New requirements for financial intermediaries to disclose commission arrangements to consumers

25 September 2019

Press Release

- Consumers to have transparency of commission arrangements between intermediaries and product producers

- Prohibition on certain types of commission arrangements and clarity on use of the term ‘independent’

- Free hospitality for intermediaries such as golf trips and sporting event tickets will be prohibited under the new rules

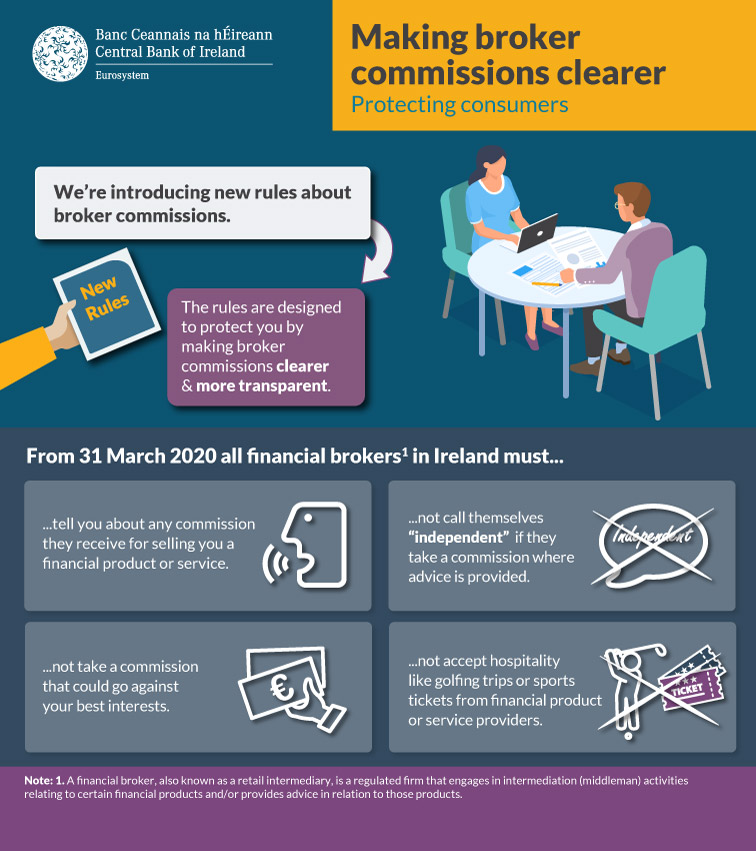

The Central Bank of Ireland has published a package of new rules to be included in the Consumer Protection Code 2012 on the payment of commission to financial intermediaries, involving new requirements on transparency for consumers and prohibitions on certain types of commission arrangements. The new rules aim to ensure transparency of commission arrangements between financial intermediaries (such as brokers and financial advisers), and product producers (such as banks and insurance firms), and to minimise the risk of conflicts of interest relating to commissions arising when consumers are getting financial advice from the intermediary.

Under the new rules, the Central Bank will require intermediaries to publish details of the commissions they receive from product producers on their website. In addition, the Central Bank will no longer permit intermediaries to describe themselves and their regulated activities as ‘independent’ where they accept and retain commission in circumstances where advice is provided.

Certain criteria must be met in order for commission to be acceptable and commission linked to targets that do not consider a consumer’s best interests will be deemed a conflict of interest and will be prohibited. Free hospitality for intermediaries such as golf trips and sporting event tickets will also be prohibited under the new rules. Any commission received in the form of non-monetary benefits must demonstrably enhance the quality of the service to the consumer in order to be permitted.

Gráinne McEvoy, Director of Consumer Protection, said: “It is important that consumers are clear about the price they are paying for financial services. These new rules will provide much needed transparency around commission payments, allowing consumers to see what commission payments their financial advisors are getting for the products they are recommending. We will not allow hospitality such as golf trips and sporting event tickets as we consider such benefits are designed to influence an intermediary to place business with a particular provider rather than to provide any direct benefits to consumers.

“These amendments to the Consumer Protection Code will reduce the potential for bias on the part of financial intermediaries and will provide consumers with access to more information about how intermediaries are paid. Consumers will also be able to have confidence that when they receive advice that is marketed as being independent, that this advice is truly independent.”

The Central Bank will be supervising firms’ compliance with these new rules when they come into effect on 31 March 2020.

Notes

The new rules can be summarised as follows:

1. A summary of the details of all commission arrangements that an intermediary has agreed with product producers must be made available to consumers. The summary must include the following details at a minimum:

- an indication of the agreed amount or percentage of any fee, commission, other reward or remuneration where the payment is made to the intermediary on this basis;

- an explanation of the arrangement including details on the type of fee, commission, other reward or remuneration paid or provided to the intermediary, for example, sales commission or trail commission, and details affecting the fee, commission, other reward or remuneration paid or provided to the intermediary, for example, clawback provisions;

- details of any other agreed fees, administrative costs, or non-monetary benefits under such arrangements, including any benefits, which are not related to the intermediary’s individual sales

2. Firms will no longer be permitted to describe themselves and their regulated activities as ‘independent’ where they accept and retain commission where advice is provided;

3. In order for commission to be acceptable, it must:

- not impair compliance with the regulated entity’s duty to act in the best interests of consumers;

- not impair compliance with the regulated entity’s obligation to satisfy the conflict of interest requirements of the Code or the Insurance Distribution Regulations 2018;

- not impair compliance with the regulated entity’s obligation to satisfy the suitability requirements of the Code or the Insurance Distribution Regulations 2018;

- in the case of a non-monetary benefit, be designed to enhance the quality of the service.

4. Commission linked to targets that do not consider a consumer’s best interests (targets linked to volume or business retention) will be deemed a conflict of interest.

5. Under the new rules, hospitality such as golf trips and sporting event tickets will not be allowed. Such benefits are designed to influence an intermediary to place business with a particular provider rather than to provide any direct benefits to consumers.

6. The Central Bank uses a number of methods to monitor compliance with consumer protection requirements including conducting inspections and specific reviews on particular topics. As part of these processes, supervisors will be able to request details of any non-monetary benefits provided to an intermediary, including the rationale for explaining how the benefits enhance the quality of the service to the consumer. Intermediaries will be obliged to provide this information where requested.

7. These measures will come into effect on 31 March 2020.

8. Consultation Paper CP116: Intermediary Inducements - Enhanced Consumer Protection Measures was published in November 2017. The closing date for receipt of submissions was 22 March 2018. Eighteen submissions were received from a wide variety of firms and representative organisations.