Explainer – What should I do if I am struggling to pay my mortgage?

If you have missed a payment on your mortgage, or think you may miss a payment in the near future, you are in, or facing, “mortgage arrears”.

Being in mortgage arrears is a serious situation for you and your family, but there are measures in place to help you, provided you engage with your lender.

If you find yourself struggling to pay your mortgage, speak to your lender as soon as possible and continue to talk to them throughout the process.

Code of Conduct on Mortgage Arrears

The Central Bank has a statutory Code of Conduct on Mortgage Arrears (CCMA) to help you if you are having difficulty paying your mortgage.

The CCMA is not currently applicable to credit unions but nonetheless considered sound practice and a realistic minimum expectation of credit unions

The CCMA is designed to protect you, – i.e. banks, retail credit firms and credit servicing firms – are legally obliged to comply with it.

Under the CCMA, lenders must treat your case sympathetically and positively, with the aim of getting you back on track with your mortgage.

It requires your lender to:

- Provide dedicated and specially trained staff in their Arrears Support Unit to manage your case. This includes having any meetings with you in private and referring you to their online or hardcopy information.

- Follow the Mortgage Arrears Resolution Process (MARP) which sets out how your lender must communicate with you and assess your situation with the aim of coming to a resolution. There is also an appeals process in place so you can appeal certain decisions of your lender.

What is the MARP?

Central to the CCMA is the Mortgage Arrears Resolution Process. This details how your lender must treat you with the aim of resolving your situation.

It has the following four components:

- Communication

This sets out how your lender communicates with you. For example, your lender cannot contact you excessively, and must provide you with information to help you understand your situation.

- Financial information

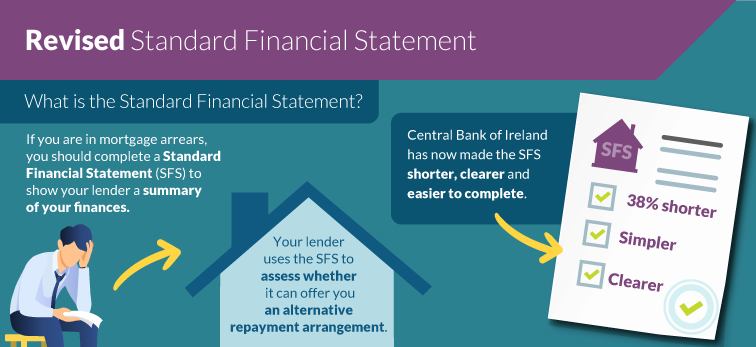

In order to assess your mortgage problem, your lender will need to get information from you about your personal financial situation. To do this your lender will ask you to complete a “Standard Financial Statement”. This allows your lender to see all of your monthly income and outgoings. For help completing this statement see our consumer guide.

- Assessment

This is where your lender assesses your case and decides whether it can offer an appropriate and sustainable alternative repayment arrangement on your mortgage. Every case is different and your lender needs to carefully assess your personal financial circumstances before making this decision.

- Resolution

This is the point at which your lender either offers you an alternative repayment arrangement or decides not to. If your lender does not offer you one, it must explain the reasons why and you can appeal this decision to the lender’s Appeals Board.

Another important protection of the MARP is that you must be given at least eight months from the date your mortgage arrears arose, or three months from the date an alternative arrangement could not be agreed (whichever is later), before your lender can take legal proceedings against you. This only applies provided you co-operate with your lender.

Can I lose protections of the CCMA?

Yes. If you do not co-operate with your lender, you risk being classified as ‘not co-operating’.

If this happens, your lender will notify you that you have lost the protections of the MARP.

This means your lender can start legal proceedings immediately, which could result in you losing your home.

For this reason, it is very important that you always engage with your lender and continue to do so throughout the process. This includes even up to the point of the repossession proceedings as under the CCMA a borrower and a lender can still agree an arrangement, even if legal proceedings have started.

What happens if my lender sells my mortgage?

If your lender sells your mortgage to another entity, the new legal owner must be regulated by the Central Bank of Ireland and you continue to be protected by the CCMA.

Your rights under the CCMA, including the right of an internal appeal, do not change.

What other support is out there?

There are a range of other supports and mechanisms available to help you with your mortgage problem.

These include the Mortgage Arrears Resolution Service (Abhaile) operated by the Money and Budgeting Service, and the Insolvency Service of Ireland.

You may also be eligible for the Mortgage to Rent scheme.

See also: