COVID-19: The impact on firms and households

17 June 2020

Blog

We published our latest Financial Stability Review (FSR) yesterday and in my opening remarks (at the launch of the report) I noted COVID-19 had been a test of the financial system like no other in the last decade, triggered by an unprecedented economic shock (in both scale and speed) as a result of a public health crisis. A resilient financial system matters to the people, the families and the firms that make up the Irish economy. But the relationship is symbiotic: a healthy, resilient economy also makes it easier for the financial system to be resilient. This blog looks at the resilience, vulnerabilities and importance of firms and households to the economy since the pandemic hit.

Firms – assets, debt, and borrowing capacity

Firms in particular have borne a lot of the initial strain with almost a quarter of them having temporarily ceased trading and a third having made staff temporarily redundant in May. Seventy per cent of firms report reduced turnover, with 44 per cent reporting that their turnover was less than half of normal levels.

The shock is felt differently across sectors. Businesses which require personal interaction or where physical distancing is impractical – such as hotels, restaurants, travel and parts of the retail sector – are the most affected. The immediate challenge for them has been to meet or defer costs and liabilities. Recent survey responses have shown that a quarter of SMEs were not confident they had the financial resources to continue operating for three months or more.

Lenders have helped firms to reduce their current liabilities; by the end of May, Irish retail banks had active payment breaks on loans worth €8bn, or 23 per cent of the outstanding balances of Irish firms. And government initiatives have played an important role in supporting firms by reducing their wage costs (by over €1bn through the Temporary Wage Subsidy Scheme), reducing or deferring certain tax liabilities (by over €2bn), and increasing the size and scope of existing government loan schemes.

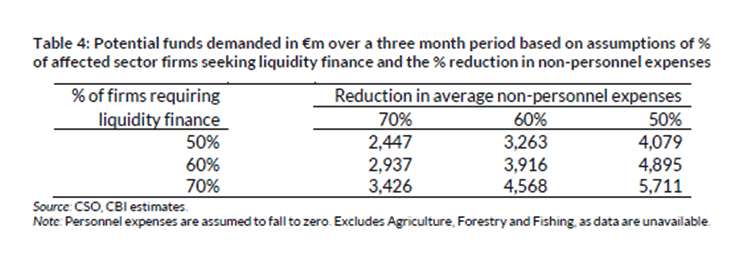

Recent research published by our economists and displayed in the table below estimates the liquidity shortfall for SMEs. The table focuses on the non-payroll expenses of moderately or highly affected firms. The range of reductions of such expenses reflects policy supports and reduced costs from closure giving an estimate of a three-month SME liquidity shortfall of between €2.4 and €5.7 billion due to COVID-19. The phased nature of economic re-opening, and uncertainty around the path for future revenue in many sectors, mean that a certain portion of the estimated liquidity needs for some firms are likely to recur beyond the first three months of the crisis.

Where liabilities fall due and cannot be met by current revenues, firms will rely on a combination of their existing liquid assets, undrawn credit facilities such as overdrafts, or new borrowing (or any pre-agreed facility with their lender).

Taking each of these channels in turn, the majority of firms entered this crisis period with relatively modest liquid assets. One in four SMEs hold 1 per cent of annual turnover in cash, while half hold less than 5 per cent. As for undrawn credit lines, Irish-resident SMEs had approximately €2.4 billion in undrawn facilities at Irish retail banks at the end of April. Access to this undrawn credit is higher in less affected sectors and is also concentrated in a small cohort of larger SME borrowers. In other words, the existing stock of undrawn credit is unlikely to be sufficient to cover the liquidity needs of all Irish SMEs in the coming months.

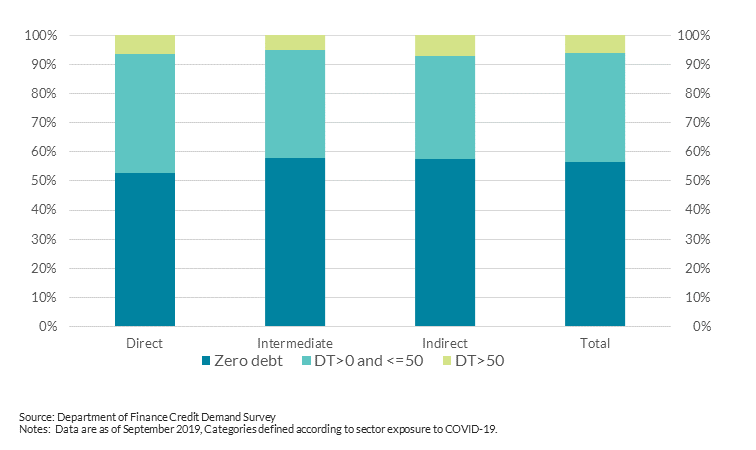

In the case of debt, the majority of SMEs entered this period with no outstanding bank debt, due to substantial deleveraging in recent years; 57 per cent of SMEs report that they have no bank debt and just 6 per cent have debt to turnover ratios of greater than 50 per cent (see Figure 1). So, from a macro perspective, SMEs have some capacity to take on debt to meet current outgoings. But we need to be cautious as the medium-term resilience of SMEs is likely to weaken if increased borrowing finances pandemic-related losses. And undoubtedly the current uncertainty around the future outlook will mean that debt financing is not attractive to all small businesses.

Figure 1: Share of SMEs in debt-to-turnover (DT) ratio bands by exposure to COVID-19

The viability of some firms will be determined by the path of recovery. But, in turn, the productive capacity of the economy will be damaged – and the pace of the recovery restricted – in the event viable companies cannot survive.

Households - debt, employment, and assets

In May, over 1 million people were accessing income assistance through income support programmes, representing 43 per cent of the labour force. This level of income loss, regardless of the temporary nature (for some), is a clear challenges to the financial position of households.

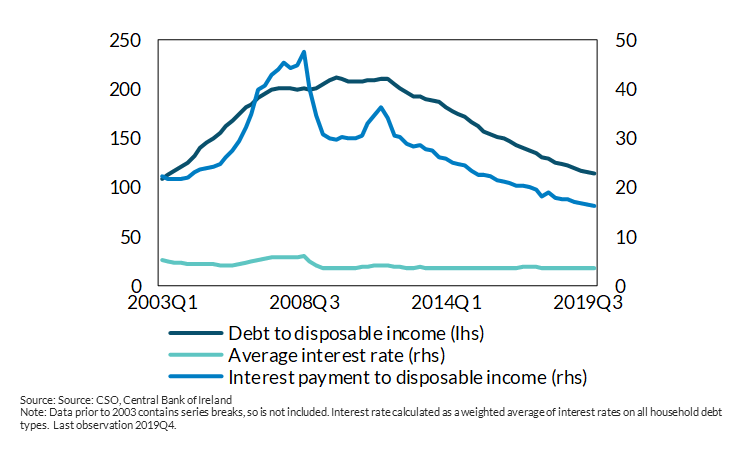

Figure 2 shows a trend of falling aggregate household debt since the last crisis. Across households, reductions in debt-to-income (DTI) levels have been widespread, with a halving of the share of highly-indebted borrowers since 2013. This means that households are in a more resilient position facing this shock: only 6 per cent of them have debt more than 5 times their income – helped by the Central Bank’s mortgage measures – and there is significant equity to protect against house price falls. Moreover, in view of current rates, the interest burden is also lower than at any time over the past 15 years. This means that it is easier for borrowers to service their debt than in the past, helping to further increase their resilience to this crisis. But despite the improvement in the financial position of the household sector in recent years, legacy issues mean that 85,000 owner-occupier mortgage accounts (11.5 per cent of total accounts) were in restructuring arrangements at the onset of COVID-19, with another 60,000 starting the crisis in arrears.

Figure 2: Household sector debt to disposable income and weighted average interest rates on outstanding loans

Mortgage holders are more likely to work in full time employment and in sectors where employment has been less affected by COVID-19. Manufacturing, human health and social work, education, and public administration are four of the five largest sectors of employment for mortgage holders. The composition of the mortgage book will therefore likely help mitigate some of the more adverse potential outcomes for financial stability. Nonetheless, the widespread nature of the shock means that 47 per cent of mortgage holders work in a sectors affected by the public health measures.

A significant number of households have limited liquid assets to support them in the event of sustained income falls or unemployment. Between one and four months’ worth of mortgage payments are estimated to be available in cash balances for the poorest fifth of mortgaged households, while the equivalent burden is higher for renters. The 2018 Household Finance and Consumption Survey (HFCS) indicates that bank deposits and incomes are lower for households working in sectors affected by COVID-19. By the end of May, retail banks had granted more than 66,000 payment breaks on Irish mortgages, providing important liquidity relief to households to absorb the immediate effects of lost income.

Conclusion

As I said yesterday at the launch of our FSR, COVID-19 has been a public health crisis the likes of which almost none of us have seen in our lifetime. It has also brought in its wake an economic shock unprecedented in scale and speed. And it has been a test of the financial system like no other in the last decade. Unlike the experience of a decade ago, the financial system is not the origin of the current challenges but, like the rest of the economy, it is affected by them. We are perhaps only at the end of the beginning of seeing those challenges emerge.

As we have taken stock of what this means for domestic financial stability in the FSR, I think there are three key messages emerging.

First, the speed, size and pervasive nature of the economic shock have presented both immediate challenges and tighter financing conditions, as well as a sharp deterioration in the macro-financial outlook, with further downside risks for households, businesses, the public finances and the financial sector.

Second, households, businesses and the financial system have entered into the current phase in a more resilient position compared to the onset of the financial crisis a decade ago. Indeed, the domestic banking system has played role in supporting the liquidity needs of households and businesses so far in this crisis, including through payment breaks. Looking ahead, the banking system will be making losses. The capital buffers we have asked banks to build up in recent years are now there to absorb those losses. But, of course, that resilience is not unlimited.

Third, the policy actions taken in the area of fiscal and monetary policy – as well as macroprudential and supervisory policy – have been necessary to mitigate the amplification of the immediate shock, enable the financial system to support households and businesses through the crisis, and to minimise the extent of longer-term difficulties.

Gabriel Makhlouf

Read More