Behind the Data

Mortgage borrowers facing end of term repayment shortfalls

David Duignan and Allan Kearns*

July 2021

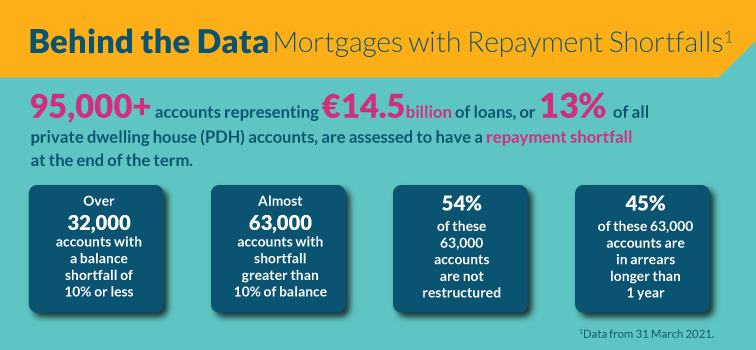

New data highlight that there is a cohort of mortgage borrowers facing repayment shortfalls at the end of their loan term. The data illustrate that the current levels of, and approach to, restructuring by financial service firms are not sufficient to solve the problems for all these borrowers.

A core focus of the work of Central Bank since the 2008 financial crisis has been on the reduction of non-performing loans and mortgage accounts in long-term arrears, including by publishing data and research on the topic (Donnery et al. (2018), Duignan et al. (2020)). In early 2020, the Central Bank of Ireland (Central Bank) initiated a new programme of work for financial services firms ("firms") to reassess all private-dwelling homes (PDH) mortgages to identify accounts with signs of distress or vulnerabilities. The motivation was threefold: First, mortgage accounts facing difficulties are not exclusively in long-term arrears. Second, a mortgage account on an existing restructure can be performing as per those agreed arrangements but not be on a sustainable path to clear the final balance. Third, there was a reporting gap for retail credit and credit servicing firms that hold PDH mortgages. The insights from this programme are informing the Central Bank’s programme of work on distressed debt.

This "Behind the Data" (BTD) estimates the size of the cohort of mortgage borrowers facing repayment shortfalls. It is the first data collection of firms’ assessments on the long-term sustainability of all PDH mortgage accounts, assessed by the borrowers’ ability to repay the full final balance at the end of the term. The insights refer to the broadest system of PDH mortgage accounts as they cover both banks and retail credit and credit servicing firms. The data inform more granular policy analysis as they facilitate systematic attention on borrowers with similar challenges. The main finding is that, as at March 2021, around 13 per cent of all PDH mortgage accounts are assessed by firms to have a shortfall in repaying the balance at the end of their term. By further segmenting this cohort into different groups, we differentiate according to the level of shortfalls and complexity of circumstances.

The data

The data summarised in this note are provided by financial services firms to the Central Bank. These data provide a system-wide perspective as they originate from five retail banks and nine retail credit and credit servicing firms and cover the majority of such firms operating in the Irish market. The Central Bank required each firm to implement a high-level process according to the guidance provided. All available information held by a firm on each account should be used in the assessment. The Central Bank aimed to achieve consistency by requiring adherence to the high-level guidance and by meeting each of the firms to check and clarify the basis of their reporting. Notwithstanding these efforts to ensure consistency, there are likely to be some inconsistencies across firms in the approach underpinning the reporting and the data should be considered carefully in this context.

The Central Bank required firms to undertake a two-step assessment to identify accounts with repayment shortfalls and categorise the scale of any shortfall:

Step 1: Assess all PDH mortgages to identify accounts facing repayment shortfalls

The firms undertook an assessment of all PDH mortgage accounts in line with guidance provided by the Central Bank. There are a number of factors guided to firms by way of reference as to why an account could be assessed as currently facing an end-of-term shortfall:

- Account is currently in arrears; and/or

- Account has not made full capital and interest monthly payments for the last 12 months under an existing alternative repayment arrangement; and/or

- Repayments under an existing alternative repayment arrangement will not lead to full repayment of the account by the maturity date, and/or

- Account is classified as in default or non-performing under international accounting standards.

Where a firm identified shortfalls for accounts in repaying the full balance, the firm was required to assess also whether they could identify agreed arrangements with the borrower at this point-in-time to address how that shortfall would be repaid. For those accounts with both a shortfall and no agreement to cover it, the mortgage account is included in the cohort of accounts classified as having a repayment shortfall. For example, an account may have a split mortgage arrangement with a warehoused portion which could be covered by a pension lump sum payment or savings, but for which there is not yet an agreement. A more challenging example could be an account in long-term arrears, for which there is no current restructure in place, and therefore both a shortfall without an agreement is evident in this case also.

Step 2: Size the shortfall and categorise accounts

Mortgage accounts facing repayment shortfalls were subsequently categorised by firms into four groups according to the assessed scale of the shortfall in repaying the final balance. Guidance requested firms to use all the information currently at their disposal (e.g., latest standard financial statement) to generate a borrower repayment profile. This profile compared against the current balance is indicative of any shortfall. While a range of financial information informs each firm’s estimation in this step, there is a qualitative and subjective element to the assessment also in relation to the value to place on any existing agreements. In addition, the circumstances within firms is likely to differ as to the range of information available to generate that borrower repayment profile. The scale of the shortfall is categorised by firms into four groups which are:

- High ability to repay balance: the shortfall is assessed to be 10 per cent or less; or

- Moderate ability to repay balance: the shortfall is greater than 10 per cent but less than 50 per cent; or

- Low ability to repay balance: the shortfall is at least 50 per cent, or

- Uncertain ability to repay: the scale of the shortfall is uncertain because there are not sufficient details or engagement between the firm and the borrower to facilitate the assessment. These borrowers are expected to be primarily in the "low" ability to repay category.Accordingly, the low and uncertain groups are consolidated in the analysis presented in this paper.

On concluding this two-step process, the number of accounts in each of the key groupings have been reported to the Central Bank. The data are collected at account level. The number of borrowers will be less than the number of accounts as borrowers can have multiple mortgage accounts. With quarterly reporting, any updated circumstances for accounts (for example, newly agreed restructuring agreements or an updated standard financial statement) can be incorporated by firms over time.

Due to the nature of the payment breaks offered to mortgage borrowers, COVID-19 has not impacted (positively or negatively) on the data reported in this note. By design, the relief did not result in a new formal arrears classification or a reclassification out of arrears – and would have superseded any alternative repayment arrangements (ARA) in place.

Mortgage accounts facing repayment shortfalls

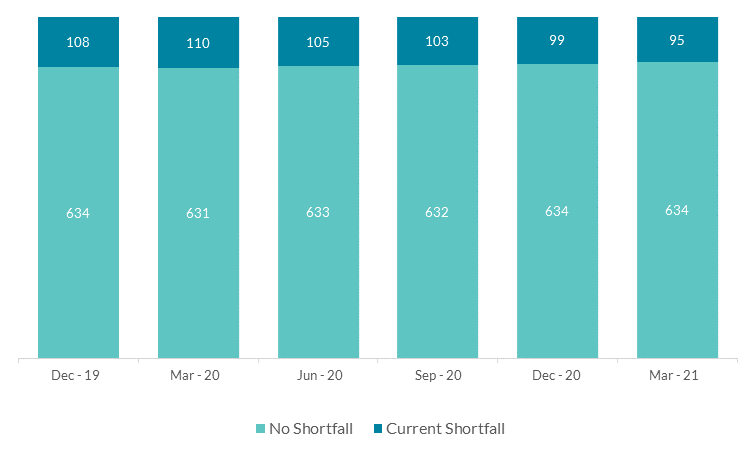

There were approximately €98 billion of Irish PDH mortgages representing almost 730,000 accounts at end-March 2021. Within this population a subset of accounts exist with shortfalls in repaying the balance at the end of the term.

Chart 1 illustrates that over 95,000 PDH accounts are assessed by firms to have a shortfall at the end of their mortgage term. This represents €14.5 billion of loans or 13 per cent of all PDH accounts. The remaining 87 per cent of PDH mortgage accounts have no shortfall at this point.

Chart 1: Repayment Status End of Life (# 000)

Chart 2: Ability to clear balance (Q1 2021)

.png?sfvrsn=140a8c1d_2)

The scale of the shortfalls in these 95,374 accounts varies across accounts and the accounts are assigned into one of four groups depending on the scale of the assessed shortfall:

- High ability to repay balance: 34 per cent of shortfall accounts will have at least 90 per cent of the outstanding balance cleared under the original or alternative repayment arrangement; or

- Moderate ability to repay balance: 17 per cent of shortfall accounts will have at least 50 per cent but less than 90 per cent of the outstanding balance cleared; or

- Low ability to repay balance: 27 per cent of shortfall accounts will have less than 50 per cent of the outstanding balance will be cleared, or

- Uncertain ability to repay: the scale of the shortfall is uncertain because there are not sufficient details or engagement between the firm and the borrower to facilitate the assessment. 22 per cent of shortfall accounts fall into this group.

Overall, there are 62,808 mortgage accounts assessed to have either a low, moderate or uncertain ability to clear the remaining mortgage debt. The subsequent section of this BTD paper focuses on the characteristics of this group according to the latest data collection (Q1 2021).

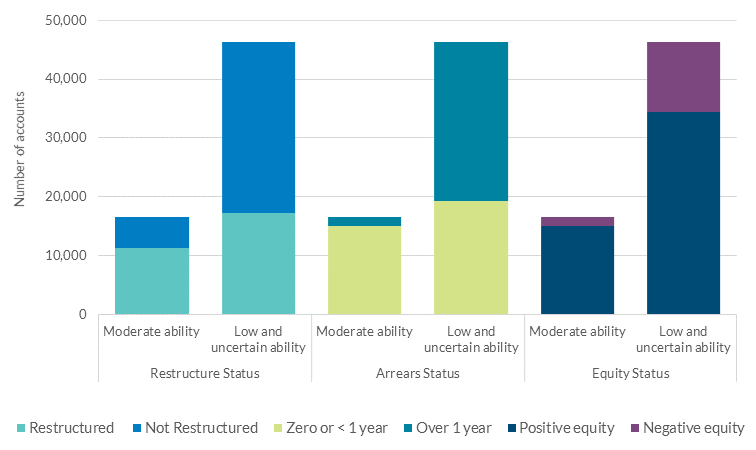

Those with low ability to repay are more likely to be not restructured and in longer-term arrears

Of the 62,808 accounts assessed to have a moderate, low or uncertain ability to clear the balance, 54% are not restructured (Chart 3). The lack of restructured arrangements is even more striking for just the low and uncertain ability to repay group with 63 per cent not on a restructure – twice as much as with the moderate ability to repay group. This low level of restructuring is also reflected in the arrears profile of the different cohorts, with 58 per cent of accounts in long-term arrears (>1 year) for the low and uncertain group versus just 9 per cent for the moderate ability to clear balance group.

Chart 3. Characteristics of accounts with moderate, low and uncertain ability to repay

An additional perspective affecting the financial status is equity status – a point in time assessment of the current loan-to-value on the property.

Chart 3 illustrates that 79 per cent of accounts have positive equity (i.e. the outstanding loan is less than value of property) with the remainder in negative equity. The propensity to be experiencing negative equity is higher the greater the assessed shortfall in the mortgage balance. For instance, the moderate ability to clear the balance cohort with 9 per cent of accounts in negative equity compare favourably with 26 per cent for low and uncertain ability group.

Grouping similar borrowers

The structure of the data collection was chosen to allow further disaggregation of borrowers and to group borrowers based on certain policy-relevant characteristics. This grouping provides a system-wide perspective across all fourteen firms holding or servicing PDH mortgages. The conclusions rest on the degree of consistency applied by firms at the request of the Central Bank and as described in the data section above.

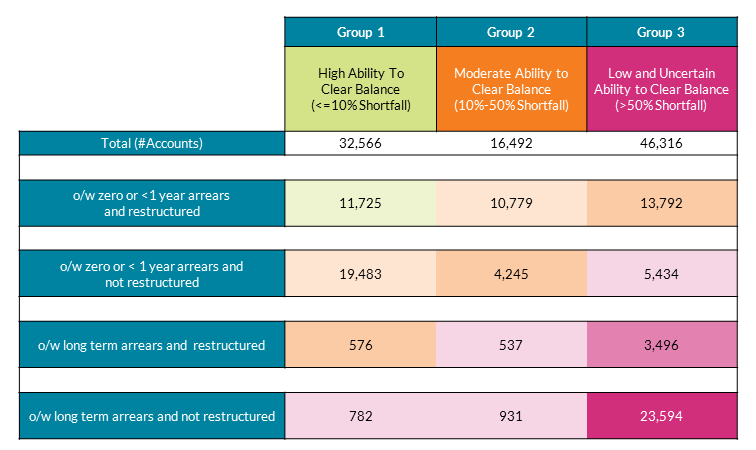

Table 1 classifies the different groups of borrowers within the total cohort according to their ability to clear balance, arrears and restructured status. From the top to the bottom of the table, we show the number of accounts with ever more challenging circumstances ranging from restructured and not in short term arrears, to those accounts in long-term arrears and not restructured.

Of the accounts with a high ability to clear the balance, the largest cohort have zero or less than one year of arrears and are not restructured. This is a concern as notwithstanding the relatively smaller shortfall for these accounts, further engagement is required to clarify how this shortfall (if any) will be covered and to avoid these accounts falling into (deeper) arrears at the end of the term.

The moderate ability to clear the balance accounts are expected to repay between 50 per cent and 90 per cent of the mortgage within the term. Over 10,000 accounts within this group are already restructured. The concern is whether having pre-existing restructures in place would be sufficient to ensure these accounts are on a sustainable path to full repayment. This is not the case for this cohort of accounts. Further, there are over 5,000 accounts within this group that have yet to be restructured.

The final category groups accounts with a low ability to clear the balance (i.e. more than 50 per cent of balance will be unpaid) or where lenders have been unable to assess the account’s position. This group includes 23,594 accounts in long-term arrears that are not restructured. A further 5,434 accounts are not deemed to be in long-term arrears but are also not restructured. The complexity of the circumstances in this group need to be considered further. Other relevant insights (not from these data) will come from features observed in long-term-arrears accounts such as (i) the high propensity to be making no repayments with 50 per cent having made no regular repayments in the last 12 months; and (ii) the low levels of engagement between the firms and the borrowers (McCann, 2018; Duignan et al., 2020). This complexity tends to result in only a small minority of these loans being successfully restructured.

Table 1: The diversity of accounts with repayment shortfalls

Conclusion

This "Behind the Data" is based on new reporting by firms with PDH mortgages to illustrate a broader perspective on residential mortgage accounts facing repayment challenges. The Central Bank has required firms to assess all accounts, including those in long-term mortgage arrears. The requirement has been for firms to identify accounts that at the time of reporting will have a shortfall at the end of the term and have no agreement in place between the borrower and the firm to pay off such shortfalls. The data illustrate that the current levels of, and approach to, long-term restructuring are not sufficient to solve the problems for all these borrowers. In summary, there are accounts with restructuring arrangements that even if successfully adhered too will not result in full repayment. There are additional accounts, many in long-term arrears, with no current restructuring arrangement in place. Finally, there are a sub-group of accounts with a variety of complex circumstances.

*Email [email protected] and [email protected] if you have any comments or questions on this note. The authors want to thank John Scanlon for analytical support. Comments from Sharon Donnery, Triona Forde, Trevor Fitzpatrick, Rory McElligott, Maria Woods, Aisling Menton, Sean Fitzpatrick, Paul Jennings, Michael Smyth and Mary Keeney are gratefully acknowledged. The views expressed in this note are those of the authors and do not necessarily reflect the views of the Central Bank of Ireland or the ESCB.

See also: