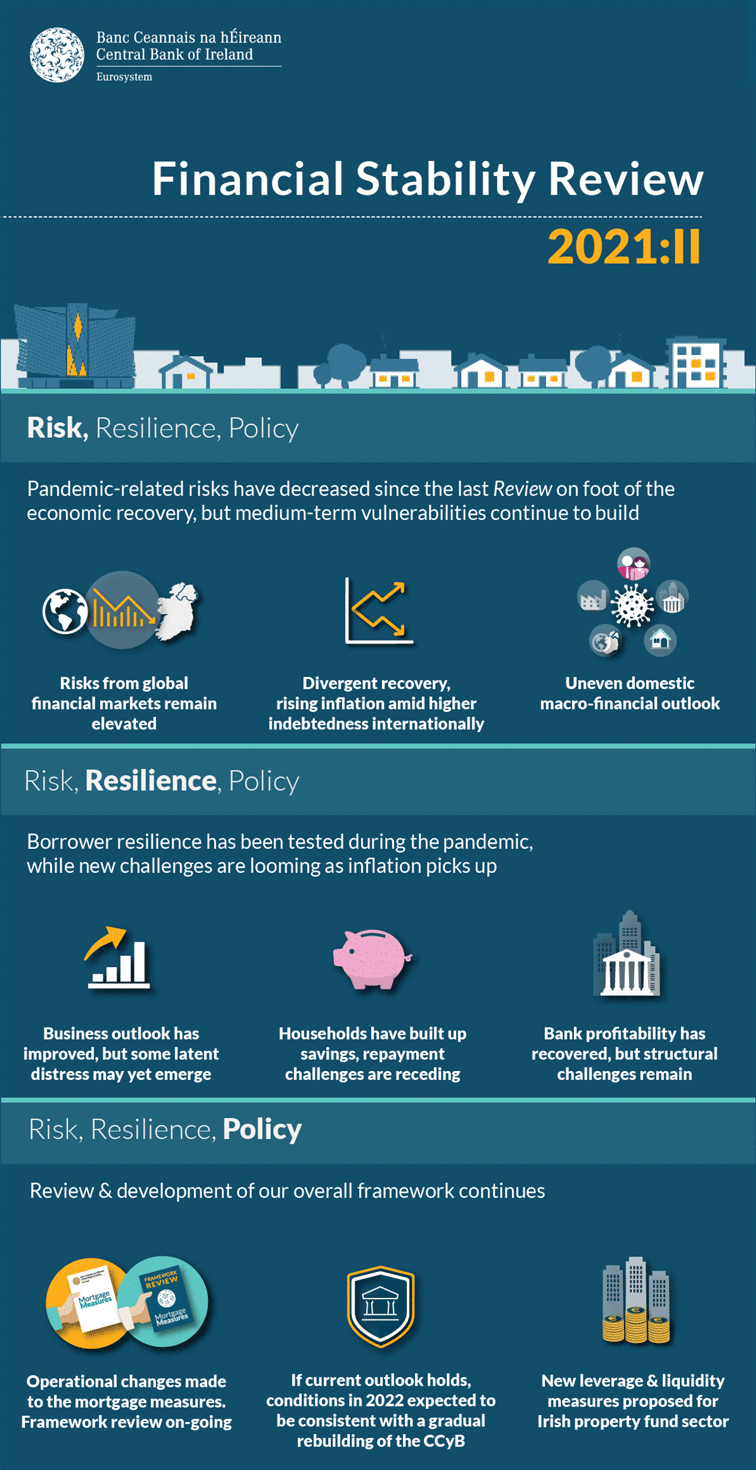

Financial Stability Review 2021 II

The economic recovery has continued since the last Review, reducing some of the near-term risks stemming from the pandemic shock. At the same time, medium-term vulnerabilities, such as those stemming from stretched asset valuations in financial markets and higher levels of global indebtedness, have continued to build, while – in the real economy – supply chain disruptions and sectoral capacity constraints have led to growing price pressures. The impact of the pandemic on the financial position of the banking sector has started to dissipate, with the sector returning to profitability. If the current outlook for economic growth continues to hold, the Central Bank expects to begin the rebuilding of cyclical macroprudential capital buffers during 2022. In parallel, reflecting the evolving links between the financial sector and the domestic economy, the Central Bank's macroprudential framework is broadening to safeguard resilience in the non-bank financial sector, enabling the wider financial system to absorb – rather than amplify – adverse shocks.

Financial Stability Review 2021: II | pdf 2478 KB

FSR 2021 II - Risk Chartpack | xls 759 KB

FSR 2021 II - Resilience Chartpack | xls 985 KB

FSR 2021 II - Policy Chartpack | xls 264 KB

FSR 2021 II - Box Chartpack | xls 243 KB

FSR 2021 II - Risk Chartpack | xls 759 KB

FSR 2021 II - Resilience Chartpack | xls 985 KB

FSR 2021 II - Policy Chartpack | xls 264 KB

FSR 2021 II - Box Chartpack | xls 243 KB

See also: