Credit Unions

Introduction, Functions & Vision of the Registry of Credit Unions

A credit union is a financial co-operative formed for the promotion of thrift among its members by:

- the accumulation of their savings

- the creation of sources of credit for the mutual benefit of its members at a fair and reasonable rate of interest

- the use and control of members` savings for their mutual benefit.

The Registry of Credit Unions (RCU) is the Division within the Central Bank which is responsible for the registration, regulation and supervision of credit unions. In recognition of the unique nature of credit unions, a statutory position of Registrar of Credit Unions was explicitly created within the Central Bank of Ireland with responsibility for the regulation and supervision of credit unions.

Under Section 84 of the Credit Union Act 1997, (" the 1997 Act") the functions of the Central Bank are to administer the system of regulation and supervision of credit unions with a view to the:

- Protection by each credit union of the funds of its members; and

- Maintenance of the financial stability and well-being of credit unions generally.

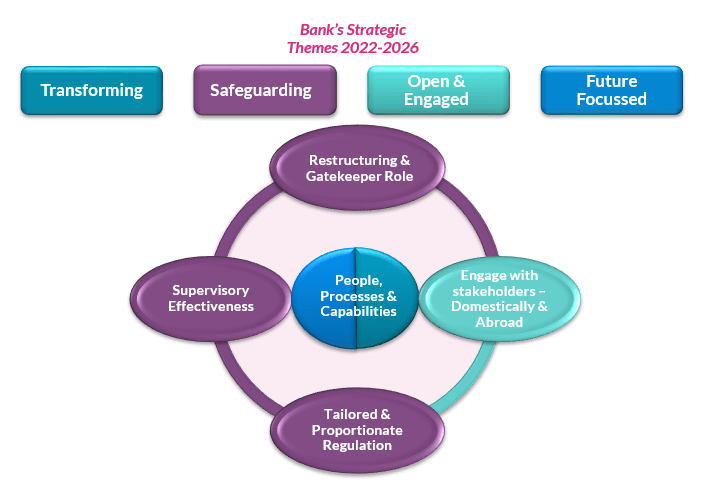

RCU`s aim is to promote a financially stable credit union sector that operates in a transparent and fair manner and safeguards its members` funds. RCU’s vision for “Strong Credit Unions in Safe Hands” is supported by four key strategic priorities which are aligned to the Central Bank’s Strategic Themes 2022-2026, delivery of which will be supported by our People, Processes and Capabilities.

Legal & Regulatory Framework

There is an extensive legal and regulatory framework in place for the Irish credit union sector. The following are the main items of legislation and regulations relevant to the regulation and supervision of credit unions:

- Central Bank Act, 1942;

- Credit Union Act, 1997;

- Central Bank Reform Act, 2010;

- Central Bank and Credit Institutions (Resolution) Act, 2011;

- Credit Union and Co-operation with Overseas Regulators Act, 2012;

- Central Bank (Supervision and Enforcement) Act, 2013; and

- Credit Union Act 1997 (Regulatory Requirements) Regulations 2016.

The Credit Union Handbook has been developed to assist credit unions by bringing together in one place the legal and regulatory requirements and guidance that apply to credit unions, arising from their authorisation as credit unions. The handbook can be found here.

Consultation Protocol

The Central Bank is committed to having clear, open and transparent engagement with stakeholders in fulfilling its financial regulation and supervisory objectives.

This Consultation Protocol for Credit Unions sets out how the Central Bank consults formally with credit unions, their representative bodies and other relevant stakeholders prior to the introduction of new regulations for credit unions. In addition to formal consultation, the Consultation Protocol sets out that the Central Bank may engage informally with credit unions, their representative bodies and other relevant stakeholders.