Behind the Data

COVID-19 Payment Breaks – who has needed them?

Allan Kearns, Andrew Campbell, David Duignan, Darren Greaney and Grace McDonnell*

July 2020

New Central Bank data finds that almost 160,000 payment breaks representing €20.1 billion in loans have been granted to borrowers in Ireland during the COVID-19 pandemic

The COVID-19 pandemic has resulted in an unprecedented shock to Ireland’s economy and has left thousands of households and businesses across the country on reduced incomes. In response to the pandemic, financial services firms in Ireland have made payment breaks available to household and business customers. The significant scale of applications for payment breaks, across all major types of loans (including mortgages, personal and business loans), speaks to the unprecedented breadth of the shock triggered by the COVID-19 pandemic

Payment breaks are a postponement of some or all of a borrower’s loan repayments. Such a payment break, when approved by a financial services firm, offers immediate cash flow relief for a defined period. The Bank for International Settlements highlights such payment break programmes need to achieve the provision of “credit to solvent, but cash-strapped borrowers, while keeping in mind the longer-term implications of these measures for the health of banks and national banking systems.”

This “Behind the Data” looks at the distribution of payment breaks across different categories of borrowers, specifically households, small & medium sized enterprises (SMEs) and corporates. High-level data are provided, aggregating across financial services firms; supplemented with additional detail for Irish retail banks’ business borrowers (i.e., SME and corporate borrowers). There is additional context to the data published in this note, namely, the recent Financial Stability Review (Box 5) and “Dear CEO” letters to banks, credit unions and other lenders.

The Data

The figures are provided in a new data collection from Irish retail banks, credit unions and retail credit and credit servicing firms. We refer to this grouping generically as “financial services firms”. The number of payment breaks and the value of loans associated with those payment breaks to households, SMEs and corporates are collected from all financial services firms. Data on approved payment breaks for mortgages is provided, identifying if it is a principal dwelling (PDH) or a buy to let (BTL) loan. For a subset of data, there is high-level information on the Irish or non-Irish residency of the borrower.

The majority of payment breaks for businesses (i.e., non-financial corporations (NFCs), encompassing SME and corporate borrowers, are issued by Irish retail banks. Accordingly, there is additional detail on payment breaks collected from Irish retail banks only. More specifically, the category of economic activity of the firm is noted (i.e., applying the two digit NACE sector classification which is a European classification system for business activities of companies). Financial services firms may offer loan modifications other than COVID-19 payment breaks, but this note focuses on payment breaks only. While these data cover Irish retail banks, credit unions and retail credit and credit servicing firms, there are some firms with an international focus offering payment breaks not included in this sample of firms. The data in this note are at 19th June, with larger credit unions reporting on 25th June.

The Scale of Payment Breaks Across the Financial System

As at late-June 2020, 227,233 payment breaks were granted to households and businesses. This represents €27.1bn of loans. 158,659 breaks representing €20.1 billion in loans have been approved for Irish borrowers. An additional 68,574 payment breaks representing €7 billion in loans have been approved for non-Irish borrowers.

Borrowers from Irish retail banks accounted for 92 per cent of the value of payment breaks. The remainder are spread across credit unions (1 per cent of value), retail credit and credit servicing firms (7 per cent of value). While Irish retail banks report payment breaks across all major types of loans, credit unions and retail credit and credit servicing firms are mainly focussed on households.

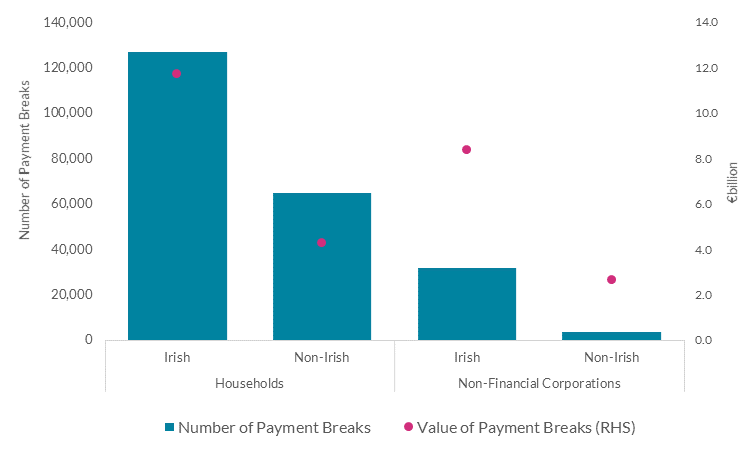

In terms of the value of loans represented by payment breaks, business borrowers account for about 40 per cent and households account for 60 per cent. These aggregate amounts include borrowers who are resident in Ireland and abroad. Irish resident businesses (NFCs) and households account for approximately three quarters of the value of approved payment breaks to all households and NFCs (Chart 1). Payment breaks for non-Irish resident households and businesses are mainly for UK borrowers, covering both households and businesses.

Chart 1. Approved Payment Breaks by Customer Type

Notes: Value of payment breaks relate to the total loan balances outstanding that have received a payment break.

Households

191,555 payment breaks have been approved for household borrowers, representing €16 billion of loans. Almost all of household loans fall into either mortgages or consumer loans. In this context, the number of household payment breaks are split almost evenly across mortgage and consumer lending.

In terms of value, mortgages account for over 90 per cent of household payment breaks at €14.5 billion, representing over 10 per cent of the value of outstanding mortgages (Table 1). Focussing on Irish borrowers, 9.6 per cent of the total value of mortgages have approved payment breaks. Within this group, approved payment breaks for households with principal dwelling mortgages (PDHs) represent 9.7 per cent of the value of outstanding mortgages. The equivalent ratio for buy-to-let (BTL) mortgages is marginally lower at 8.9 per cent.

Consumer loans account for almost half the number of approved household payment breaks but account for less than 10 per cent of the value at €1.3 billion. These payment breaks represent 6.6 per cent of loans to Irish resident consumers (i.e., calculated for Irish Retail Banks and Credit Unions only).

Table 1: Approved Payment Break for Households

Notes: Irish consumer loans only include Irish retail banks and credit unions. Payment break ratio is the total value of payment breaks / total loans and advances.

Non-financial Corporations

There are 35,678 payment breaks approved for business borrowers, representing €11 billion in loans; most of which are to Irish resident businesses. Irish retail banks account for the overwhelming number and value of these payment breaks. On a consolidated basis for Irish and non-Irish borrowers, there are 34,259 or €10.7 billion in payment breaks. The equivalent figures for Irish SME and corporate firms is 30,476 or €8 billion (Table 2).

Accordingly, the rest of the note contains information on Irish retail banks only.

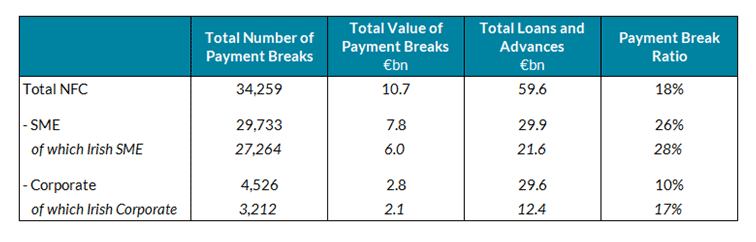

Table 2: Approved Payment Breaks for Non-Financial Corporations (Irish retail banks)

We disaggregate the Irish retail banks’ NFC portfolio into SMEs and larger firms (corporates) and by Irish/non-Irish borrowers. Consolidating across all borrowers, the value of payment breaks represent 26 per cent and 10 per cent of the SME and corporate portfolios respectively. For Irish borrowers specifically, the share of payment breaks on the value of outstanding loans is higher – 28 per cent and 17 per cent of the SME and corporate portfolios respectively.

Small and Medium Sized Enterprises

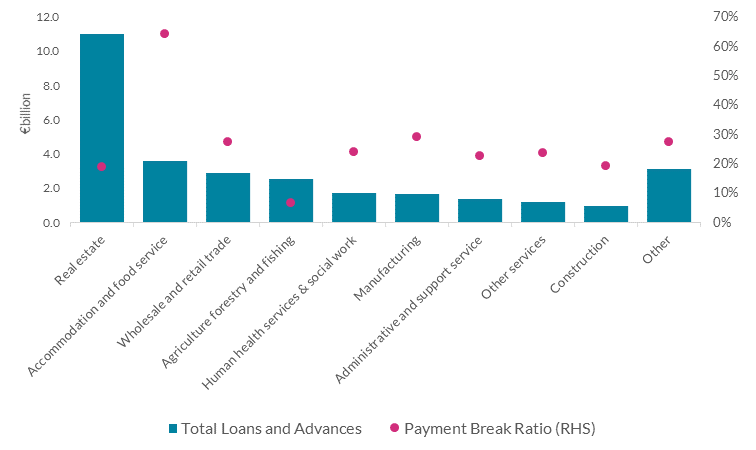

The data show there are payment breaks across all 19 categories of economic activities of SMEs (i.e., by two digit NACE sector), but most of the impact can be traced to the top five sectors in terms of SME loans (Chart 2). These data are consolidated across both Irish and non-Irish borrowers.

The top five sectors in terms of lending (i.e., real estate, accommodation & food services, wholesale & retail trade, agriculture, forestry & fishing, and human health services) account for 72 per cent of all lending to SMEs resident in Ireland or abroad. They account for a similar proportion of the value of payment breaks (73 per cent). Notably, accommodation and food service activities is an outlier with almost two thirds of loans linked to a payment break.

Chart 2. Irish Retail Bank SME Payment Breaks (Total / % portfolio with a payment break)

Notes: Other is an aggregate of sectors where loans are less than €900 million.

Corporate Enterprises

Among larger businesses, the data show there are payment breaks across 17 of the 19 categories of economic activity (two digit NACE sectors).

The top five sectors in terms of overall corporate loans are manufacturing, real estate, wholesale & retail trade, accommodation & food services, and human health services) (Chart 3). These top five sectors collectively account for 59 per of lending to corporates resident in Ireland or abroad, and a higher proportion of the value of payment breaks (71 per cent). Within this grouping of sectors, real estate as well as the accommodation & food service activities report 17 per cent and 22 per cent respectively of the value of loans availing of payment breaks.

Chart 3. Irish Retail Bank Corporate Payment Breaks (Total / % with a payment break)

Notes: Other is an aggregate of sectors where loans are less than €900 million.

Notes: Other is an aggregate of sectors where loans are less than €900 million.

Conclusion

Payment breaks are giving borrowers affected by COVID-19 the opportunity to postpone or substantially reduce their repayments at a time of severe financial stress. It is clear from the significant scale of payment breaks that it has been a very necessary relief for many borrowers to enable them to deal with the immediate shock that they are experiencing. The significant scale of payment breaks speaks to the unprecedented breadth of the shock triggered by COVID-19. These payment break data demonstrate clearly the impact has been widespread covering all categories of borrowers and all sectors of the economy.

The Central Bank is evolving its data collection to support further analysis on payment breaks, including tracking the evolution of these breaks to expiration or for those payment breaks where a return to full capital and interest payments is not possible. The evolution of the aggregate position on payment breaks is uncertain and depends on the evolving public health response, as well as the timing of the recovery. However, the Central Bank is focused on ensuring that all financial services firms appropriately support borrowers in distress. This means financial services firms treating borrowers fairly, consistently and engaging effectively to deliver appropriate and sustainable solutions so as to facilitate as many borrowers as practical can return to repaying their debt in a sustainable way.

*Email [email protected] if you have any comments or questions on this note. Comments from Ed Sibley, Sharon Donnery, Trevor Fitzpatrick, Rory McElligott, Caroline Mehigan, Helena Mitchell, Fergal McCann, Kenneth Devine, Maria Woods, and Mark Channing are gratefully acknowledged. The views expressed in this note are those of the authors and do not necessarily reflect the views of the Central Bank of Ireland or the ESCB/SSM.

See also: