breaks and analysis shows a strong positive relationship with higher originating loan to income ratios.

While the pandemic highlights the gains of the mortgage measures in periods of stress, they also play a critical role in stopping credit dynamics from amplifying the price effects of the demand-supply imbalance in the housing market. Central Bank analysis shows that in the absence of the mortgage measures, the house price to income ratio would have been between 4.9 and 5.4 as at March 2019, compared to the actual level of 4.4 times.

The mortgage measures are part of the Central Bank’s wider macroprudential toolkit and complement other macroprudential capital buffers such as the counter cyclical capital buffer (CCyB) and the other systemically important institutions (O-SII) buffer. As the mortgage measures operate through the flow of new lending, it takes time for the effects to feed through to the overall stock of outstanding mortgages. As of end-2020, 38 per cent of outstanding mortgage lending at Irish retail banks had been issued since the introduction of the Central Bank’s mortgage measures. This means that while the stock of mortgages is becoming more sustainable, there still remains a stock of vulnerable loans in place.

Mortgage Measures in Other Countries

Ireland is not alone in its use of mortgage measures. In fact, mortgage measures are regularly used internationally. There are a variety of measures that can be used but in general terms they affect the terms and conditions of lending by imposing limits on the volume of credit granted in relation to, in particular, a property’s value, the borrower’s income, as well as the borrower’s repayment capacity or total indebtedness (and the ability to support it).

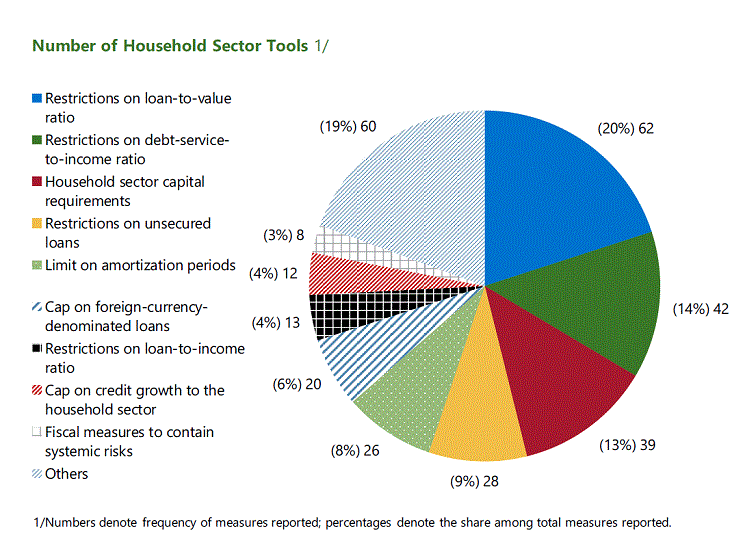

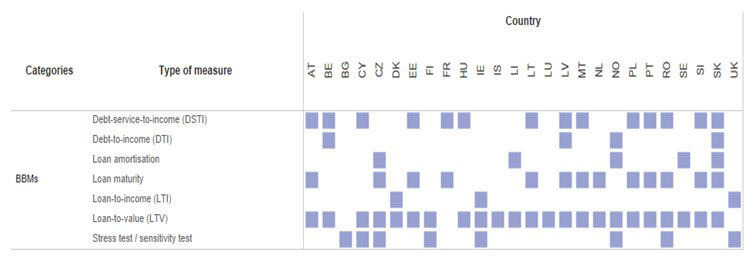

The international picture brings out three particular features. First, in terms of mortgage measures implemented globally, loan-to value limits and debt-service-to-income ratios are the most commonly used household sector tools (see Figure 1). The majority of European countries have mortgage measures in place, with loan-to-value limits and debt-service-to-income ratios also the most commonly used tools (see Table 1).

Figure 1: IMF Overview of Household Tools Including Mortgage Measures Used Globally

Source: International Monetary Fund (2018 (PDF 592.73KB))

Table 1: ESRB Overview of Active Mortgage Measures in the EEA in Q4 2020

Source: European Systemic Risk Board (2021, forthcoming). Note: EEA countries without mortgage measures are not included in this table.

The debt-service-to-income ratio takes into account a borrower’s total debt, while a loan-to-income ratio considers only the mortgage debt. At the time of the introduction of the mortgage measures, consideration was given to introducing a debt-based instrument in Ireland rather than the loan-to-income ratio. But in the (then) absence of a credit register, it was impractical to attempt to establish enforceable regulations on total debt.

Second, a trend when looking at mortgage measures in Europe is that they tend to be used in combination, in order to enhance their effectiveness and to limit circumvention of individual tools. It is common for loan-to-value limits to be combined with some form of an income-based measure such as a debt-service-to-income limit or a loan-to-income limit. This is the case in Ireland where both loan-to-value and loan-to-income limits are in place. Loan-to-value and loan-to-income limits tend to re-enforce each other. Loan-to-income limits provide a buffer against the effects of income and employment shocks, thereby increasing the resilience of borrowers and reducing the probability of default. Importantly, they also act to anchor house price dynamics to developments in the economy. Loan-to-value restrictions provide a home equity buffer against house price declines, and directly lower the loss in the event of a default.

Third, when looking at how mortgage measures are implemented abroad, it is apparent that the choice, combination and calibration of mortgage measures varies across countries, reflecting the fact that there is ‘no one-size fits all’ approach to implementing them (Arena et al, 2020). This variation reflects the different risks characterising a country’s housing and mortgage markets, the legal instruments at the disposal of national authorities, as well as the institutional frameworks in place in terms of macroprudential policy decision-making. While other aspects of macroprudential policy including the counter-cyclical capital buffer are part of the EU’s harmonised legal framework, this is not the case for mortgage measures. Many European countries, including Ireland, implement their mortgage measures through national laws. However, other authorities issue national recommendations instead, reflecting the legal and institutional differences at play.

Taking Stock: Framework Review of the Mortgage Measures

The role of the mortgage measures in guarding against the over indebtedness of households and protecting financial stability is clear. However, as a permanent part of our framework, it is important that we not only maintain the good practice of regularly reviewing the calibration of policy but also consider the overarching framework. It is now approaching seven years since the introduction of the measures and a review of the framework will allow us to consider the overarching approach, our toolkit and strategy to ensure they continue to remain fit for purpose in view of the evolution of our financial system and economy.

Our review will provide an opportunity to examine a range of topics including but not limited to the objectives of the mortgage measures, the choice of tools and the framework and strategy used for calibration. The evolution of the housing and mortgage markets since 2015 and the availability of new data sources (such as the central credit register) will inform analysis. Given the widespread international use of mortgage measures, we will also analyse how different countries implement and evaluate their measures to ensure we take international learning and best practice into our own review.

Given the importance of the measures in the mortgage market, our regular annual reviews will continue to take place in parallel throughout 2021 and 2022.

As a first step of the framework review, we want to hear from the individuals and households who experience the effect of the mortgage measures. They are also those whose welfare the measures are designed to protect. We will be holding listening events to gather perspectives and experiences across as wide an audience as possible on the housing market, the mortgage market and the mortgage measures. Activities will also include the use of an online public engagement survey which will launch in the coming weeks on centralbank.ie.

I invite everyone to share their views, on all aspects of the mortgage measures, and I look forward to reviewing your responses and incorporating them into our understanding of the role the measures have played in our economy and society.

Gabriel Makhlouf

Read more