Diversity of Thought - Sylvia Cronin, Director of Insurance Supervision

13 June 2018

Speech

Milliman breakfast briefing

Good morning, ladies and gentlemen. I am very pleased to join you at this event today and I would like to thank Milliman for the kind invitation to speak.

There are many topics I could have spoken on today, but I have chosen to speak specifically on the following four areas:

- The European level review of fitness and probity requirements in financial services;

- Provide some observations and findings relevant to Irish insurance companies;

- Address diversity of thought and the implications for risk culture and governance of Irish insurers; and finally

- Outline the Central Banks plans in this area for the year ahead and highlight what this means for regulated (re)insurance entities.

Also, by sharing with you today some statistics on diversity at the most senior levels in the insurance companies which we regulate, I will conclude that the insurance sector has a significant gap to bridge to address diversity and inclusion in the boardroom. This is both at the executive level and in the pipeline of talent needed to run the organisation.

European level review of fitness and probity requirements in financial services

Developments within the area of fitness and probity requirements in financial services

The critical role of fit and proper requirements is recognised within the financial services sector. The fit and proper requirements, previously a part of national legislation in some countries, are now part of sectoral European Directives that all European Member States must implement in their jurisdictions, subject to their national law. There continues to be ongoing developments in the area of fitness and probity, which will further strengthen the supervisory frameworks and practices within the EEA.

The Financial Stability Board considers that widespread misconduct in the financial services sector may give rise to systemic risk. They developed a toolkit for financial services firms and supervisors entitled “Strengthening Governance Frameworks to Mitigate Misconduct Risk”1

In 2017, the European Insurance and Occupational Pensions Authority (EIOPA), through its Board of Supervisors, initiated a peer review on the assessment of “Propriety of AMSB Members and Qualifying Shareholders”. AMSB members are members of the Administrative, Management and Supervisory Body of an insurance or re-insurance entity. Typically the members include directors of the board, key function holders and qualifying shareholders.

This peer review examined regulatory frameworks and practices across 31 Member States of the European Economic Area (EEA). The Central Bank’s Insurance Directorate led this peer review on behalf of the EIOPA with participation from National Competent Authorities (NCAs) of France, Belgium, Italy, Czech Republic, Slovenia, the Netherlands and EIOPA itself.

The objective of the peer review is to focus on the convergence of supervisory practices in fitness and probity assessments across the EEA.

Observations and findings relevant to Irish insurance companies

Arising from these peer review findings, the Panel made recommendations which should facilitate improvements in supervisory practices across the EEA. I would like to touch on three key recommended improvements. Firstly, in a number of Member States, NCAs are recommended to seek legislative change to strengthen the national regulatory frameworks for their fitness and probity regimes. Secondly, EIOPA recommends an ongoing focus on fitness and probity post the initial approval of individual Pre-Approval Controlled Functions (PCF) applications. NCAs should focus, as an integral part of their supervisory activities, on how fitness and probity requirements are complied with on an ongoing basis. Thirdly, EIOPA recommend measures to strengthen cross border cooperation between NCAs. This peer review is a significant initiative by EIOPA and is expected to raise the bar in terms of standards of supervision of fitness and probity requirements within the EEA. Separately, at home, we continue to review the Irish fitness and probity framework so as to develop and strengthen it. To this end, the Central Bank responded to the Law Reform Commission‘s Issues Paper on Regulatory Enforcement and Corporate Offences2.

As a result of the work by EIOPA and by the Central Bank, you should expect to see a continuing supervisory focus on fitness and probity following the initial PCF approvals by the Central Bank. It is equally important that firms are fully aware of their F&P responsibilities to ensure that all individuals who are performing Controlled Function and Pre-Approval Controlled Function roles within firms comply with the Fitness and Probity Standards. The ultimate objective is to embed a culture of individual responsibility and compliance with the core standards of fitness and probity within all financial services firms; to influence the behaviours of individuals and to protect consumers.

Since the introduction of Solvency II, the Central Bank has assessed over 700 insurance PCF applications. In 2017, the Central Bank was also the first regulator to publish its data on the gender profile of senior roles put through the Bank’s fitness and probity regime.

This year in order to further promote transparency around diversity issues, the Central Bank released statistics broken down by gender, age and country of origin of F&P applications for approval to occupy senior roles within regulated financial service providers. Unchanged from last year, we saw that 78% of applicants to PCF roles in the insurance sector were male, additionally Insurance had one of the lowest proportion of younger applicants (25-34) when compared to other sectors, <5%.3

The Central Bank’s F&P data showed that female applicants account for only 22% of the total IQ applications submitted and that this percentage has remained static since 2015. This illustrates the fact that we still has a significant gap to bridge to address the lack of diversity at the highest level of management in the companies we regulate.

Addressing diversity of thought – the implications for risk culture and governance of Irish insurers

Gender however is only one of many dimensions of diversity. In its broadest sense diversity can be defined as “any attribute which may lead people to the perception that: that person is different from me”4 Others have defined diversity as the “art of thinking independently together”.

In terms of business, “Diversity is not simply a formula or a set of tools and protocols”5 and for that reason some companies are reluctant to embrace a more diverse mix since the exact proportions of optimal diversity is an unknown. However, what we do know from the benefit of hindsight and analysis of the financial crisis, that it was a lack of intellectual diversity at the helm of financial institutions that sowed the seeds for the 2008 financial crisis and it was “this lack of diversity, intellectual and financial” which “contributed significantly to the depth and the severity of the crisis”6 (Haldane, 2016). Despite being ten years past the events of 2008 and despite the regulatory and institutional overhaul, we still encounter the kind of problems which contributed to the financial crisis, such as groupthink, insufficient challenge, poorly assessed risk, and problems with culture – all symptoms of a lack of diversity at the Board and senior management level in many Insurance firms.

I want to focus today on thought diversity and the lack of which can lead to poor decision making.

What comes to the fore in a broad mix of people with different backgrounds, gender, age and skills is diversity of thought.

“Thought diversity allows for differing perspectives on ideas and unique insights into problems. It creates opportunities for innovation, entrepreneurship, and partnerships in unexpected places. It allows you to take a “reality check” before plunging into new activities. Most important, it helps you avoid groupthink.”7

Group think, which is the lack of challenge and independent thought, is a direct symptom of a lack of diversity of thought. Additionally, it is widely acknowledged that a lack of diversity of thought increases the risks of poor decision-making and can have a negative impact on the culture in a business; this in turn increases the risk of poor customer outcomes and can have detrimental consequences on the financial performance of a business.

By having a more diverse senior team and board of directors there is a greater potential that a company will better understand its diverse customer base. A study by Watermark Consulting 8, which analysed the stock market returns for companies that had high customer ratings, indicates that these companies are rewarded for their great customer experience with increased loyalty and higher than average market returns when compared to companies that rate low among customer experience. The business value of great customer experience is that insurance companies were rewarded by both customers and investors. A 2018 update to this study found that the gap of outperformance has widened considerably.

The reality however is that “Boards fail to recruit members who are independent thinkers” 9

If we are to take a look what is happening in the wider global economy – in January 2018, Bloomberg launched its inaugural sector neutral gender equality index, and 104 companies from ten sectors headquartered in 24 countries and regions were included. This index is a useful tool for investors as it provides access to data that measures how companies approach gender equality and helps investors make decisions that are more informed. Interestingly, a number of the companies included on the index have subsidiaries, which are regulated by the Central Bank and a review of the profile of the group board and the local entity board shows a large asymmetry. In that, while the parent company has a diverse board this is not reflected in the board profile here locally, with one notable exception. We need to understand why the local entity does not reflect the group ethos. Why does the diversity stop at the Group Board and not filter down to local entities here? Is this a local culture issue? Or have we simply not put enough pressure on the local Boards to enact change? It is likely that this is the case since we have seen in other jurisdictions, when a large enough push is given and pressure is applied on providing transparency noticeable improvements have been made. It is important also that we create an environment where diversity is valued at all levels of the organisation – including at the very top. This is a critical component in an inclusive culture.

However any initiative in promoting diversity “will fail miserably without a change in attitude and culture”10. Evidence of this prevailing culture in many organisations can be found in comments such as ”We have one woman already on the board, so we’re done”. This and other similar comments were highlighted in the 2017 Hampton-Alexander Review of Gender balance in FTSE Leadership roles.

Culture is a key area of focus for us in supervision, it underpins the work we are continuing to do on diversity. Within the Central Bank’s risk culture assessment model, decision-making is one of the four key pillars, along with Leadership, Governance and Competency. Diversity of thought is a key foundation of good decision-making and this in turn shapes the culture of an organisation.

The OECD defines diversity of the board in the following manner:

“Diversity of thought, experience, knowledge, understanding, perspective and age means that a board is more capable of seeing and understanding risks and coming up with robust solutions to address them. It is about the fundamental principles of good governance”. 11

Where then are we failing to achieve tangible change in the area of diversity? It is a topical issue and while the energy is palpable and results are seen at entry level and middle management positions, there are many disparate initiatives so we need to bring a cohesiveness to the overall effort. In this regard, the Central Bank is uniquely placed in our role as regulator, and has to ensure that there is no place for companies to hide. We need to make it simple and keep the statistics transparent. This is a key driver to ensure that diversity is embedded at the highest level of management in the companies which we regulate. The Central Bank is committed to challenging supervised firms over a lack of diversity at Board and at management level.

So what have we done and what will we do?

The old adage states that “What is not measured cannot be managed” and in this regard, the insurance directorate conducted a Benchmarking study using 2016 data12 to assess the levels of diversity among Executive and Non-executive directors serving on the boards of Irish regulated (Re)Insurance companies. This is the first time that such a study has been performed in the insurance sector in Ireland, and the objective was to see what was the impact of the introduction of the Corporate Governance Code on the levels of diversity at regulated (re)insurance entities. We sent the survey to 70 of the Medium-Low to High impact regulated Insurance Entities. Responding to the survey was on a voluntary basis; however, we received a response rate of 62% to the survey. Interestingly, the impact of gender of the Compliance officer factored in to the response rate with 76% of female compliance officers responding compared to 53% of their male counterparts.

Observations and findings relevant to Irish insurance companies

I would like to share with you today some statistics on this benchmarking exercise. Firstly, it was unique in that most studies available are split by gender, whereas we sought to quantify other aspects of diversity namely, Age, Tenure, Skill set and Geographical Provenance.

First, let us look at Gender, as this is an area where public information is available and there are some studies for comparison.

A recent E&Y study in Ireland found that regarding Board gender composition, 26% of positions were held by females. For the survey carried out by the Central Bank in the Insurance sector the board gender composition shows that only 11% of Board members are Female, (based on information from the sample of companies Medium-Low to High impact entities).

In fact, 53% of companies in the sample population have all male boards. This falls far behind the Banking sector in Ireland and European norms.

Q1 – Age & Gender split of Executive directors:

Largest group is 41 – 50 years of age

Male 83% and female 17%

As the age decrease the percent of females increased

Female CEOs – 13%

European study equivalent 3% female CEOs in financial sector (EWB, 2016)

An interesting observation, from the above statistics is that while the percentage of Women Directors is smaller in the Irish sample, there is a higher proportion of those women holding the CEO role (13% vs 3%) when compared to the percentage of Women CEO’s in the European wide study.

Q2 – Age & Gender split of Non-executive directors:

Largest group is 51 – 60 years of age (m)

Largest group is 61 – 70 years of age (f)

Male 89% and female 11%

No female < 51 years, 14.5% male directors in 30s and 40s range

Female Chairman – 9%

European study equivalent is 7% female Chairman in financial sector (EWB, 2106)

Studies have shown that age diversity of Board members is found to be positively related to internationalization and recent trends have seen a noticeable shift in the age of directors. In a study of new directors added to the largest US companies in 2015, 17% of the new directors are 65 and older, while 16% are 49 or younger 13 . This is indicative of companies tapping into fresh insights in a rapidly changing business environment. The trend is most notable in companies that are engaging Directors with specific Information Technology (IT) experience.

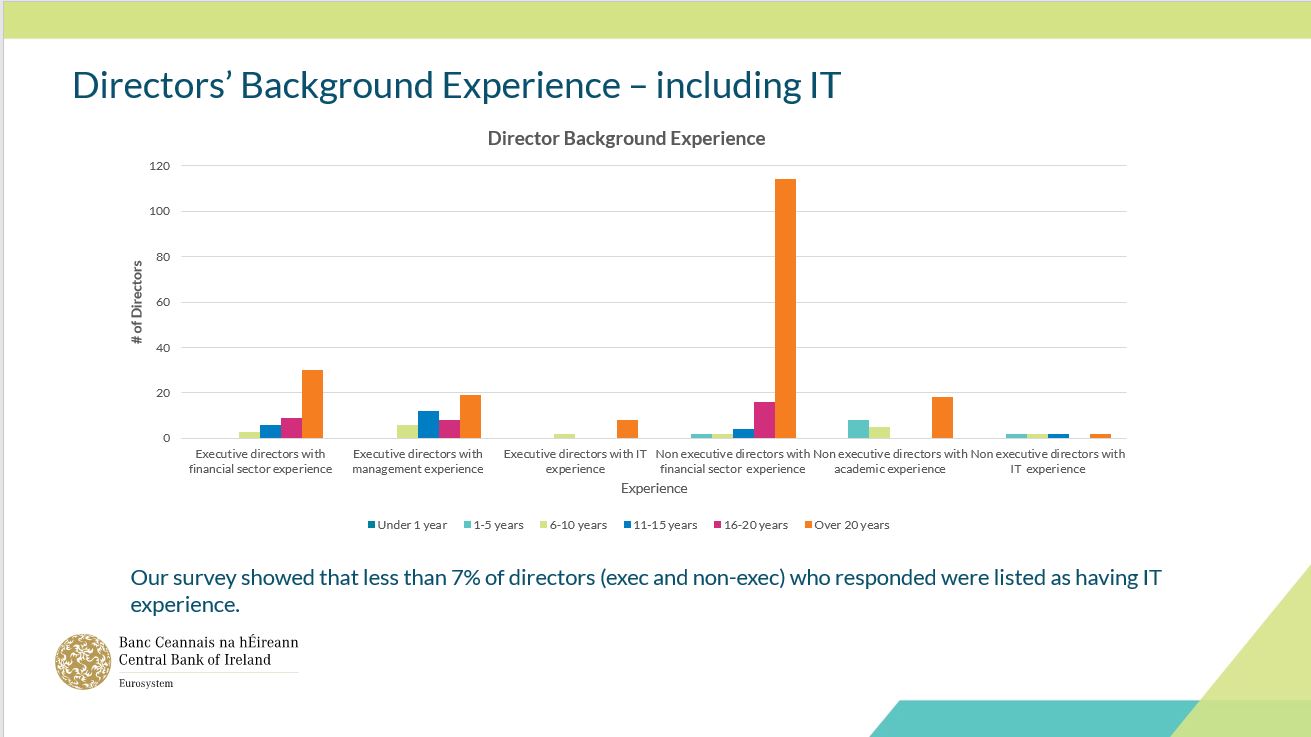

Diversity in skill set is also an asset with IT competence shown as a factor in positively influencing innovation strategies. However, our survey showed that less than 7% of directors (exec and non-exec) who responded were listed as having IT experience.

In Q1 2018, InsureTech deals reached record levels, with investments more than doubling on what was recorded in the same quarter last year 14. The fastest growing general insurance company in the US in 2017 was an InsureTech start-up, recording significant growth in Gross Written Premium. Does your company’s management team have the skills, in particular the skills in technology to address these challenges in the market place? If not, how are you mitigating this risk?

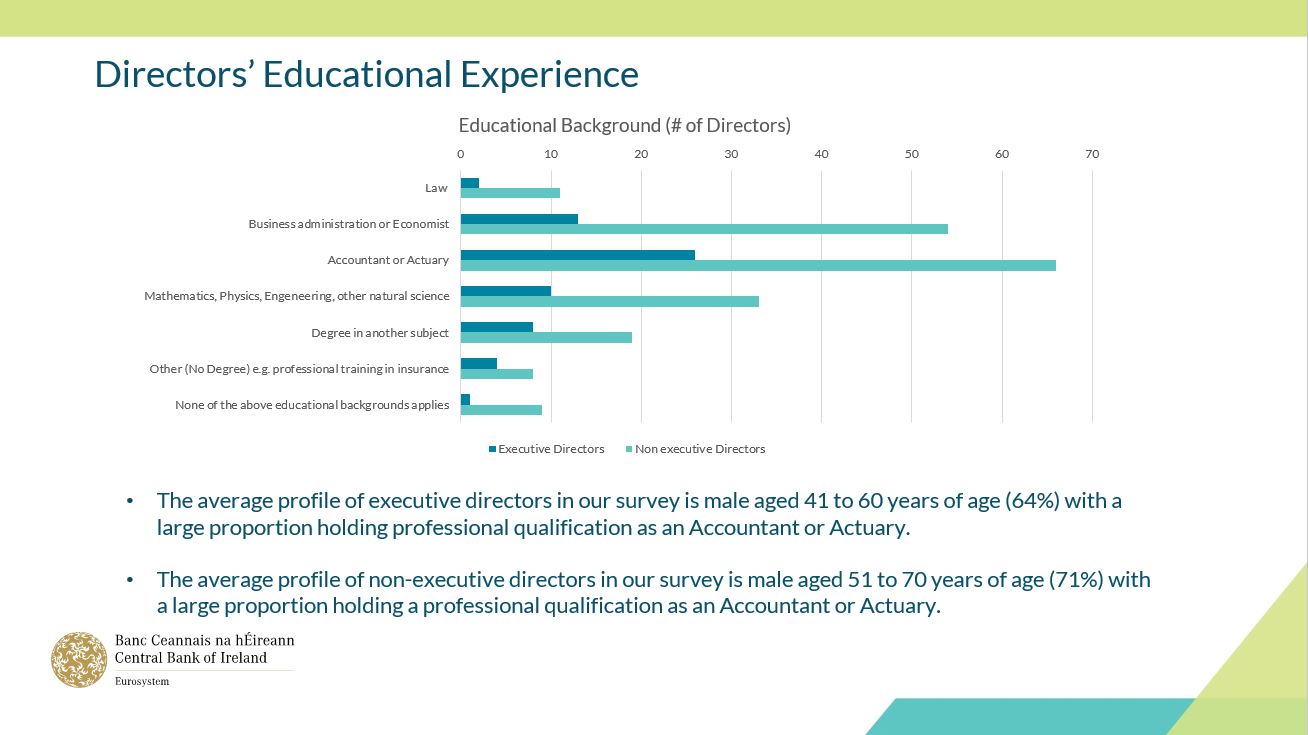

We also captured Educational Background for Directors surveyed:

The data shows that Accountant or actuary are the most common background across both type of directors, which is not surprising for the Insurance sector.

So what does the overall picture of Irish Directors in the Insurance sector look like? Not unexpectedly, the survey paints a fairly homogenous group of individuals with respect to age, gender and skill set.

The average profile of executive directors in our survey is male aged 41 to 60 years of age (64%) with a large proportion holding professional qualification as an Accountant or Actuary.

The average profile of non-executive directors in our survey is male aged 51 to 70 years of age (71%) with a large proportion holding a professional qualification as an Accountant or Actuary.

Despite the low number overall of female directors, the numbers being hired are increasing with the survey showing that from 2010 to 2015 15% of non-executives hired were female, while in 2016 that number rose to 21%.

So, while a small amount of progress has been observed, the above results demonstrate that a lack of diversity in Insurance companies’ senior management exposes the sector to the risks which I outlined earlier. This is a key concern for the Central Bank.

Outlining the Central Bank’s priorities and plans in this area for the year ahead.

Eight years ago, the 2010 Corporate Governance set out the initial requirements for the INED requirements. This means that a large number of the directors serving on the Boards of Irish regulated entities have been in situ for more than eight years, given that a subset of these individuals as INEDS have a nine year maximum term ceiling for independence and that the Central Bank has no appetite to extend the nine year independence requirement. The implications for this is that a large cohort of INEDs will need to be replaced in the next couple of years, indeed we have seen some evidence of this already on the Boards of regulated companies.

This is a salient opportunity for companies to take time on the search for replacements and succession planning is key in this regard. The search criteria for new directors should be re-evaluated. In order to increase diversity of thought companies should consider individuals with deep relevant experience and knowledge, for example in the area of technology.

Additionally, any discriminatory practices in the recruitment of directors and senior managers will come under the scrutiny of the Central Bank. A recent survey by The Institute of Directors has noted that only 19% of directors are appointed through independent recruitment 15. The supervision teams will be reviewing individual companies’ succession plans and challenging PCF holders during the PRISM interviews on the levels of diversity on the Board and in senior management. We will require more transparency from companies in their succession planning process for all PCFs.

It is worth noting that due to the work completed over the recent past in relation to changes to the recruitment policy and process for public Boards in Ireland, the public boards now lead private sector in respect to diversity and inclusion, typically it is the reverse.

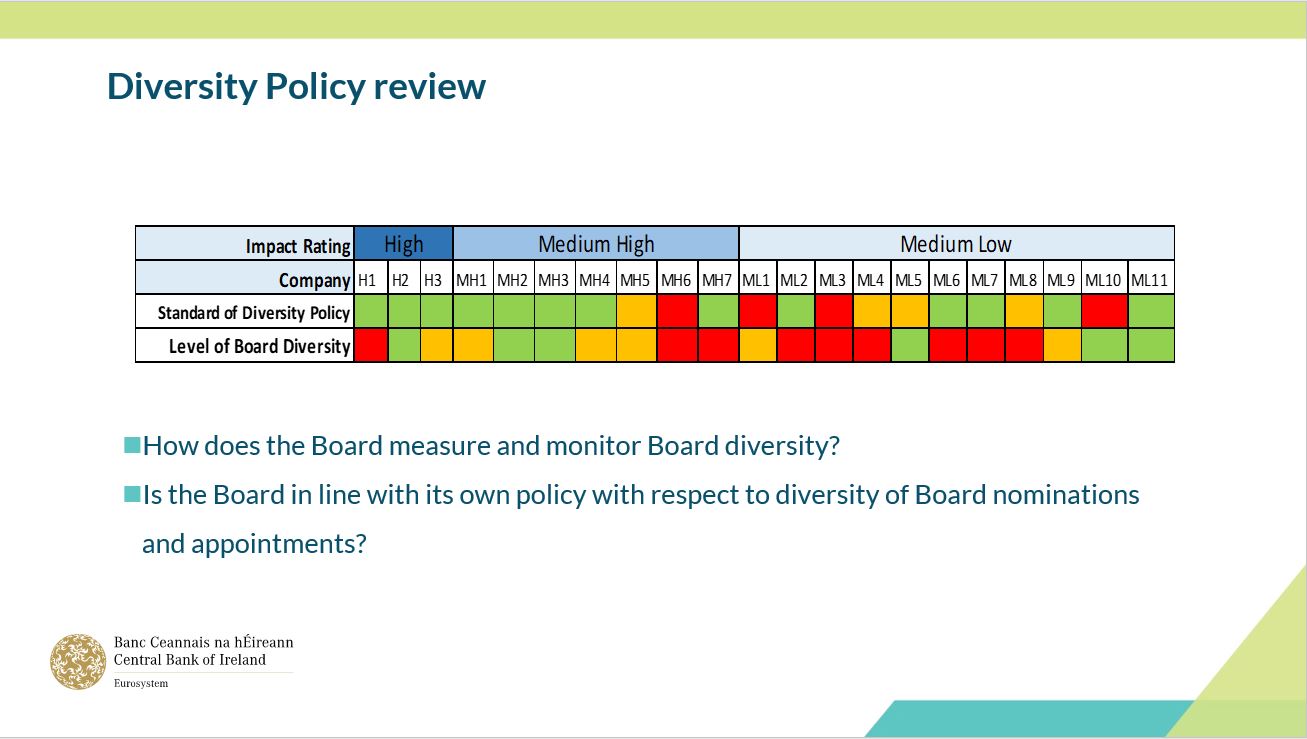

Diversity Policy review

The 2013 Corporate Governance Code introduced the requirement for a Board diversity policy,

‘The Board, or nomination committee where one exists, shall establish a written policy on diversity with regard to selection of persons for nomination to become members of the Board’ (CGC, 2013).

A second component to the 2016 diversity study was the review of the Board diversity policies put in place by regulated (re)insurance entities, and respondents to the survey were asked to provide a copy of their Board diversity policy with the survey response, only 21 companies provided a copy of their Board diversity policy. Our review of these policies showed that few companies have set a target for Board diversity or have a robust process for monitoring and measuring the progress made in meeting these objectives. What is notable though is that all Board diversity policies received call out the benefits of diversity for the organisation as “key success factors”, why then is this not reflected in the Board’s own composition? This is something the Central Bank will be expecting to see.

With respect to setting targets for diversity, most policies just stated that the Board would agree measurable objectives to ensure the diversity target is met, however with such a vague statement it is unclear as to how or if these targets are set. More transparency is required around this process.

So while it is essential that Boards be allowed to determine the mix of diversity, the Central Bank will be expecting that Boards should critically assess if they have been achieving this mix and assessing if firms have been successful. To achieve diversity, Boards should be able to demonstrate that they have held themselves to account by answering the following questions:

1. How does the Board measure and monitor Board diversity?

2. Is the Board in line with its own policy with respect to diversity of Board nominations and appointments?

Implications for roles and responsibilities

Where knowledge drives results – diversity is a key asset.

The Insurance directorate will repeat the survey in 2019 and publicise the results. This time making it mandatory. Why? Because it was evident that the responders to the query were more engaged in diversity than the companies that did not respond. We could easily compare some basic dimensions of diversity (gender, tenure) with existing information on our systems. The comparison showed that all metrics of gender diversity were elevated in the companies that responded, for example, 13% of responders had a female chairperson versus only 4% of non-responders, and likewise female CEOs were in place at 19% of the companies that responded versus 4% of non-respondents.

We also plan to extend the survey to include all senior management (PCFs) and not just the Executive and Non–executive directors.

Another area that is under consideration is how the Corporate Governance Code may need updating to assist with the initiative to move the dial on diversity.

To conclude today on the topic of diversity of thought, this is an area that needs further work, both by the Central Bank and by firms. I would like to leave you with three key messages:

- I would encourage you to meaningfully address diversity and inclusion in the boardroom, at the executive level and the pipeline of talent needed to run the organisation in the long-term, and in doing so avoid the pitfalls of group think and experience the benefits that can be gained;

- Diversity of skill set is a critical ingredient in the diversity of thought needed at all levels of the organisation; and

- Consider who represents the voice of the consumer at the highest levels of your organisation and how this is factored into the decision making process?

I will finish today with this variation on a quote by the author and political commentator, Walter Lippman:

“When great minds think alike no one thinks very much”

I would like to thank Eilish Mattison and Faheem Mirza for their assistance with this speech.

References:

1 http://www.fsb.org/wp-content/uploads/P200418.pdf

Misconduct in some financial institutions has the potential to significantly harm consumers, undermine trust in financial institutions and markets and create systemic risks…. Fines and sanctions act as deterrents to misconduct. Such fines have generally been imposed on firms rather than individuals, but preventative approaches that aim to influence the behaviour of individuals may also be needed to mitigate misconduct risk.

2 https://www.centralbank.ie/docs/default-source/publications/correspondence/general-correspondence/central-bank-of-ireland-response-to-the-law-reform-commission-issues-paper-%27regulatory-enforcement-and-corporate-offences%27.pdf (PDF 568.58KB)

3 2017 Demographics of applications for regulatory approval for senior financial roles released, https://www.centralbank.ie/news/article/demographics-report-07-March-2018

4 Triandis, H., Kurowski, L. & Gelfand, M. (1995) Workplace Diversity, Handbook of industrial and organizational psychology, 4 (2), pp. 769-827.

5 Barton, D. & Wiseman, M. 2018, Where Boards fall short, (HBR 2015 Jan/Feb)

6 Haldane, A. (2016) The Sneetches, A speech given at the Scottish Business Friends Dinner in aid of BBC Children in Need, Edinburgh on 12 May 2016. Available from: http://www.bankofengland.co.uk/publications/Pages/speeches/2016/906.aspx

7 Fernandez, C. 2007, Thought Diversity the Antidote to Group think, available from: https://journals.lww.com/jphmp/Fulltext/2007/11000/Creating_Thought_Diversity__The_Antidote_to_Group.21.aspx

8 Watermark Consulting (2106) The 2016 Customer Experience ROI Study Insurance Industry Edition, [online], available at http://www.watermarkconsult.net/docs/Watermark-Customer-Experience-ROI-Study-(Insurance-Edition).pdf

9 Barton, D. & Wiseman, M. 2018, Where Boards fall short, (HBR 2015 Jan/Feb)

10Catalyst EuroBoards, http://www.catalyst.org/issues/board-diversity

11 OECD Forum (2013) Boardrooms in transition, [online], available at https://www.oecd.org/forum/boardrooms-in-transition.htm

12 Diversity – a business strategy or a compliance exercise? Benchmarking diversity among Directors on the Boards of Insurance and Reinsurance companies regulated by the Central Bank of Ireland. Eilish Mattison, 2016

13 Korn Ferry (2015) Governance changes at the top 100 US companies by market capitalisation, Board of Directors Class of 2014, [online], available at http://www.kornferry.com/institute/the-korn-ferry-market-cap-100-governance-changes-at-the-top-100-us-companies-by-market-capitalization

14 Spoerry, L., 2018, Insurance Day, available at https://insuranceday.maritimeintelligence.informa.com/ID1122202/Insurtech-deals-reach-record-levels-in-Q1

15 Institute of Directors, 2017, “Diversity in the Boardroom” available at https://www.iodireland.ie/resources-policy/research/diversity-boardroom