Mortgage Measures Framework Review

Transcript of the video "Mortgage Measures Framework Review - Update October 2022".

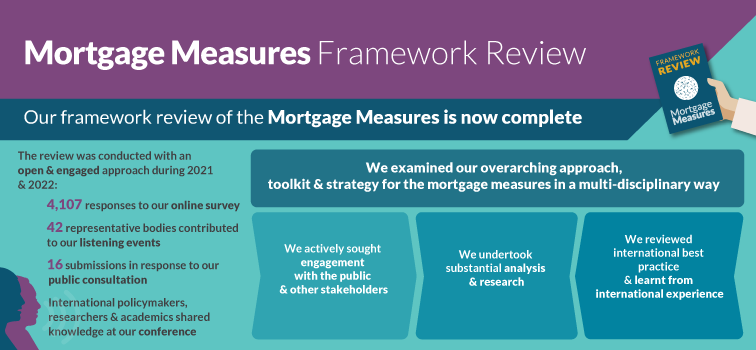

Over the course of 2021/22, Central Bank of Ireland conducted a comprehensive review of the overall mortgage measures framework.

The purpose of this overarching review was to ensure the measures remained fit for purpose, in light of changes to our financial system and economy since they were first introduced in 2015.

The Central Bank has set out the conclusion of its review in its framework for the macroprudential mortgage measures.

Key outcomes of the review

The Central Bank’s mortgage measures framework review has re-affirmed the benefits of the mortgage measures. Since 2015, the measures have strengthened the resilience of borrowers, lenders and the economy overall. By guarding against very high levels of indebtedness and unsustainable lending in the housing market, the economy as a whole is in a better position to withstand adverse shocks than in the past, including shocks stemming from interest rate increases or cost of living pressures.

The Central Bank assesses that the economic costs of the measures have increased since 2015, primarily arising due to structural developments that have led to persistently higher house prices relative to household incomes. As a result, the Central Bank reached the judgement that targeted changes were appropriate to re-balance the benefits and costs of the calibration of the measures and to ensure they remain fit for purpose into the future.

The changes to the measures will come into effect on 1 January 2023, from which point the calibration of the mortgage measures will be:

– The LTI limit for first-time buyers *(FTB) is being increased from 3.5 to 4 times income.

– No changes are being made to the FTB LTV limit which remains at 90 per cent.

– The LTI limit for second and subsequent buyers (SSB) will remain at 3.5 times income.

– The LTV limit for SSBs is being changed from 80 per cent to 90 per cent.

– No changes are being made to the mortgage measures relating to buy-to-let (BTL) lending where a 70% LTV limit will continue to apply.

The proportion of lending allowed above the limits will now apply at the level of the borrower type (e.g. FTB) rather than the individual limit (e.g. FTB LTI).

– 15 per cent of FTB lending can take place above the limits.

– 15 per cent of SSB lending can to take place above the limits.

– 10 per cent of BTL lending can take place above the limits.

Mortgage Measures at a glance ...

First-time buyer criteria

The Central Bank is also making a number of changes to the criteria required for a borrower to be considered a FTB for the purposes of the mortgage measures.

– From a “fresh start” perspective, borrowers who are divorced or separated or have undergone bankruptcy or insolvency may be considered FTBs for the mortgage measures (where they no longer have an interest in the previous property).

– FTBs who get a top-up loan or re-mortgage with an increase in the principal may be considered FTBs, provided the property remains their primary home.

These changes, acknowledge the feedback received by the Central Bank through the listening and engagement events held over the course of the review and look to reflect the society we live in.

For more on these changes read: Mortgage Measures – Frequently Asked Questions

Speaking on the outcome of the Mortgage Measures Framework Review, Vasileios Madouros, Director of Financial Stability said: “Our review has re-affirmed the benefits of the measures, through fostering a more sustainable mortgage market. Overall, we judged that a targeted recalibration of the measures was appropriate. This eases some of the costs of the measures, especially for FTBs, without compromising the benefits of the measures.”

The conclusions of the review have been informed by the Central Bank’s analysis based on a wide range of evidence, lessons from international experience and the feedback received through engagement with the public and other stakeholders.

Public & Stakeholder Feedback

Listening to the public was one of the key elements of our review. In July 2021 we conducted an online survey alongside a series of listening events where we asked the public and other stakeholders to share views and experiences on the functioning of the mortgage measures, as well as perspectives on what a sustainable mortgage market looks like. The online survey elicited 4,107 responses while 42 representative bodies took part in the listening events. This engagement showed strong support for having some form of measures to ensure sustainable mortgage lending standards in place in Ireland. The following reports provide summaries of the rich and valuable feedback we have received – all of which helped inform the outcome of our review.

On 17 December 2021, the Central Bank published Consultation Paper 146 – Mortgage Measures Framework Review (CP146). The closing date for responses was 16 March 2022 and 16 responses were received. The feedback received informed the final conclusions on the design of the framework.

Summary Report – Mortgage Measures Framework Review Listening and Engagement Events | pdf 637 KB

Mortgage Measures Framework Review – Detailed Results of the Online Public Engagement Survey | pdf 2867 KB

CP146 – Mortgage Measures Framework Review

International conference on macroprudential mortgage measures

On 26 - 27 April the Central Bank held a conference "Macroprudential mortgage measures: lessons on design, implementation and effectiveness." The event facilitated the coming together of academics, policymakers and researchers to share perspectives, learnings and expertise on many elements of macroprudential frameworks and was therefore highly valuable for the Central Bank’s work on the mortgage measures framework review.

Summary Report on Conference - Macroprudential mortgage measures: lessons on design, implementation and effectiveness | pdf 494 KB

Aikman, D., Kelly, R., McCann, F., and Yao, F. (2021). The macroeconomic channels of macroprudential mortgage policies. Central Bank of Ireland, Financial Stability Note, Vol. 2021, No.11.

Arigoni, F., Kennedy, G., and Killeen, N. (2022). Rising construction costs and the residential real estate market in Ireland. Central Bank of Ireland, Financial Stability Note, Vol. 2022, No.12

Arigoni, F., McCann, F., and Yao, F. (2022). Mortgage credit and house prices: evidence to inform macroprudential policy. Central Bank of Ireland, Financial Stability Note, Vol. 2022 No.11.

Gaffney, E. (2022). Loan-to-income limits and mortgage lending outcomes. Central Bank of Ireland Financial Stability Note, Vol. 2022, No.10.

Gaffney, E., and Kingham, C. (2021). Mortgage lending in Ireland during the 2010s. Central Bank of Ireland Financial Stability Note, Vol. 2021, No. 9.

Kelly, J., Kennedy, G., and Lambert, D. (2021). The cost of housing and indebtedness across European and OECD households. Central Bank of Ireland Financial Stability Note, Vol. 2021, No. 10.

See also: