Frontier Statistics: Mortgage Interest Rate Distributions (March 2025)

Background

Interest rates on Principal-Dwelling Home (PDH) mortgage loans can vary widely between borrowers and lenders. These differences are not captured fully by the weighted averages published in official statistics. In order to provide greater insight into the Irish mortgage interest rate environment than is provided by official statistics alone, Central Bank of Ireland is publishing full PDH mortgage interest rate distributions for loans held by three entity types: banks, lending non-banks, and non-lending non-banks. Lending non-banks are non-bank entities that originate their own mortgage lending, while non-lending non-banks are the non-bank entities that hold residential mortgage loans, but do not originate mortgages themselves (i.e. they hold or service loans that were purchased from originating institutions).

Key Observations

- Non-lending non-banks hold a higher concentration of mortgage loans at the low end of the distribution than lending non-banks or banks, but also have the highest median interest rate, at 4.15 % (4.5% in December 2024).

- The median interest rate on bank-held mortgages at end-March 2025 was 3.75% (3.95% in December 2024).

- The median interest rate on mortgages held by lending non-banks was 3.65% (3.5% in December 2024).

- At end-March 2025, 99% of bank-held mortgages, 92% of lending non-bank held mortgages, and 68% of non-lending non-bank held mortgages had interest rates less than or equal to 5%.

- Nearly all bank-held and lending non-bank held mortgages and 98% of non-lending non-bank held mortgages had interest rates at or below 8% at end-March 2025.

This Frontier Statistics release page is updated with new data periodically. Historical data can be accessed in the data file at the end of this page.

Cumulative Distributions

Table 1: Cumulative Distribution by Institution Type, March 2025

| Interest Rate Bucket | Bank (%) | Lending non-bank (%) | Non-lending non-bank (%) |

|---|

| ≤ 0.5 | 1.07 | 0.36 | 13.23 |

|---|

| ≤ 1.0 | 1.08 | 0.36 | 13.47 |

|---|

| ≤ 1.5 | 1.08 | 0.36 | 14.10 |

|---|

| ≤ 2.0 | 1.37 | 7.1 | 14.63 |

|---|

| ≤ 2.5 | 12.21 | 21.00 | 15.10 |

|---|

| ≤ 3.0 | 23.60 | 36.82 | 18.23 |

|---|

| ≤ 3.5 | 40.28 | 46.41 | 26.10 |

|---|

| ≤ 4.0 | 68.05 | 70.36 | 47.87 |

|---|

| ≤ 4.5 | 89.94 | 84.82 | 64.83 |

|---|

| ≤ 5.0 | 99.22 | 91.59 | 67.99 |

|---|

| ≤ 5.5 | 99.75 | 96.85 | 71.21 |

|---|

| ≤ 6.0 | 99.90 | 99.26 | 73.71 |

|---|

| ≤ 6.5 | 99.94 | 99.86 | 79.67 |

|---|

| ≤ 7.0 | 99.95 | 99.99 | 84.68 |

|---|

| ≤ 7.5 | 99.96 | 100.00 | 88.28 |

|---|

| ≤ 8.0 | 99.96 | 100.00 | 97.69 |

|---|

| ≤ 8.5 | 99.96 | 100.00 | 98.89 |

|---|

| ≤ 9.0 | 99.97 | 100.00 | 99.43 |

|---|

| > 9.0 | 100.00 | 100.00 | 100.00 |

|---|

Source: Central Credit Register and author calculations.

Note: Table 1 compares the cumulative distributions of the interest rates on loans held by banks, lending non-banks, and non-lending non-banks as of March 2025.

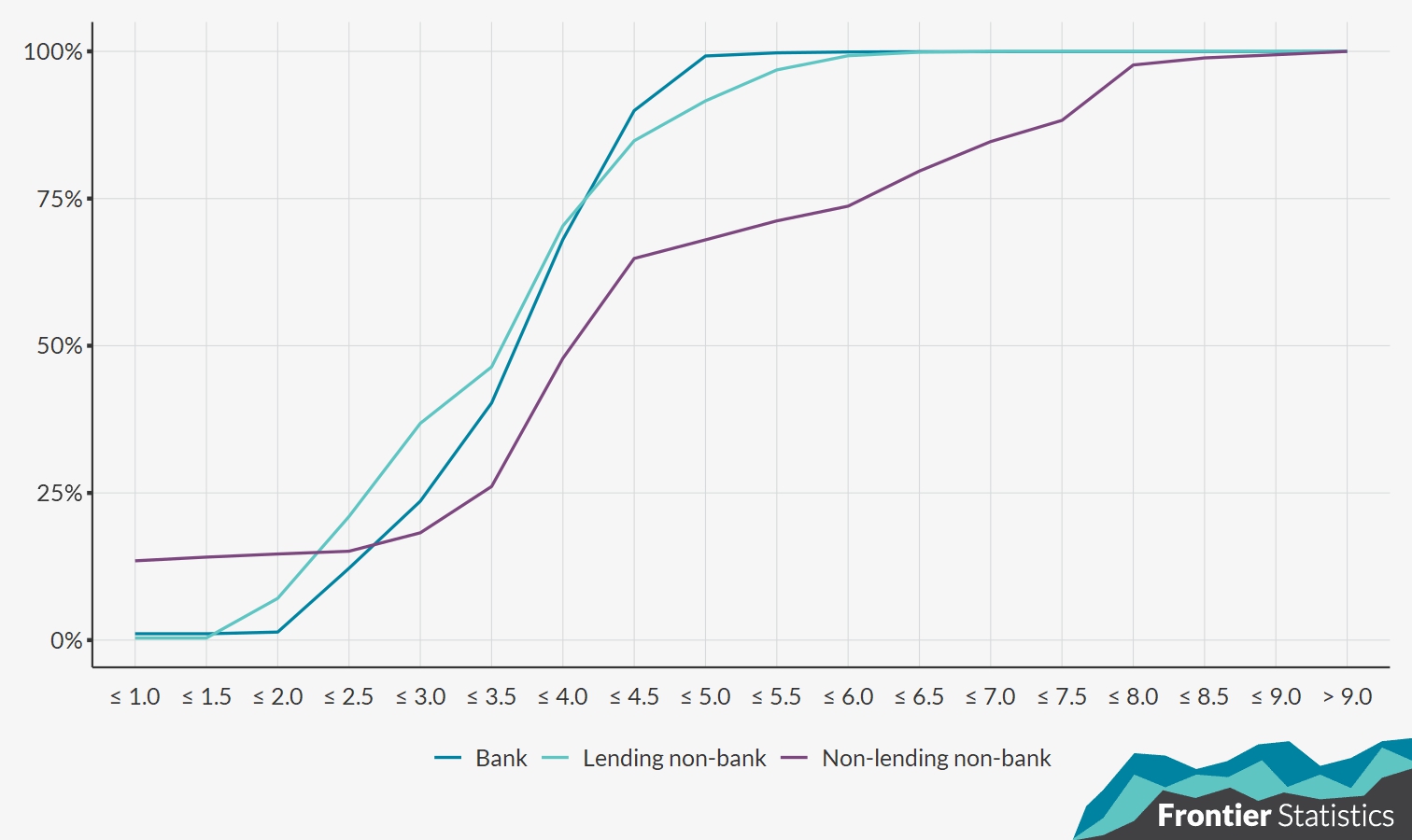

Chart 1 compares the cumulative distributions of mortgage interest rates at end-March 2025 for banks and non-banks, which are further split into lending non-banks and non-lending non-banks. Each cumulative distribution shows the proportion of loans held by each entity type, which have interest rates less than or equal to a given rate.

Intervals where the curves are steeper are interest rate ranges where loans are more highly concentrated.

At the end of Q1 2025, loans held by all three entity types had interest rates highly concentrated above 3.5% and up to 4.5%, though interest rates on loans held by non-lending non-banks were more evenly spread, with less concentration at any particular interest rate interval than those held banks and lending non-banks.

The distribution of mortgage interest rates varies by institution type

Chart 1: Cumulative Distributions by Entity Type, March 2025

Source: Central Credit Register and author calculations

Note: Chart 1 compares the cumulative distributions of interest rates on loans held by banks, lending non-banks, and non-lending non-banks.

Accessibility: Get the data in accessible format (XLSX 12.6KB)

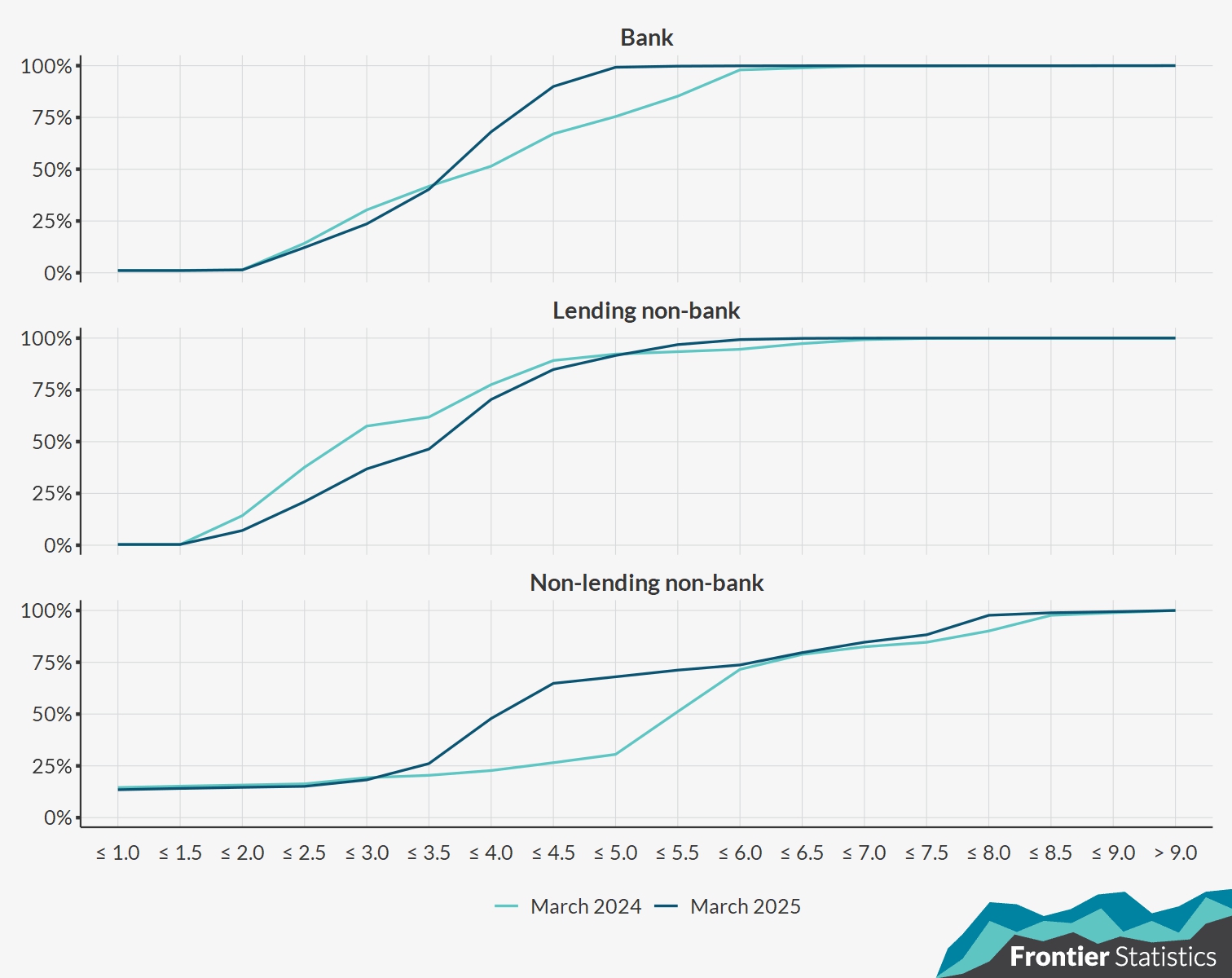

Between March 2024 and March 2025, interest rates on PDH mortgage loans held by non-lending non-banks and banks decreased at interest rates around the median, where loans are more highly concentrated. In March 2024, 51% of bank-held mortgages had interest rates below 4%. In March 2025, 68% of bank-held mortgages had interest rates below 4%. For non-lending non-banks, 25% of mortgages had interest rates below 4% in March 2024, while 48% had interest rates below 4% in March 2025. There was less movement in interest rates on lending non-bank held mortgage across the distribution between March 2024 and 2025 (Chart 2).

Interest rates shifted more over the previous year on mortgages held by bank and non-lending non-banks than for lending non-banks

Chart 2: Change in Mortgage Interest Rate Distributions, March 2024 -March 2025

Source: Central Credit Register and author calculations.

Note: Chart 1 compares the cumulative distributions of interest rates on loans held by banks, lending non-banks, and non-lending non-banks.

Accessibility: Get the data in accessible format. (XLSX 13.22KB)

Mortgage Interest Rate Percentiles

Table 2: Mortgage Interest Rate Percentiles, March 2025

| Percentile | Bank (%) | Lending non-bank (%) | Non-lending non-bank (%) |

|---|

| 10 | 2.42 | 2.29 | 0.00 |

|---|

| 20 | 2.90 | 2.50 | 3.15 |

|---|

| 30 | 3.20 | 2.65 | 3.65 |

|---|

| 40 | 3.50 | 3.45 | 3.90 |

|---|

| 50 | 3.75 | 3.65 | 4.15 |

|---|

| 60 | 3.90 | 3.80 | 4.40 |

|---|

| 70 | 4.05 | 3.98 | 5.20 |

|---|

| 80 | 4.21 | 4.15 | 6.55 |

|---|

| 90 | 4.52 | 4.75 | 7.65 |

|---|

Source: Central Credit Register and author calculations.

Note: Table 2 presents the distribution of interest rates on PDH mortgages by decile, broken down by entity type.

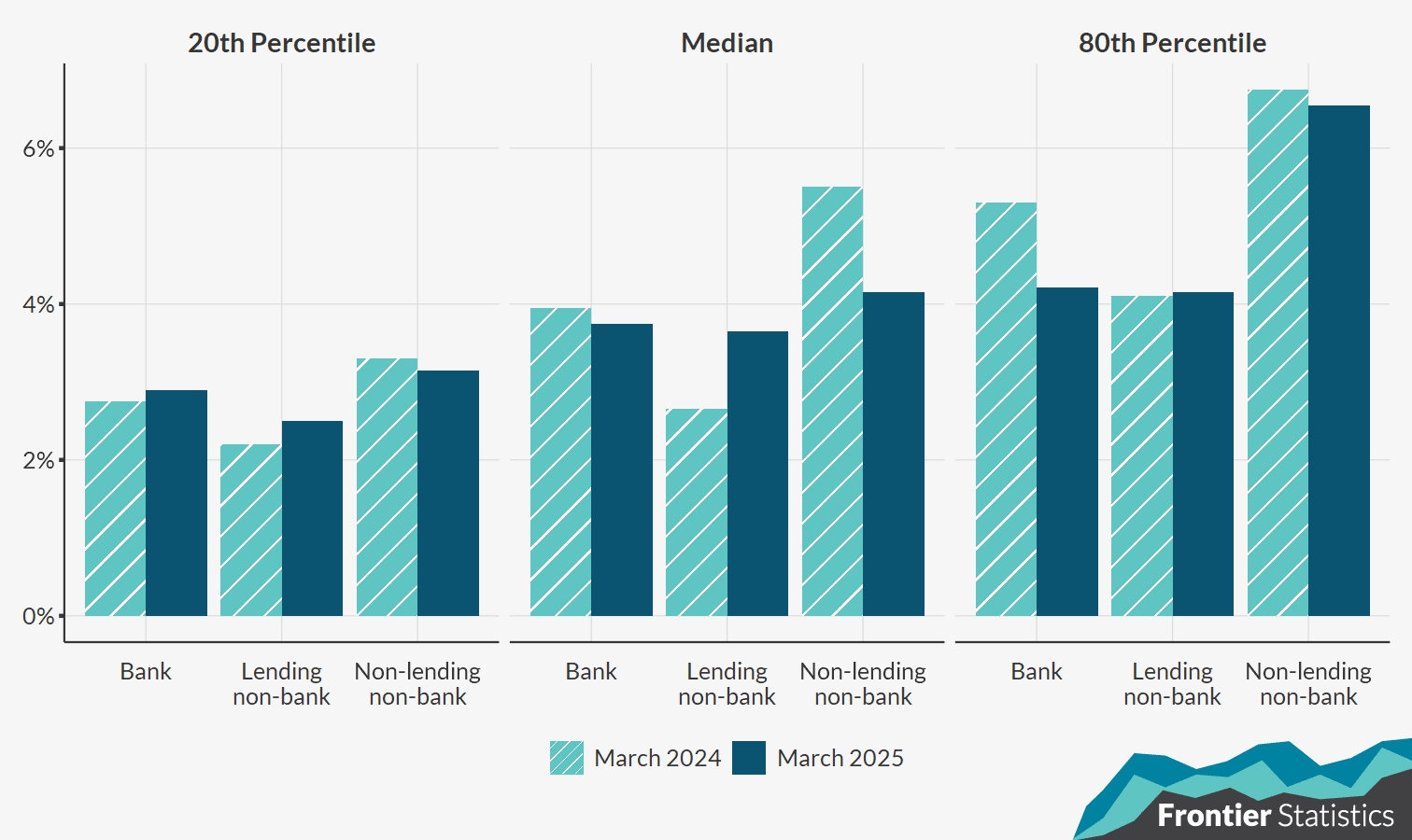

As of March 2025, non-lending non-banks have the highest median interest rate on mortgage loans, at 4.15%, while lending non-banks have the lowest, at 3.65%, separated by 50 basis points (Chart 3). Since at least June 2023, this is the lowest difference between the highest and lowest median interest rates between the three entity types. The gap has decreased from 290 basis points to 50 basis points since end-2023.

The median interest rate on non-lending non-bank held mortgages fell by 135 basis points between March 2024 and March 2025

Chart 3: Change in mortgage interest rates between March 2024 and March 2025

Source: Central Credit Register and author calculations.

Note: Chart 3 shows the 20th, median, and 80th percentiles of interest rates on outstanding Principal-Dwelling Home (PDH) mortgage loans, broken down into loans held by banks, lending non-banks, and non-lending non-banks.

Accessibility: Get the data in accessible format. (CSV 8.03KB)

Background

The Mortgage Interest Rate Distributions Frontier Statistics publication presents data on the distribution of Principal-Dwelling Home (PDH) mortgage loans broken down by the type of entity that holds the loans.

Mortgage interest rate distribution figures are compiled using data from the Central Credit Register (CCR), a database containing records of loans and loan applications of over €500 borrowed by Irish residents or governed by Irish law. The CCR is established by the Central Bank of Ireland under the Credit Reporting Act 2013 as amended. As such, lenders are required to submit information on loans to the CCR.

Coverage and Scope

The lenders included in this publication, and defined in the CCR, are regulated financial service providers (i.e. banks and credit unions). Irish-resident lenders and lenders in the EEA regulated by other agencies are included in the CCR. This publication also includes non-banks—non-regulated Irish-resident companies which are lenders or holders of mortgage loans. Data for all entity types in this publication comes from the CCR.

Data Checks and Revisions

As part of the Frontier Statistics series, the Mortgage Interest Rate Distributions publication will undergo continuous revisions each quarter, and the data and methodology are subject to change. CCR data are subject to change, and therefore analysis will be repeated each quarter to ensure the timeliest data is included.

Data quality checks have been carried out by comparing the data underlying the Mortgage Interest Rate Distributions publication with Central Bank of Ireland Official Statistics data sets, most notably the Mortgage Arrears data set.

Definitions

Bank: Licenced credit institutions as published on our Registers. In this publication, credit unions are considered banks.

Borrower: In this publication, borrowers are defined as the debtors on Principal-Dwelling Home (PDH) mortgage loans.

Central Credit Register (CCR): A database of loans of €500 or more borrowed by a person living in the Irish State at the time of applying for the loan, or borrowed via a loan agreement/application which is governed by Irish law. The CCR was set up in 2013 by the Central Bank of Ireland under the Credit Reporting Act 2013 (as amended). Lenders submit information on existing loans and loan applications to the CCR.

Cumulative distribution: The cumulative distribution of mortgage loans shows the proportion of loans less than or equal to a given interest rate.

Non-bank: Lenders or holders of mortgage loans which are not banks, credit unions, or government-sponsored entities. This category includes retail credit firms and credit servicing firms.

Lending non-bank: Lending non-banks are the subset of non-banks which originate PDH mortgage lending.

Non-lending non-bank: Non-lending non-banks are the subset of non-banks which hold PDH mortgage loans, but do not originate lending themselves.

Related Publications