Behind the Data

The Who’s Who of Irish Collateralised Loan Obligations

Barra McCarthy, Tarek Elbay, Pierce Daly and Simone Cima

November 2019

Recent growth in corporate indebtedness has been identified by the European Central Bank, US Federal Reserve, Bank of England and Central Bank of Ireland as a potential financial stability risk. Specifically, they have highlighted the growing size of the market for leveraged loans. These are subprime loans provided to borrowers who already have significant debt, or have a poor or non-existent credit history. A significant portion of leveraged loans are syndicated, which means that there are multiple lenders providing the loan.

One driver of the growth of leveraged loans has been the demand for bonds backed by portfolios of syndicated loans, known as collateralised loan obligations (CLOs). CLOs may amplify the spread of risk throughout the financial system due to uncertainty over who is exposed to them. During periods of market stress, this uncertainty can exacerbate financial institutions’ unwillingness to do business with each other. For this reason, institutions such as the Bank for International Settlements have compared CLOs to collateralised debt obligations, which had a pivotal role in spreading stress through the financial system during the global financial crisis.

Shedding Light on an Opaque Market

Due to the extent and granularity of Central Bank of Ireland’s reporting requirements for securitisation vehicles, including CLOs, our data can shed light on this opaque market.

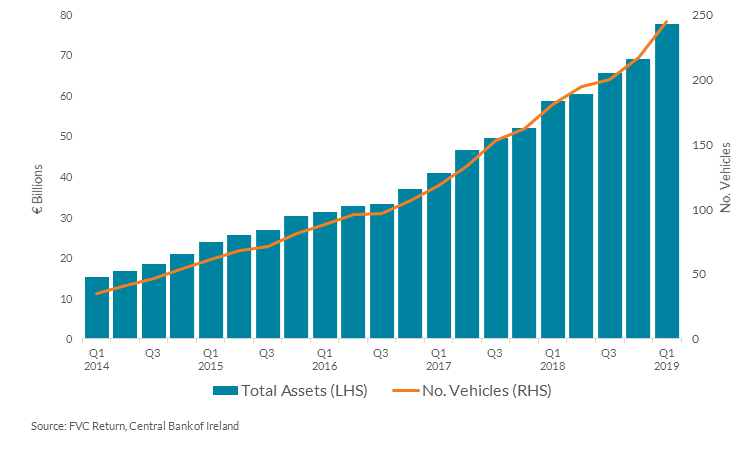

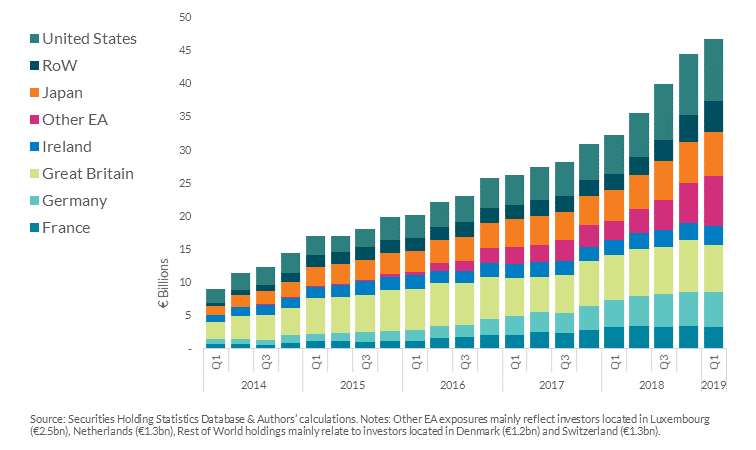

Irish-resident securitisation vehicles are a significant part of the European CLO market. As of March 2019, the outstanding issuance of CLOs by Irish domiciled vehicles stood at €68bn. The total value of outstanding European CLOs was privately estimated at around €100bn in the same period. We think this underestimates the market’s size but, even if the true size of the market was double this figure, Ireland would still account for a large share of the European market. In line with global trends, the assets of Irish CLOs have grown rapidly in recent years, from just €15bn at the start of 2014 to €78bn by March 2019 (see chart 1). While the Central Bank of Ireland collects data from these entities, they are not prudentially regulated by the Bank.

Chart 1: Total CLO assets have grown rapidly since 2014

So, given Ireland’s importance in a European context, it is worth answering the following three key questions surrounding the European CLO market:

- Who is setting up CLO vehicles?

- Who are the borrowers whose loans are being purchased by CLO vehicles?

- Who are the purchasers of the bonds issued by CLO vehicles?

Who is setting up these vehicles?

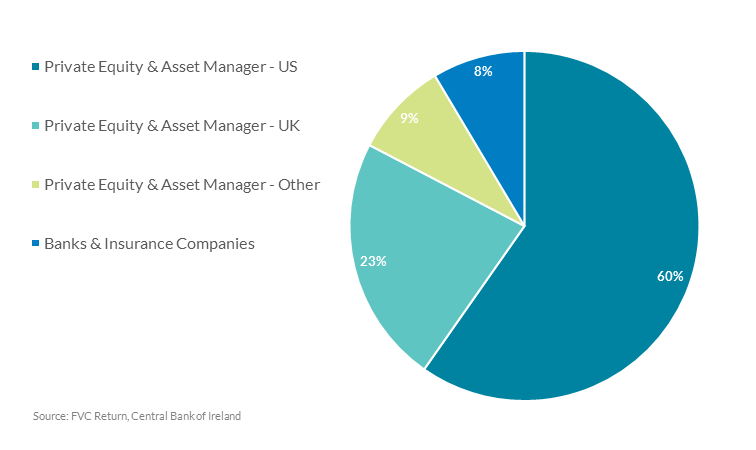

US and UK asset managers and private equity firms are ultimately responsible for setting up the vast majority of Irish-resident CLOs. This is different to other vehicles engaging in similar securitisation activities, which are more often set up by banks and institutions outside the US and UK. Many institutions choose Ireland as a place to securitise assets, and the reasons for doing so are varied (see Shining a Light on Special Purpose Entities for more information).

These institutions, or sponsors, make their money through charging fees for organising the issuance of these bonds, and for managing the loan portfolios backing these bonds once they have been issued. There are no CLOs identified where the ultimate sponsor is based in Ireland, although some sponsors do use Irish subsidiaries to set up and manage these entities.

Chart 2: US and UK institutions set up most CLOs

Who are the Borrowers?

As of March 2019, two thirds of the assets of Irish-resident CLOs consisted of syndicated loans. It is important to point out that while there is substantial overlap, syndicated loans are not necessarily leveraged loans. However, syndicated loans are typically associated with high debt levels on the part of the borrower and higher risk perceptions on the part of the lenders – hence the reason for multiple lenders.

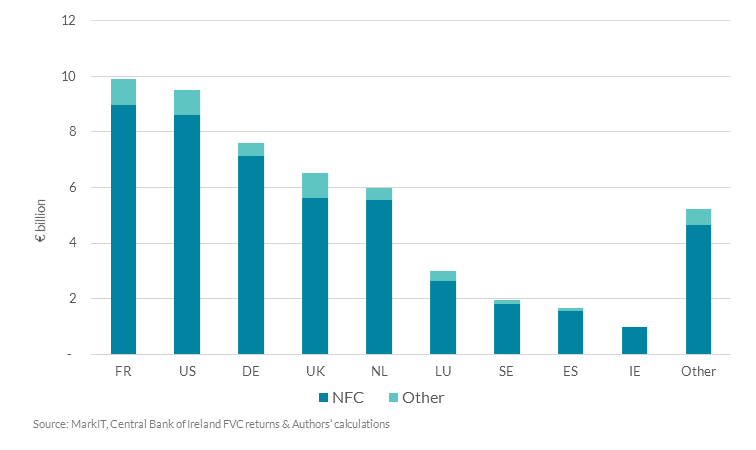

The borrowers for these loans mostly consist of non-financial corporations (NFCs) located in the euro area, the US and the UK (Chart 5), and are almost entirely (~98%) denominated in Euro. The “other category” mainly consists of insurance companies and finance vehicles set up to take loans on behalf of corporate borrowers.

NFC borrowers are mainly in the healthcare, chemicals, computer and electronics, professional services, media and retail sectors. These sectors combined represented over half of the exposure of Irish-resident CLO vehicles at any given time.

Irish borrowers constitute only a minor part of the portfolio (approximately €1.0bn), consisting solely of non-financial corporates. In comparison, Irish banks had approximately €41bn in loans outstanding with Irish NFCs in the same period. There are only a small number of these borrowers, and their syndicated loans mostly relate to their acquisition by another company.

Chart 3: Borrowers whose loans are being securitised are mostly euro area, US and UK

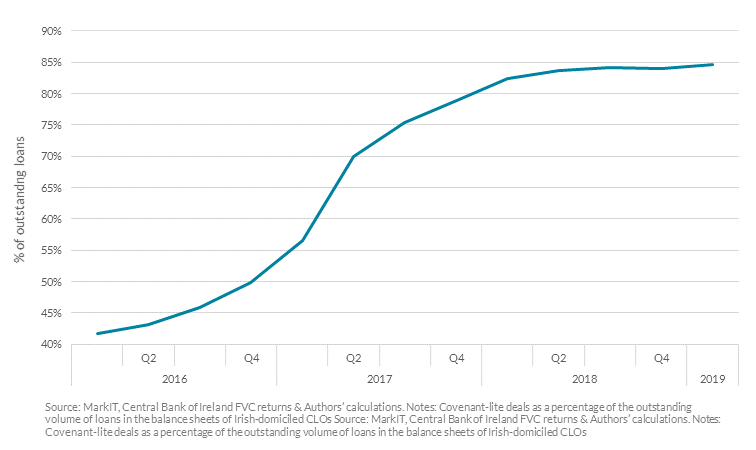

Lending standards for borrowers appear to be weakening over time. Loans with reduced investor/lender protections, known as “cov-lite” loans, constitute 84% of all loans held by Irish-resident CLO vehicles as of Q1 2019 (see Chart 6). This estimate is a lower bound, as we proxy the cov-lite status of a loan by whether the words “cov-lite” appear in its deal name. The predominance of cov-lite loans in Irish vehicles’ portfolios is not an outlier; rather, it is representative of the leveraged loan market.

Chart 4: Share of cov-lite deals has increased rapidly

The remaining assets of these vehicles consist of bonds (€9.3bn) as well as deposits and loan claims (€8.2bn). The bonds are mostly issued by, or on behalf of, NFCs. A significant portion of the deposits and loan claims relate to vehicles that have been funded, but have not yet purchased portfolios of loans. This could indicate pent-up demand from the CLO industry for syndicated loans.

Who is purchasing the CLO Bonds?

To identify who is purchasing CLOs issued by Irish-resident vehicles, we combine the Central Bank’s Financial Vehicle Corporation (FVC) return, which covers all securitisation vehicles resident in Ireland, and the European Securities Holdings Statistics Database (SHSD). CLO vehicles should report any debt securities they issue in the FVC return with ISIN Codes. ISIN codes are unique identifiers for bonds and equity, which can be combined with the SHSD to identify the ultimate holders of CLOs - provided they are held directly or indirectly within the euro area.

Irish CLO vehicles had issued ISIN-coded bonds with a value of €62.8bn as of Q1 2019. The SHSD allows us to identify the ultimate holders of €46.5bn of this debt, with the remainder held by non-euro area investors.

Chart 5: Region of investors in CLOs issued by Irish-domiciled vehicles: Q1 2014 - Q1 2019

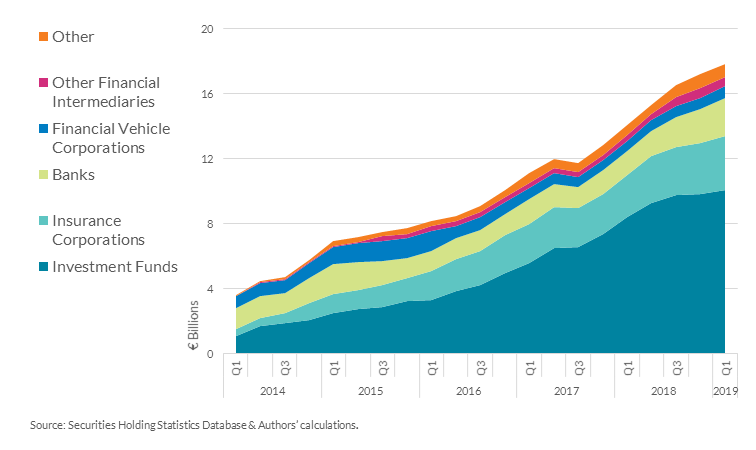

The ultimate holders of this €46.5bn are not geographically concentrated; no country or region holds a majority of issuance. Euro area (EA) investors constitute the largest component, holding approximately €17.8bn of bonds. Within the euro area, holdings are concentrated amongst non-bank investors – investment funds and insurance corporations hold €10.1bn and €3.3bn, respectively, while only €2.3bn is held by banks. Outside of the euro area, other large holders include the US, UK and Japan. Japan holds more than Germany, France or any other EA country.

Chart 6: Investment funds and insurance corporations are the largest euro area investors in Irish CLOs

While understanding who is purchasing CLOs is a first step to understanding how stress can be transmitted through the financial system, information about the riskiness of what is being purchased provides a more complete picture. A bond’s coupon (i.e. the interest that it pays) generally increases with the level of risk associated with it, although it also is determined by its maturity, inflation risk and other factors. Therefore, it can be used as an imperfect proxy of the riskiness of the CLO holdings of different investor groups.

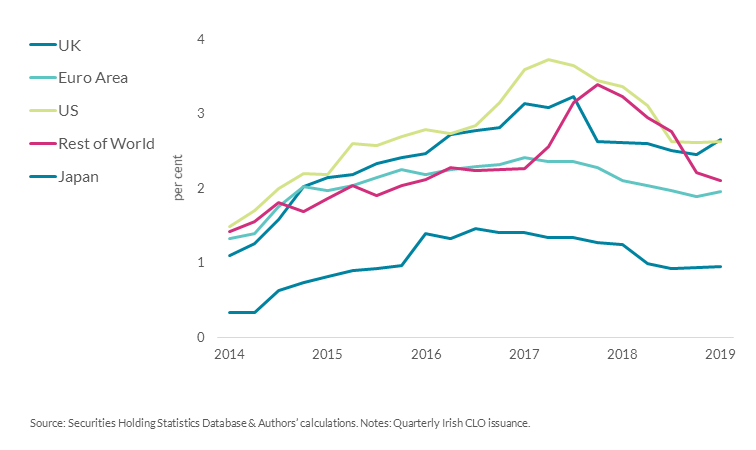

Chart 7: US and UK investors appear to have a greater risk appetite

US and UK investors appear to have a greater appetite for risk than investors from other regions. In Q1 2019, the CLO holdings of US and UK investors both had a weighted average coupon of approximately 2.6 %. In contrast, euro area investors’ holdings had a weighted average coupon of 2.0 %, Japanese investors’ holdings had a weighted average coupon of 1.0 % and the holdings of all other investors (rest of world) had a weighted average coupon of 2.1 %. This ordering amongst different investor regions is a near continuous feature of the series (chart 7).

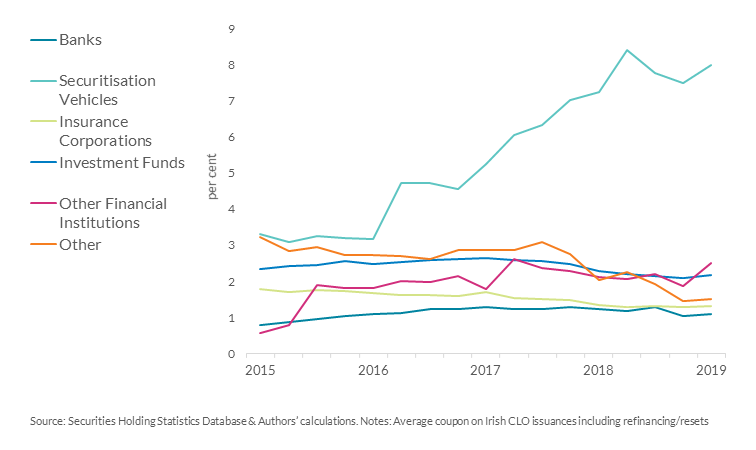

Within the euro area, there is a large and widening spread between the sectors with the highest and lowest weighted average coupons. Banks and insurance corporations have held CLO tranches with the lowest weighted average coupon for most of the series, suggesting they primarily invest in low risk CLO issuances. FVCs have consistently held the tranches of CLOs with the highest weighted average coupon, which could reflect FVC involvement in risk retention or re-securitisation (chart 8).

Chart 8: Other securitisation vehicles are purchasing the riskiest CLOs

Conclusion

Irish CLO vehicles, like most of Ireland’s financial sector, are channels for global finance. They are mainly set up by US and UK asset managers and private equity funds, and securitise the loans of other euro area companies. While euro area non-banks are significant investors in Irish issued CLOs, the majority of these CLOs are held by investors outside of the euro area. Non-bank investors in the UK and US tend to hold the riskiest CLOs issued by Irish-resident FVCs

We have only touched on the financial stability issues in this piece, but future Central Bank of Ireland publications, such as the upcoming Financial Stability Review, will delve deeper into the risks associated with this activity.

See also:

Behind the Data: A New High in Irish Household Wealth: What is Different this Time?